- United States

- /

- Oil and Gas

- /

- NYSE:AM

Reassessing Antero Midstream (AM) After Its Recent 20% Year‑to‑Date Share Price Climb

Reviewed by Simply Wall St

Antero Midstream (AM) keeps grinding higher, with the stock up about 5% over the past month and more than 20% this year, quietly rewarding income focused investors watching energy infrastructure names.

See our latest analysis for Antero Midstream.

With the share price now at $18.68, Antero Midstream’s steady climb and roughly 20.7% year to date share price return suggest momentum is building. A 1 year total shareholder return of about 31.5% underlines how income plus price gains have compounded for patient holders.

If AM’s run has you rethinking your energy exposure, it could be worth scanning the broader infrastructure and income universe through fast growing stocks with high insider ownership for other potential long term compounders.

Yet with Antero Midstream now trading right on top of Wall Street’s price target but still flashing a sizable intrinsic discount, investors face a key question: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 0.2% Overvalued

With Antero Midstream’s last close sitting almost exactly on the most popular fair value estimate of $18.64, the valuation hinges on a finely balanced long term earnings story.

Long term, exclusive contracts with Antero Resources, combined with over 20 years of high quality, dedicated natural gas inventory, ensure stable minimum volume commitments, supporting strong earnings visibility and reducing risk for future net margins.

Curious how modest revenue growth, rising margins, and a richer future earnings multiple can still support this price, even with a tiny implied premium? The full narrative unpacks the forecast playbook and shows exactly how those assumptions stack up to justify today’s near perfect alignment with fair value.

Result: Fair Value of $18.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that outlook could be upended if Appalachian regulation tightens or Antero Resources pulls back activity, pressuring volumes and Antero Midstream’s fee based earnings.

Find out about the key risks to this Antero Midstream narrative.

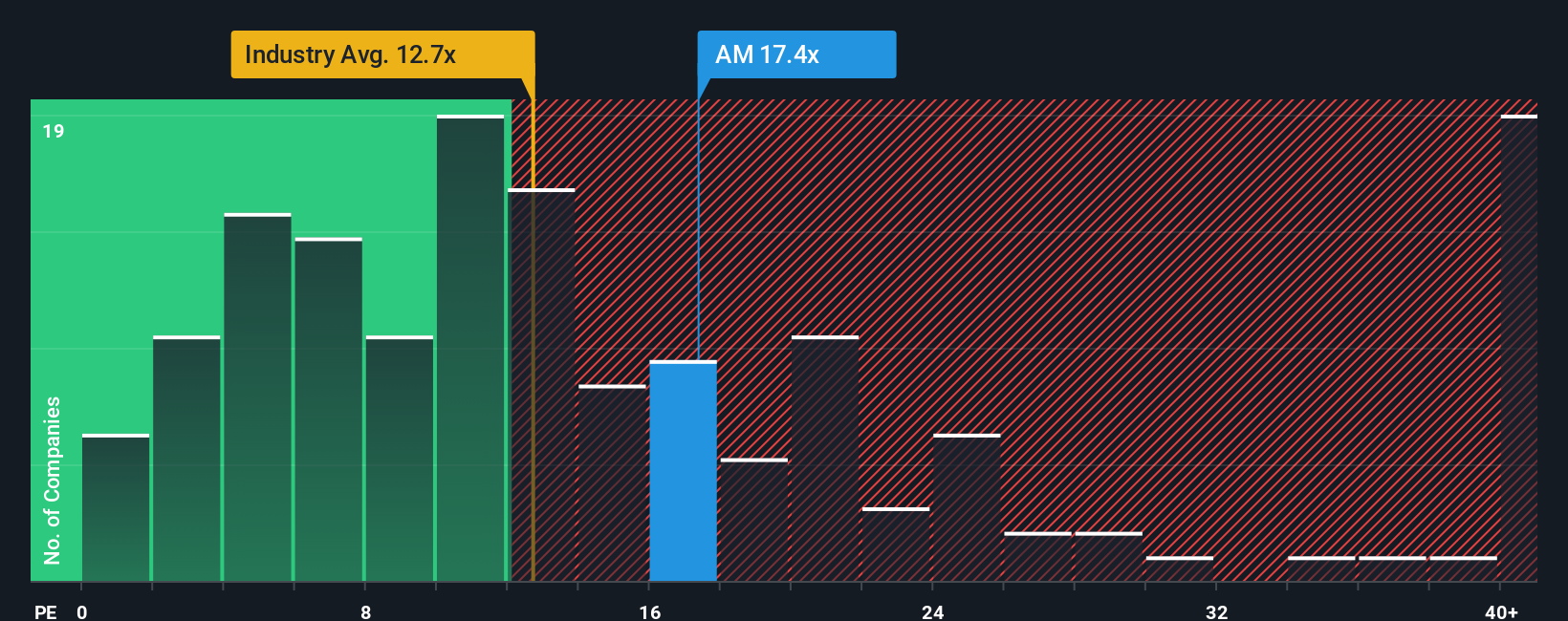

Another View: Multiples Paint a Different Picture

Step away from narrative fair value and Antero Midstream suddenly looks far from stretched. Its P/E of about 18.9 times sits well below peers at roughly 40.1 times and only slightly under a fair ratio of 19.6 times, suggesting potential valuation headroom rather than excess. One question for investors is whether the real risk lies in underestimating how long this premium cash flow story may persist.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Antero Midstream Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in minutes with Do it your way.

A great starting point for your Antero Midstream research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before the market’s next shift leaves you on the sidelines, use the Simply Wall Street Screener to uncover data backed opportunities tailored to your strategy.

- Capture potential mispricings by targeting strong cash flow opportunities through these 909 undervalued stocks based on cash flows and position yourself ahead of more cautious investors.

- Capitalize on cutting edge innovation by zeroing in on companies powering intelligent automation and diagnostics using these 30 healthcare AI stocks before the crowd catches on.

- Boost your income stream by focusing on reliable payouts and resilient balance sheets with these 15 dividend stocks with yields > 3% that may strengthen your portfolio through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AM

Antero Midstream

Owns, operates, and develops midstream energy assets in the Appalachian Basin.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026