- United States

- /

- Construction

- /

- NYSE:AGX

3 US Stocks That May Be Trading Below Estimated Value In January 2025

Reviewed by Simply Wall St

As the United States stock market shows signs of recovery with major indexes poised for weekly gains, investors are keenly observing the impact of recent economic data, which has fueled optimism about potential interest rate cuts. In this environment, identifying stocks that may be trading below their estimated value becomes crucial, as these opportunities can offer significant potential for growth if market conditions continue to improve.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $61.21 | $117.59 | 47.9% |

| German American Bancorp (NasdaqGS:GABC) | $39.47 | $78.06 | 49.4% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $28.50 | $55.69 | 48.8% |

| Old National Bancorp (NasdaqGS:ONB) | $22.70 | $43.90 | 48.3% |

| Equity Bancshares (NYSE:EQBK) | $43.00 | $85.17 | 49.5% |

| Kanzhun (NasdaqGS:BZ) | $13.86 | $27.19 | 49% |

| Cadre Holdings (NYSE:CDRE) | $36.03 | $70.00 | 48.5% |

| Constellium (NYSE:CSTM) | $10.93 | $21.09 | 48.2% |

| Bilibili (NasdaqGS:BILI) | $16.98 | $32.73 | 48.1% |

| Mobileye Global (NasdaqGS:MBLY) | $16.51 | $32.92 | 49.9% |

Here's a peek at a few of the choices from the screener.

Argan (NYSE:AGX)

Overview: Argan, Inc., with a market cap of $2.38 billion, operates through its subsidiaries to offer engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market.

Operations: The company's revenue segments include Power Services at $615.58 million, Telecom Services at $14.70 million, and Industrial Services at $175.98 million.

Estimated Discount To Fair Value: 36.2%

Argan, Inc. appears undervalued based on cash flows, trading at US$175.35, which is 36.2% below its estimated fair value of US$274.86. The company reported robust earnings growth of 94.6% over the past year and forecasts suggest annual profit growth of 21.2%, outpacing the broader US market's expected growth rate of 14.9%. Recent earnings showed significant improvements, with net income rising to US$28 million for Q3 2024 from US$5.46 million a year ago.

- The analysis detailed in our Argan growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Argan stock in this financial health report.

Cushman & Wakefield (NYSE:CWK)

Overview: Cushman & Wakefield plc, with a market cap of $2.96 billion, provides commercial real estate services globally under its brand in regions including the United States, Australia, and the United Kingdom.

Operations: The company's revenue segments are comprised of $1.46 billion from APAC, $950.80 million from EMEA, and $6.96 billion from the Americas.

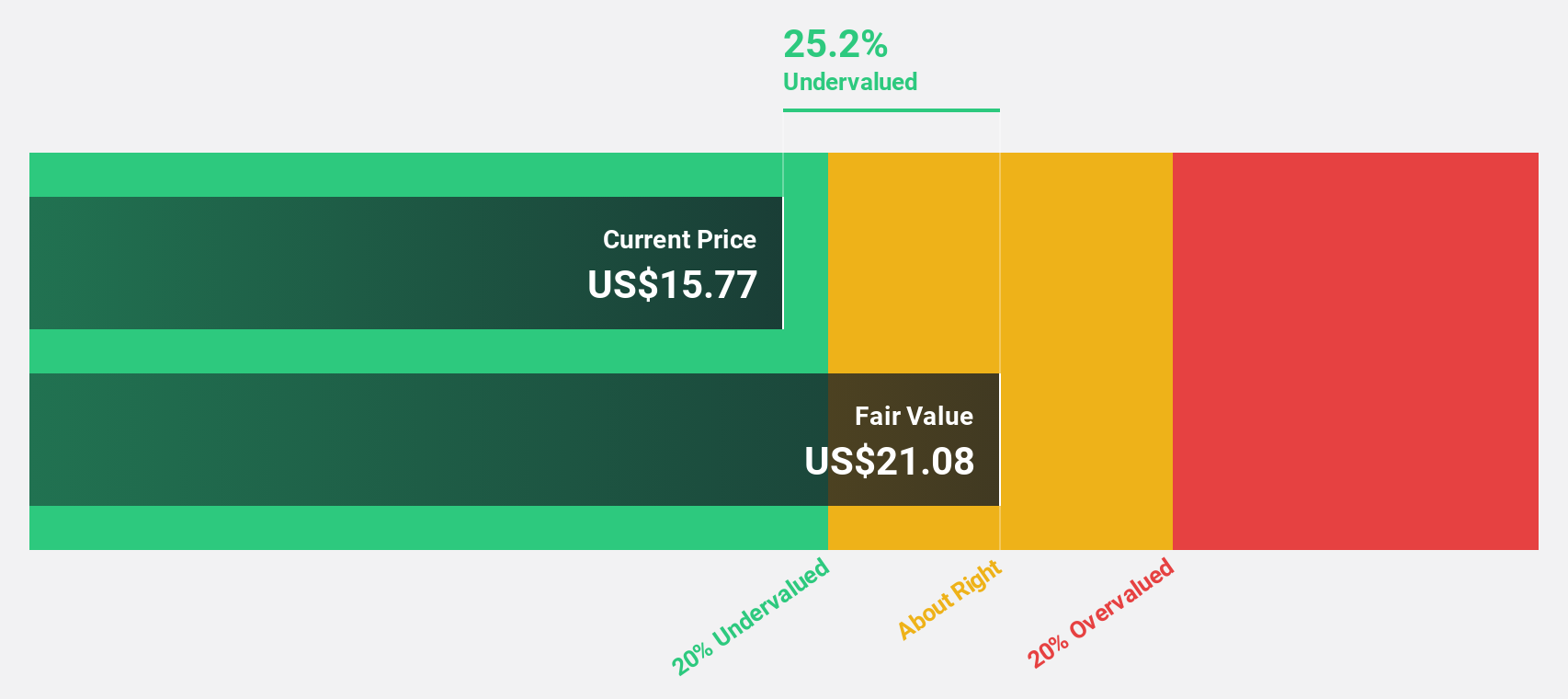

Estimated Discount To Fair Value: 24.8%

Cushman & Wakefield is trading at US$13.14, approximately 24.8% below its estimated fair value of US$17.46, suggesting it may be undervalued based on cash flows. The company recently turned profitable with a net income of US$33.7 million for Q3 2024 compared to a loss last year and forecasts indicate earnings growth of over 20% annually, outpacing the broader market's expected growth rate of 14.9%.

- Our growth report here indicates Cushman & Wakefield may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Cushman & Wakefield.

SouthState (NYSE:SSB)

Overview: SouthState Corporation is the bank holding company for SouthState Bank, National Association, offering a variety of banking services and products to individuals and businesses, with a market cap of approximately $10.07 billion.

Operations: The company generates revenue of approximately $1.67 billion from its banking operations segment, providing a wide range of financial services to both individuals and businesses.

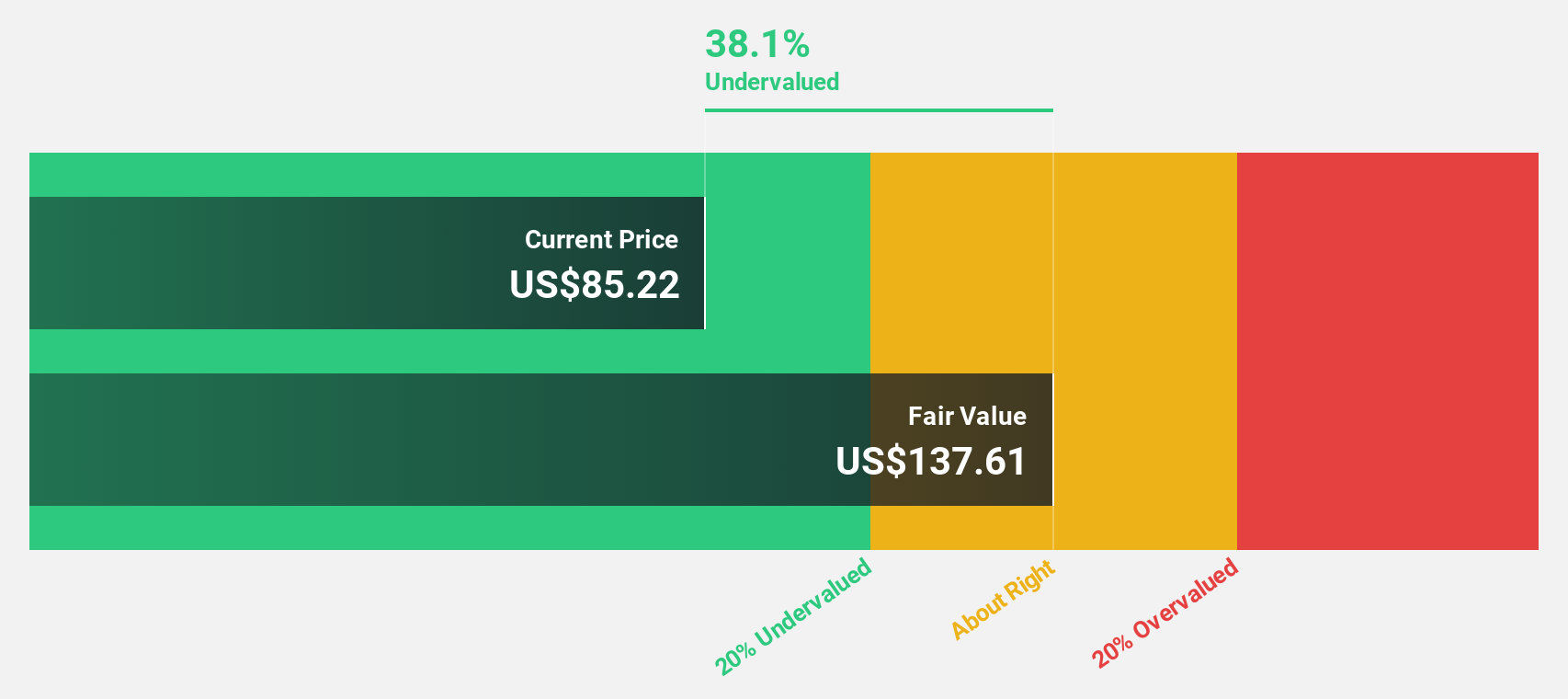

Estimated Discount To Fair Value: 29.6%

SouthState, trading at US$98.63, is considered undervalued with a fair value estimate of US$140.09. Earnings are projected to grow 29.7% annually, surpassing the broader market's 14.9% growth expectation. Despite significant insider selling recently and past shareholder dilution, the company maintains a reliable dividend yield of 2.19%. The recent merger with Independent Bank Group introduces experienced directors to its board, potentially enhancing strategic direction and continuity in key markets.

- Our comprehensive growth report raises the possibility that SouthState is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of SouthState.

Summing It All Up

- Access the full spectrum of 165 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives