- United States

- /

- Oil and Gas

- /

- NasdaqGM:HPK

Exploring 3 Top Undervalued Small Caps With Insider Buying In None Region

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant volatility due to escalating geopolitical tensions in the Middle East and unexpected job gains in the U.S., which have influenced investor sentiment and affected various indices, including small-cap stocks. Despite these challenges, the S&P 600 for small-cap companies has shown resilience amidst fluctuating oil prices and supply chain disruptions. In this environment, identifying promising small-cap stocks often involves looking for those with strong fundamentals and insider buying activity, as these factors can indicate potential value even during uncertain times.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.8x | 1.6x | 40.51% | ★★★★★☆ |

| Vital Energy | 4.4x | 0.6x | 49.34% | ★★★★★☆ |

| Tourism Holdings | 10.2x | 0.4x | 37.08% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 12.4x | 3.3x | 48.15% | ★★★★☆☆ |

| Dicker Data | 21.4x | 0.8x | -73.90% | ★★★☆☆☆ |

| Corporate Travel Management | 21.6x | 2.6x | -0.83% | ★★★☆☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -59.32% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -112.37% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -232.46% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

HighPeak Energy (NasdaqGM:HPK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: HighPeak Energy is engaged in the development, exploration, and production of oil and natural gas with a market capitalization of approximately $2.25 billion.

Operations: The company generates revenue primarily from oil and natural gas development, exploration, and production. Over recent periods, the gross profit margin has consistently remained above 80%, indicating strong profitability relative to cost of goods sold. Operating expenses include significant depreciation and amortization costs, along with general and administrative expenses.

PE: 12.6x

HighPeak Energy, a smaller company in the energy sector, has shown insider confidence with recent share purchases. Despite a dip in profit margins from 25.2% to 12.6%, revenue for Q2 2024 increased to US$275 million from US$241 million year-over-year. However, net income fell slightly to US$30 million from US$32 million. The company repurchased shares worth US$5.79 million between April and June 2024 and confirmed an annual production increase target of up to 49,000 Boe/d for the full year.

- Click to explore a detailed breakdown of our findings in HighPeak Energy's valuation report.

Gain insights into HighPeak Energy's past trends and performance with our Past report.

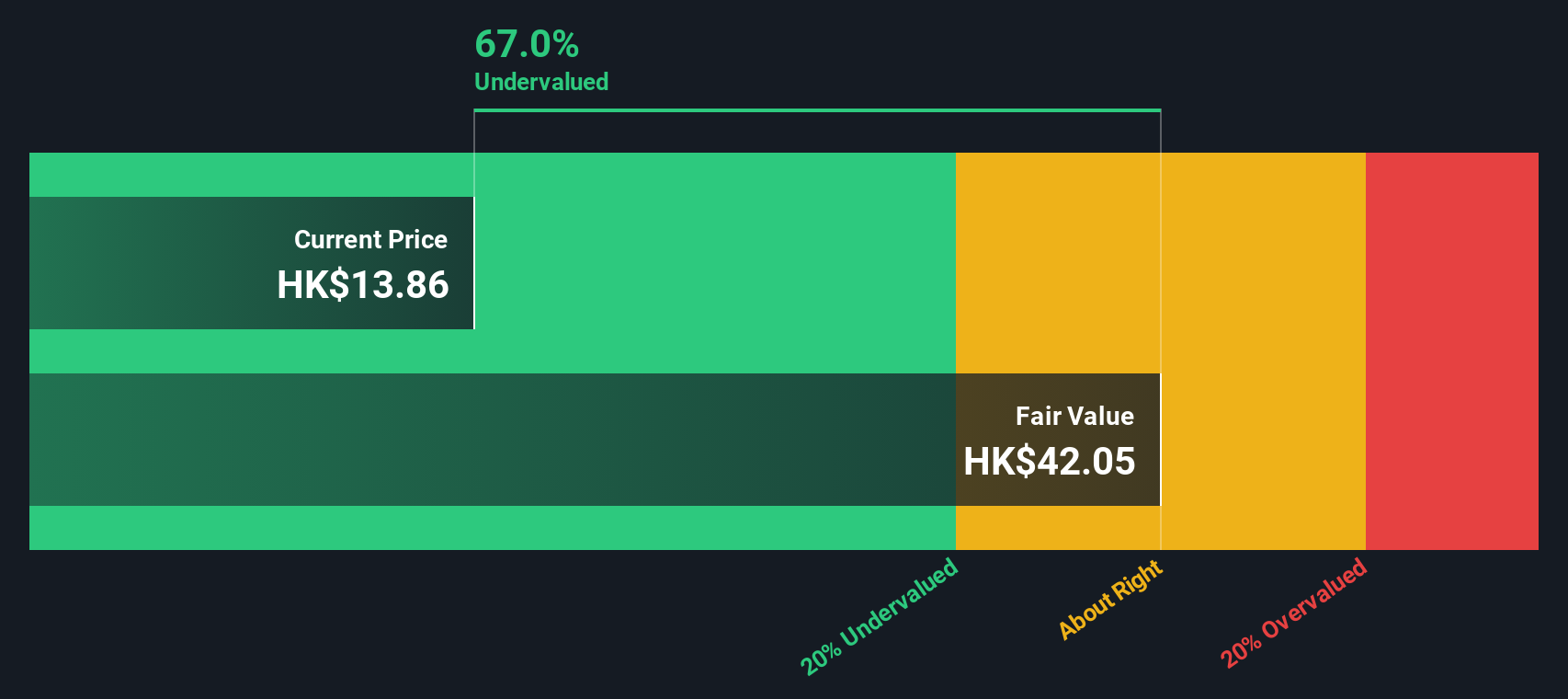

Hang Lung Group (SEHK:10)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hang Lung Group is primarily engaged in property leasing and sales in Hong Kong and Mainland China, with a market capitalization of HK$27.12 billion.

Operations: The company generates revenue primarily through property sales in Hong Kong and property leasing in both Hong Kong and Mainland China. Over recent periods, the gross profit margin has shown a declining trend, moving from 71.96% to 63.42%. Operating expenses have remained relatively stable, while non-operating expenses have fluctuated significantly.

PE: 7.7x

Hang Lung Group, a smaller company in its sector, has caught attention due to recent insider confidence. Wenbwo Chan increased their stake by purchasing 200,000 shares for approximately HK$1.93 million between July and October 2024, signaling potential optimism about the company's future. Despite a drop in net income to HK$888 million from HK$1.68 billion year-on-year and declining profit margins, the consistent interim dividend of HK$0.21 per share reflects stability amidst challenges with higher-risk external borrowing as its sole funding source.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading manufacturer and distributor of building materials and interior decoration products, with operations primarily focused on plastics and rubber, boasting a market capitalization of CN¥19.76 billion.

Operations: The company generates revenue primarily from its Plastics & Rubber segment, with a recent figure of CN¥29.13 billion. Its cost structure is heavily influenced by the cost of goods sold (COGS), which was CN¥21.55 billion for the same period. The gross profit margin has shown fluctuations, reaching 26.04% in the latest period analyzed, indicating variations in profitability over time.

PE: 7.3x

China Lesso Group Holdings, a smaller company in its sector, recently reported a decline in sales and net income for the first half of 2024 compared to the previous year. Despite these challenges, insider confidence is evident as Founder & Executive Chairman Luen Hei Wong purchased 4 million shares worth approximately CNY 10.05 million. This move suggests optimism about future prospects despite current high debt levels and reliance on external borrowing. Earnings are projected to grow by 10.65% annually, indicating potential for recovery and growth ahead.

Where To Now?

- Unlock our comprehensive list of 190 Undervalued Small Caps With Insider Buying by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HighPeak Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HPK

HighPeak Energy

An independent oil and natural gas company, engages in the exploration, development, and production of crude oil, natural gas, and natural gas liquids reserves in the Permian Basin in West Texas and Eastern New Mexico.

Good value with questionable track record.