- United States

- /

- Oil and Gas

- /

- NasdaqGS:GPRE

Shareholders in Green Plains (NASDAQ:GPRE) have lost 71%, as stock drops 6.9% this past week

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Green Plains Inc. (NASDAQ:GPRE); the share price is down a whopping 71% in the last three years. That would be a disturbing experience. And over the last year the share price fell 57%, so we doubt many shareholders are delighted. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Green Plains

Green Plains isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years, Green Plains saw its revenue grow by 0.09% per year, compound. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 19%, compound, over three years) suggests the market is very disappointed with this level of growth. We generally don't try to 'catch the falling knife'. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

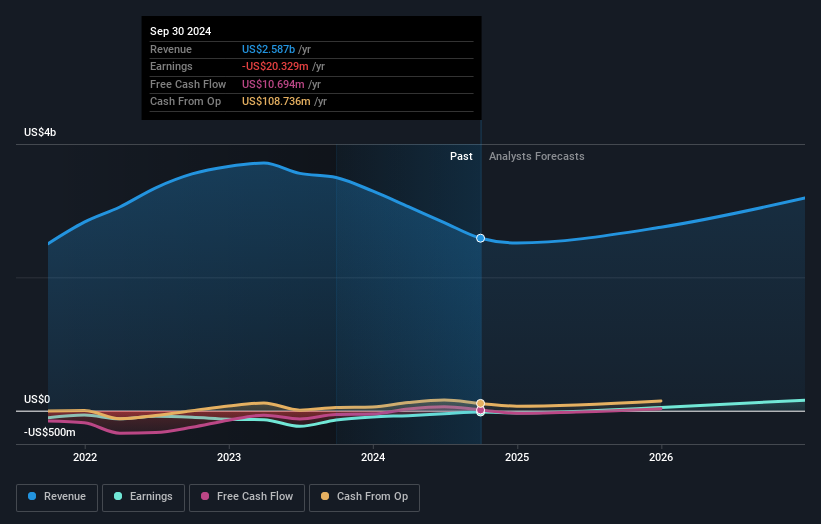

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Green Plains stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Investors in Green Plains had a tough year, with a total loss of 57%, against a market gain of about 34%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Green Plains you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GPRE

Green Plains

Produces low-carbon fuels in the United States and internationally.

Undervalued with excellent balance sheet.