- United States

- /

- Diversified Financial

- /

- NasdaqCM:MBIN

Undiscovered Gems in United States for January 2025

Reviewed by Simply Wall St

The United States market has shown impressive momentum, rising 3.8% in the past week and up 24% over the last year, with earnings expected to grow by 15% annually. In such a dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering undiscovered gems that may offer promising opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Merchants Bancorp (NasdaqCM:MBIN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Merchants Bancorp is a diversified bank holding company in the United States with a market cap of approximately $1.77 billion.

Operations: Merchants Bancorp generates revenue primarily from its Banking segment ($320.88 million), followed by Multi-Family Mortgage Banking ($154.17 million) and Mortgage Warehousing ($129.91 million).

Merchants Bancorp, with assets totaling $18.7 billion and equity of $1.9 billion, is flying under the radar despite its strong performance metrics. The bank's earnings have surged by 19% over the past year, outpacing industry growth of 14%. Total deposits stand at $12.9 billion against loans of $10.3 billion, though it faces a challenge with insufficient bad loan allowances at 2% of total loans. Recently, Merchants announced a preferred stock redemption and dividend adjustments on Series B shares due to rate changes, highlighting its proactive financial management amidst evolving market conditions.

National Energy Services Reunited (NasdaqCM:NESR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: National Energy Services Reunited Corp. offers oilfield services in the Middle East and North Africa region, with a market capitalization of $886.70 million.

Operations: NESR generates revenue primarily from Production Services, contributing $853.86 million, and Drilling and Evaluation Services, which add $411.68 million.

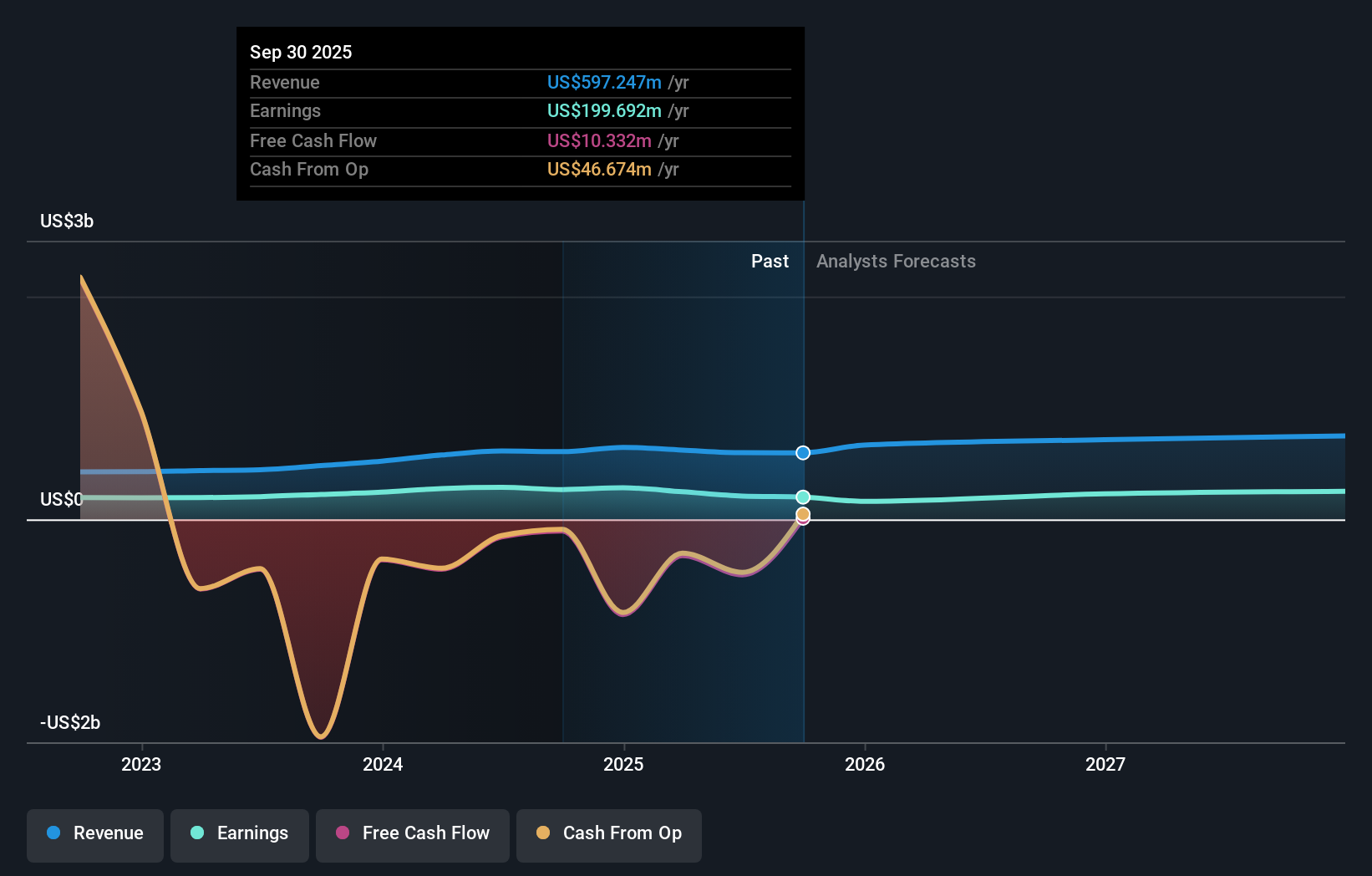

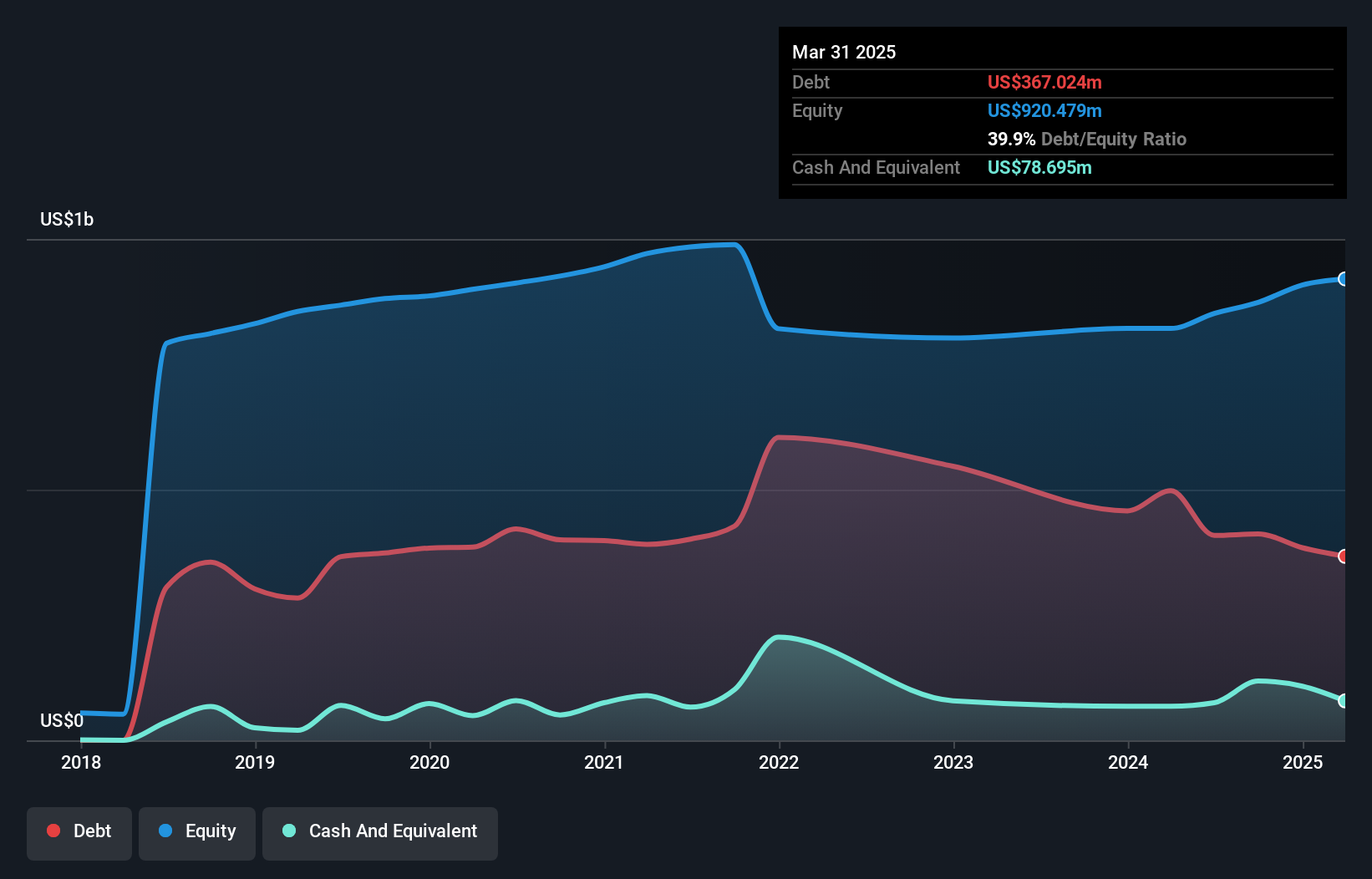

National Energy Services Reunited is making waves with significant earnings growth of 22,460% over the past year, far outpacing the industry average of 30.5%. This up-and-comer has secured contracts worth over $200 million in Saudi Arabia, Oman, and Kuwait for its drilling technology. Despite an increase in debt to equity ratio from 42.4% to 47.1% over five years, its net debt to equity remains satisfactory at 33.6%. With a fair value estimate showing it trading at a discount of 62.4%, NESR's financials reflect both potential and challenges within the energy services sector.

La-Z-Boy (NYSE:LZB)

Simply Wall St Value Rating: ★★★★★★

Overview: La-Z-Boy Incorporated is involved in the manufacturing, marketing, importing, exporting, distributing, and retailing of upholstery furniture products across the United States, Canada, and international markets with a market capitalization of approximately $1.86 billion.

Operations: La-Z-Boy generates revenue primarily through its Retail and Wholesale segments, with Retail contributing approximately $856.51 million and Wholesale about $1.46 billion. The company experiences a deduction in revenue due to inter-segment eliminations amounting to roughly $407.91 million, while the Corporate segment adds around $158.27 million.

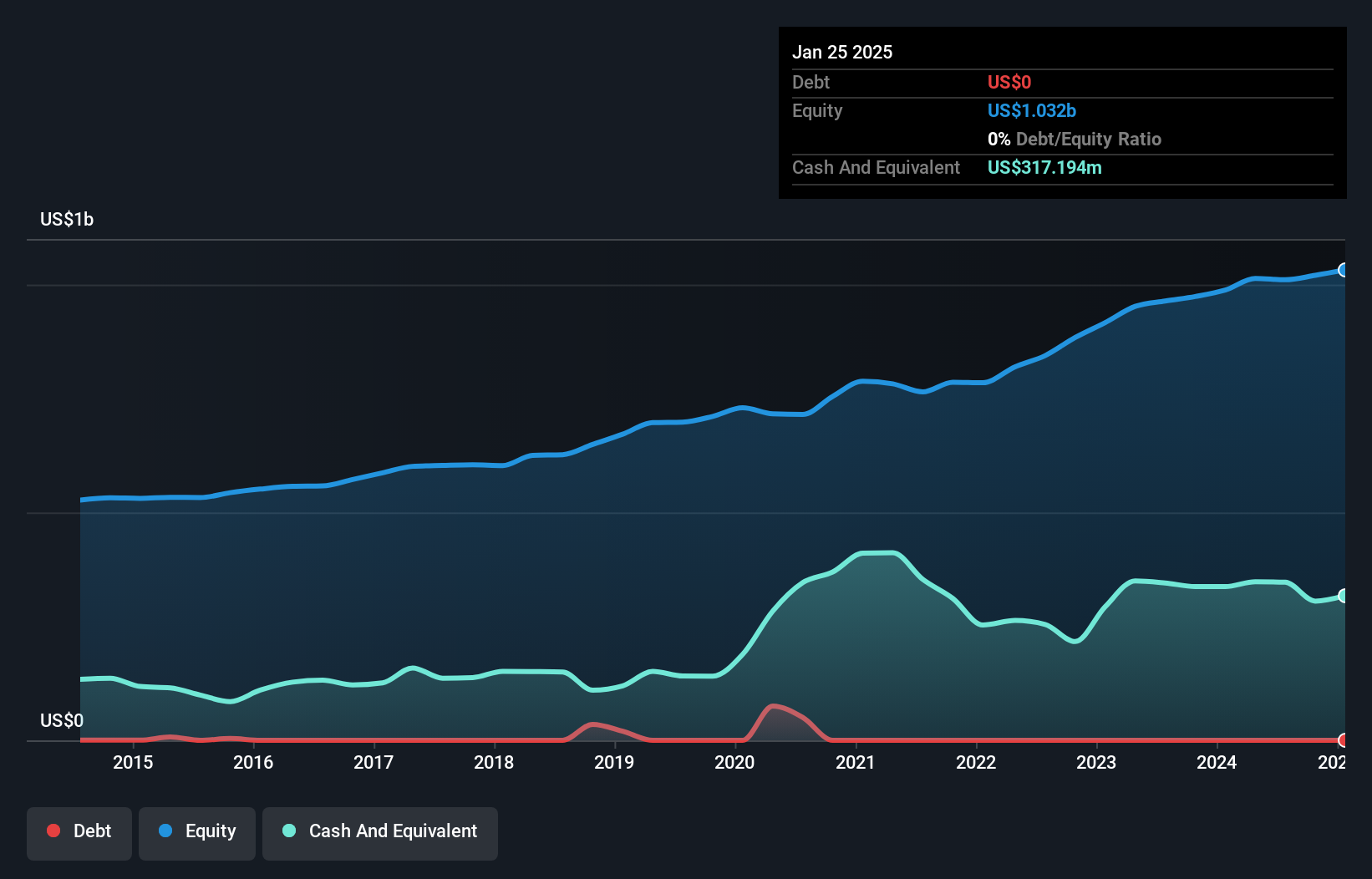

La-Z-Boy, a prominent player in the furniture industry, has been making strategic moves to bolster its market presence. The company is debt-free and trades at 32.9% below estimated fair value, indicating potential undervaluation. Recent earnings growth of 2.4% surpassed the Consumer Durables industry's 1.8%, showcasing resilience despite sector challenges like high mortgage rates affecting demand. With a net profit margin projected to rise from 6% to 6.8%, La-Z-Boy's focus on expanding its retail footprint and enhancing brand awareness through campaigns such as "Long Live the Lazy" could drive future growth, though current share price suggests modest upside potential.

Turning Ideas Into Actions

- Reveal the 256 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MBIN

Merchants Bancorp

Operates as the diversified bank holding company in the United States.

Very undervalued with adequate balance sheet.