The Brains Of Our Machines: Logic And Connectivity Chips

Reviewed by Bailey Pemberton, Michael Paige

Quote of the Week: “ Innovation is not about grand visions, it's about solving real problems.” - Jensen Huang

Last week's newsletter provided a brief overview of the semiconductor industry and chips that give machines memory.

This week we are taking a closer look at the companies that design logic chips and the chips that make networking and connectivity possible. These are the chips that power the digital economy and make it all happen at the speed of light - well, you know, close to it.

Then, over the next few weeks, we’ll cover analog chips, the supply chain, and industry cycles. Plus, we’ll delve into how to screen for great stocks in these sectors, valuation methods and investor narratives!

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

📉 US Corporate Bankruptcy Filings Surge In June ( S&P Global )

- What’s our take?

- Higher interest rates, supply chain issues and slowing consumer spending continue to weigh on struggling companies. The 346 filings so far this year are higher than any comparable period in the last 13 years. The consumer discretionary sector seems to be struggling the most, with 55 filings compared to 40 in healthcare and industrials, and 20 in information technology. If interest rates, supply chains and slower consumer spending remain, the second half of the year may show more of the same. Keep this in mind for these sectors, and any highly indebted companies.

- What’s our take?

-

⛏️ Few New Major Copper Discoveries As Focus Remains On Older Deposits ( S&P Global )

- What’s our take?

- If this analysis is anything to go by, there are plenty of reasons to be bullish on the price of copper. Given how much copper would be needed for the electrification of the world, and the lack of new deposit discoveries, the copper market could see a large imbalance in demand outweighing supply from 2027 onwards according to this research. Copper exploration budgets in 2023 were 34% lower than the peak in 2012, and even lower when adjusted for inflation. Also, the average lead time for creating new mines has jumped to 17.9 years from 12.7 years. This has been fueled by longer times for exploration, permitting, feasibility studies, construction, and financing. All in all, given most of the newly discovered sites are years away from being finished, production from these mines may not come to market soon enough to alleviate projected supply deficits. This, of course, would be very bullish for the price of copper.

- What’s our take?

-

🏦 Top US Banks Withstand Annual Ritual Of Federal Reserve ‘Stress Tests’ ( Financial Times )

- What’s our take?

- These hypothetical scenarios do provide good insights into how well banks could handle stressful situations, but they’re not perfect. For example, they didn’t account for the banking crisis in March of 2023 when 3x banks were completely wiped out in 1 month. Analysts estimate that despite passing the tests, several of the major banks will see their capital requirements increase, and that may reduce the dividends and buybacks for shareholders of these banks.

- What’s our take?

-

📱 Meta’s Threads Reaches 175m Users In The First Year ( Sherwood )

- What’s our take?

- Don’t underestimate the value of prior experience and having a huge existing network to leverage. Threads grew to 100m registrations in less than 5 days, then had a sharp decline, but has now reached 175m monthly users. This is a huge feat considering it started from scratch just a year ago. Threads CEO Adam Mosseri said that “the metrics they care about most like impressions per day, time per day, daily people, monthly active people, engaged dailies, engaged monthlies are all growing well.” If Threads plays its cards right, it could achieve its goal of becoming the go to place to share ideas online, which means replacing X (Twitter).

- What’s our take?

-

💴 Yen Drops To 38-year Low, US dollar Slumps After Weak Data ( Reuters )

- What’s our take?

- The market is on high alert for Japanese intervention to boost the currency in its downward spiral. The Bank of Japan currently purchases about ¥6 trillion Yen in bonds per month, and market participants are calling for them to reduce this to ¥2-4 trillion. Doing this would allow Japanese interest rates to move higher, which would help the central bank start the process of tightening monetary policy and increase demand for the Yen (a higher yield = more currency bought by investors to then buy JPY bonds). However, they’re so indebted that higher yields would be a huge problem for their economy, so they’ll likely continue buying the bonds themselves to keep yields down. Some believe that the BoJ will need to wait for intervention on the US side of things for their currency to stop falling - meaning US rate cuts.

- They might be in some luck because news of the slowing US labour market and inflation falling to 3% has increased the chances of Fed rate cuts, which weakened the US dollar. If the likelihood of rate cuts in the US increases, the USD may continue to trend lower as the possible yield difference between the US and other countries shrinks.

- What’s our take?

-

🇨🇳 Podcast: China's Race To Tech Supremacy ( FT )

- What’s our take?

- China has a grand plan to be the world leader in science and technology. The country has evolved from being a low-cost producer to a tech leader in several industries, including smartphones, drones, AI, electric cars and space. The FT recently wrapped up a five-part podcast on the country’s tech sector and the factors driving success in key industries.

- Setting aside China’s economy, stock market and the trade war, China is very likely to become a leader in other tech industries. That means tech companies around the world may face more competition in the future, and so their current dominance should not be assumed as permanent.

- What’s our take?

🧠 Logic Chips

Logic chips, or processors, are the brains within electronic devices and computing systems.

These are the integrated circuits (ICs) that process information and control other components. The largest 10 microprocessor companies accounted for more than half of all revenue amongst chipmakers in 2023.

There are many types of processors, with the most common being:

-

Central processing units (CPUs) are the ‘brains’ in PCs, mobile phones and servers. They are also the brains in the growing list of smart devices. These chips include the CPUs designed and sold by Intel and AMD.

-

Graphic processing units (GPUs) were originally developed to speed up image rendering. They do this by executing instructions in parallel rather than in series. Whether by luck or design, it turned out that GPUs are also great at processing large amounts of data - making them ideal for running AI models, amongst other tasks. Nvidia became the leader in the GPU space in the 1990s, which set it up for its current success.

-

Digital signal processing units act as the interface between the real world and the digital world. The processors are essential to communication and networking.

-

Data processing units combine CPUs or GPUs and networking components to ensure that data travels quickly and securely across a network.

-

Microcontrollers (MCUs ) are less powerful chips that can be pre-programmed to control devices. They are relatively cheap and use very little power. MCUs are used to control home appliances, vehicles and industrial machines.

The table below shows some of the most well known examples, where they’re located, their market cap, their 2023 revenues and what they primarily sell.

| Company | Country | Market Cap | 2023 Revenue | Primary Products |

| Nvidia | USA | $3,095B | $61B | GPUs |

| Intel | USA | $136B | $54B | CPUs |

| Qualcomm | USA | $230B | $36B | Wireless IP and mobile processors |

| Advanced Mico Devices | USA | $278B | $22.2B | CPUs, GPUs |

| Infineon | Germany | $38B | $17B | Microcontrollers and power chips |

| STMicroelectronics | Netherlands | $21B | $16.5B | Microcontrollers and Microprocessors |

| MediaTek | Taiwan | $70B | $13.3B | Mobile processors, modems |

| Microchip Technology | USA | $28B | $8.5B | Microcontrollers, mixed-signal chips, memory solutions |

| Arm Holdings | United Kingdom | $190B | $3.2B | Processor IP |

📈 Moore’s Law and Process Nodes

We’ll cover the manufacturing process in more detail in a future newsletter, but the topic of transistor density is worth a mention here.

In 1962, one of the earliest integrated circuits contained 16 transistors. By 1964, a 120 transistor chip was commercially produced. This led Gordon Moore, one of the founders of Intel, to predict that the number of transistors on a chip would double every year for at least a decade.

This became known as Moore's law and ultimately held true for at least five decades. Apple’s M2 chip contains 134 billion transistors, while Micron’s latest NAND module contains 5.3 trillion transistors.

Increasing the transistor density of chips does three things:

- More transistors means more processing power per mm 2

- Smaller components use less power, so efficiency increases

- Small chips make PCs and smart devices possible

Process nodes describe the scale at which chips are manufactured. The node size originally referred to the actual size of IC components in micrometers (μm) and then nanometers (nm).

In 1970 the node size was around 20μm, or 20,000nm. The latest process nodes in production are 3nm or 0.015% of that size - except that isn’t quite accurate. Nowadays, process nodes are more of a marketing term and aren’t necessarily comparable between different foundries and chipmakers.

The competition between the leading chipmakers takes place within the smallest process nodes, and is now approaching ‘1nm’. These chips are the most powerful and efficient, but, as you might expect, they’re also the most expensive.

This doesn’t mean there isn't a place for chips based on older technologies and higher nodes. PCs and phones based on 14nm nodes are still common. Many of the microcontrollers used today are based on a 40nm process - which makes them very affordable.

Is Moore’s law dead? Some say yes, while others disagree. Regardless, current process nodes are close to the limit: 1nm is the size of 5 silicon atoms! Going beyond that will require new material or a new approach.

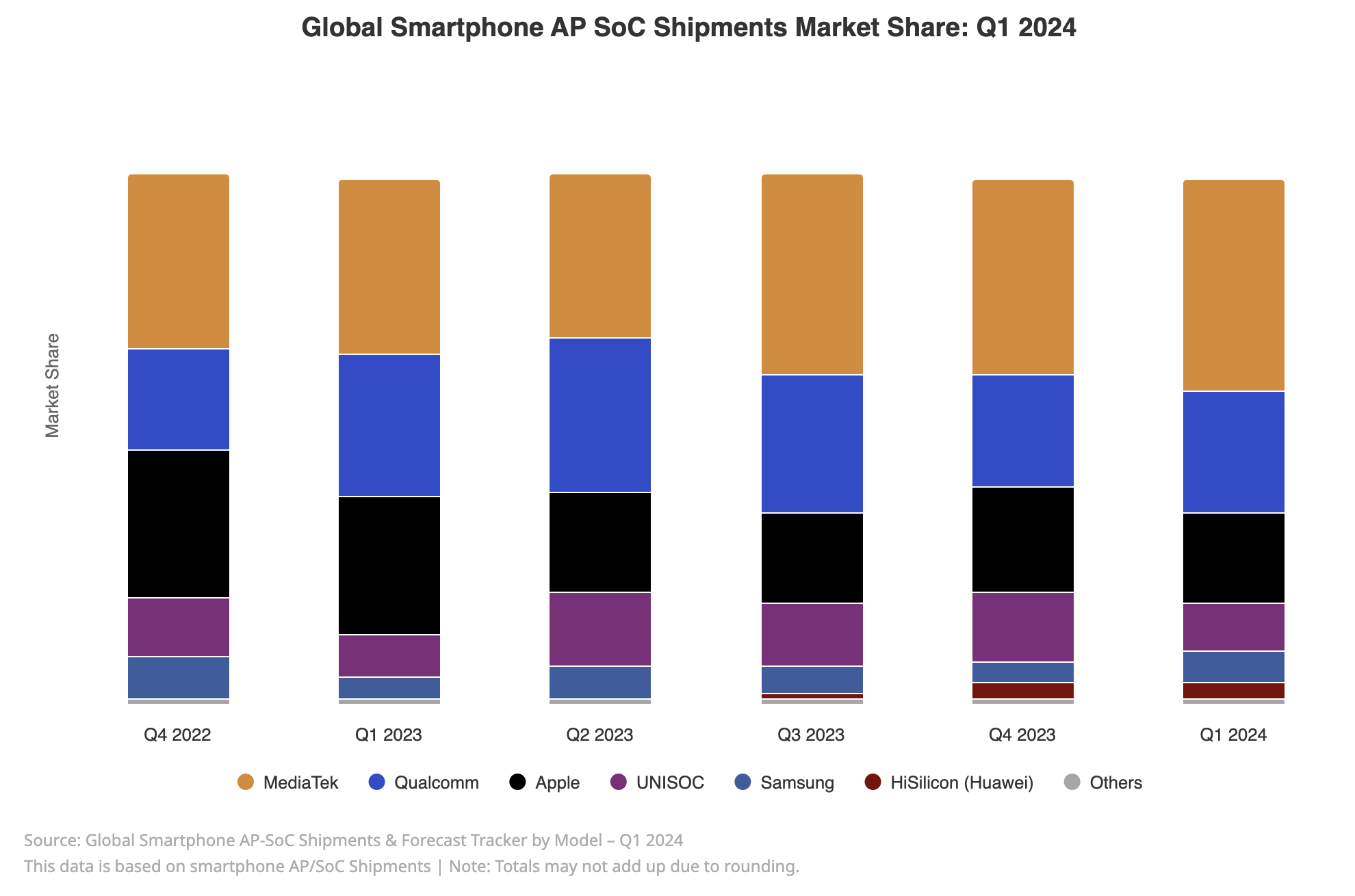

📱 Mobile Processors and 5G

Interestingly, most of the world's CPUs aren’t actually designed or sold by Intel and AMD. The processors in nearly every mobile phone sold today are based on IP licensed by Arm Holdings. These chips are manufactured and sold by numerous companies, including Apple.

Processors based on Arm’s architecture have low power consumption and heat generation, which makes them ideal for battery-powered devices.

ARM chips are also making their way into more PCs and servers, and are winning market share away from Intel and AMD’s x86 CPUs. Microsoft recently announced a range of AI PCs that use Qualcomm’s ARM-based SnapDragon X processors.

Qualcomm also licenses its technology to the entire mobile industry. The company developed the original 2G standard, which was adopted by the industry. Over the years this has evolved to the current 5G standard, and Qualcomm owns the patents to most of the technology.

🛜 Communication and Networking Chips

Every time you interact with the internet, data is travelling across the globe, via switches, data centres and servers - and then back to your PC or phone. All of this happens in seconds thanks to the chips and equipment made by a handful of companies.

Broadcom is the leader in this field - which has also made it a leader in the current AI boom. Data centers don’t just need incredibly powerful GPUs to train AI models - they also need the infrastructure to tie it all together. This has created a massive opportunity for Broadcom and the other chipmakers that specialize in networking and infrastructure solutions.

Just like the earlier table, here are some of the communication and networking chip company’s examples with their leading products, market caps and revenues.

| Company | Country | Market Cap | 2023 Revenue | Leading Products |

| Broadcom | USA | $793B | $36.2B | Communications and networking chips |

| Marvel | USA | $67B | $5.5B | Data processing units, ASICs, Networking and SSD controllers |

| Realtek | Taiwan | $9B | $3B | Communications and networking chips |

| Cirrus Logic | USA | $7B | $1.8B | Digital signal processors and analog chips |

| Credo Technology | USA | $5B | $0.2B | Digital signal processors and connectivity solutions |

🤖 AI Accelerators, NPUs, and TPUs

The requirements of AI have resulted in a rapidly evolving list of variations of the processors used to train models.

These chips go by various names including AI accelerator, neural processing unit (NPU), and tensor processing unit (TPU). Essentially, these are processors that are specifically designed for machine learning applications. So while GPUs are better than CPUs, AI accelerators are even more efficient.

✨ The other development in this area is that all the tech giants are designing their own chips. These processors are typically designed and optimized to run on each company’s own software and infrastructure. They are also used for very specific tasks, while more general tasks still run on Nvidia’s chips. This isn’t actually new - Google’s began using its own TPUs in 2015.

AI chips are also finding their way into PCs and mobile devices. This will allow inference to run on the customer's device rather than in the cloud. Just how much of the workload will end up running like this remains to be seen.

💡 The Insight: Taking the Long-Term View vs Playing the Cycle

Given the fact that the semiconductor industry is cyclical, you may be wondering whether it’s worth owning chip stocks for the long term - or trying to time the cycles. We’re fans of long-term investing - but that doesn’t mean there’s never a time to sell or reduce exposure to an investment.

Well-positioned semiconductor companies can create value over long periods - but investing at the right time certainly helps. If you invested in the leading chip stocks at the 2000 high you would have been underwater for quite a while - and in the case of Intel, you would still be in the red!

Remember, no company, no matter how good, is worth an infinite price. Therefore, being good at estimating the value of a business is one of the keys to increasing your chances of investing success (along with having a good temperament).

To get some perspective on a company’s current share price, it’s crucial to try and estimate its value (or view somebody else’s valuation), because:

- This will give you an idea of whether the stock is potentially overvalued or undervalued, and

- You’ll understand what fundamental developments would need to occur for this estimated valuation, and today’s price, to make sense.

That’s where our narrative tool comes in. This tool is accessible when setting a Fair Value on any stock in your watchlist or portfolio, and it allows you to use the Future PE multiple approach to estimate the value of the stock.

With this approach, you are estimating the price you think the market will pay for the stock at some point in the future.

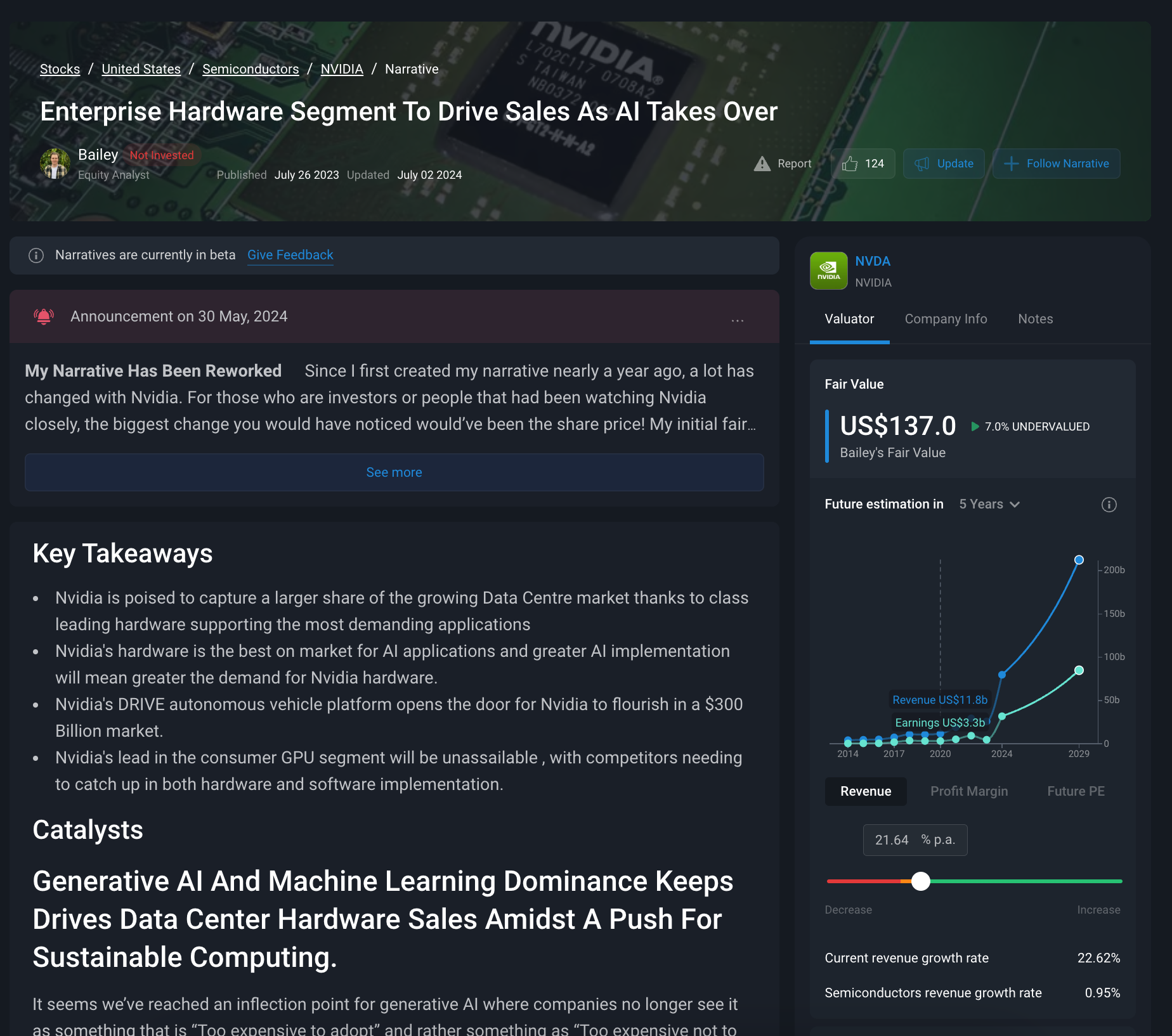

This Nvidia investment narrative is a great example, based on a five-year time horizon with a fair value estimate based on a P/E exit multiple.

There are six components to this estimate:

- The time horizon (3, 5 or 10 years)

- The average annual revenue growth rate for that period

- The expected profit margin at the end of that period

- The expected P/E ratio at the end of that period

- The estimated number of shares outstanding at the end of the period

- The discount rate

This calculation estimates the company’s net income at the end of the period and then multiplies it by the expected P/E multiple at that time. That gives you an estimate of the future market value.

The future P/E ratio will reflect the market’s expectations at that time - but will probably also be influenced by historical growth rates.

The estimated future market value is then divided by the number of shares to arrive at a future share price. The current fair value is then estimated by calculating the present value using the discount rate.

The estimate above is based on a revenue growth rate of 21.6%, a profit margin of 40% and a future P/E ratio of 60x. Based on those assumptions, the fair value estimate is $137 implying that the share is undervalued by 7%.

But of course, you may not agree with those assumptions - and we encourage you to experiment with your own estimates! This other Simply Wall St analyst has their own narrative on Nvidia, and they have a very different opinion and assumptions!

For stocks you’re interested in, play around with possible revenue growth rates, profit margins and future PE multiples to see what fair values might make sense based on what you think is likely. Then write down your narrative that explains why you think this future state could be reached.

Next week we will look at analog chips and the crucial ingredient for long-term returns: capital allocation.

Key Events During The Next Week

Monday

- 🇨🇳 China’s GDP growth rate will be published. Current forecasts are for growth to decline from 5.3% to 5%.

Tuesday

- 🇨🇦 Canada’s inflation rate is expected to remain at 2.9%.

- 🇺🇸 US retail sales are due to be released. The year-on-year figure is expected to fall from 2.3% to 2.1%, with the monthly change remaining flat at 0.1%

Wednesday

- 🇬🇧 UK inflation is forecast to remain at 2%.

Thursday

- 🇬🇧 UK unemployment is expected to be flat at 4.4%

- 🇪🇺 The ECB interest rate decision will be announced. After recent comments from ECB officials, no change is expected.

It’s the second week of Q2 earnings season. Those reporting will be the remaining ‘big banks’, some more financial sector companies and the first technology companies:

- Goldman Sachs

- BlackRock

- UnitedHealth

- Bank of America

- Morgan Stanley

- Charles Schwab

- ASML

- Johnson and Johnson

- TSMC

- Netflix

- Abbott Laboratories

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.