- United States

- /

- Banks

- /

- NasdaqCM:PKBK

3 US Dividend Stocks Offering Up To 7.8% Yield

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed movements amidst fluctuating earnings reports and record-breaking cryptocurrency surges, investors are increasingly seeking stability through dividend stocks. In such a dynamic environment, selecting dividend stocks with solid yields can provide a reliable income stream, making them an attractive option for those looking to balance potential volatility with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.65% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.80% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.50% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.01% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.63% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

Click here to see the full list of 138 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

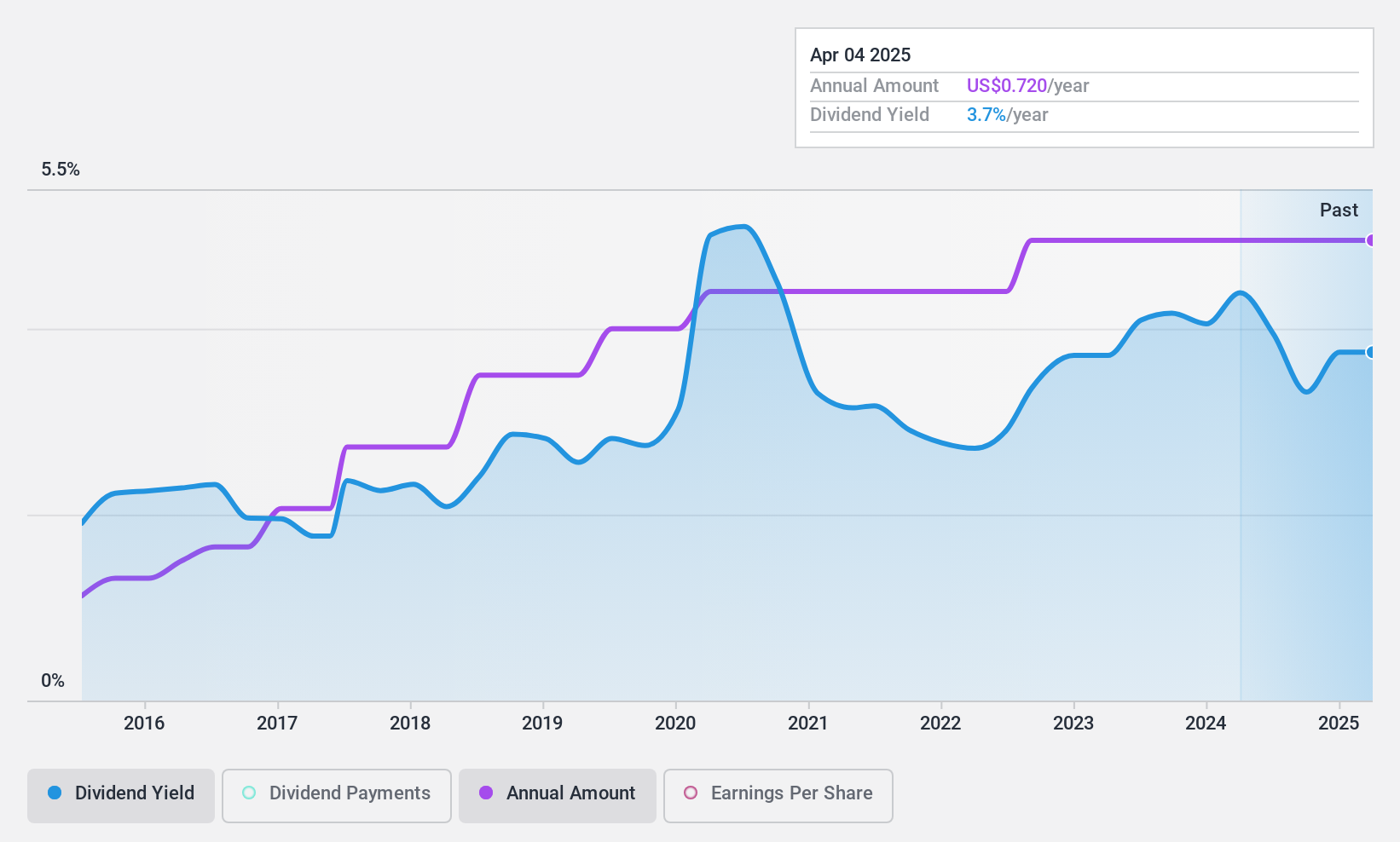

Parke Bancorp (NasdaqCM:PKBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Parke Bancorp, Inc. is the bank holding company for Parke Bank, offering personal and business financial services to individuals and small to mid-sized businesses, with a market cap of $272.51 million.

Operations: Parke Bancorp generates its revenue primarily from community banking, amounting to $63.15 million.

Dividend Yield: 3.2%

Parke Bancorp offers a stable dividend history with payments increasing over the past decade, supported by a low payout ratio of 30.5%, indicating dividends are well covered by earnings. Despite recent insider selling, the company maintains a reliable dividend yield of 3.15%, although it's below the top tier in the US market. Recent financials show stable net income growth, and a completed share buyback may enhance shareholder value further.

- Delve into the full analysis dividend report here for a deeper understanding of Parke Bancorp.

- Our valuation report here indicates Parke Bancorp may be undervalued.

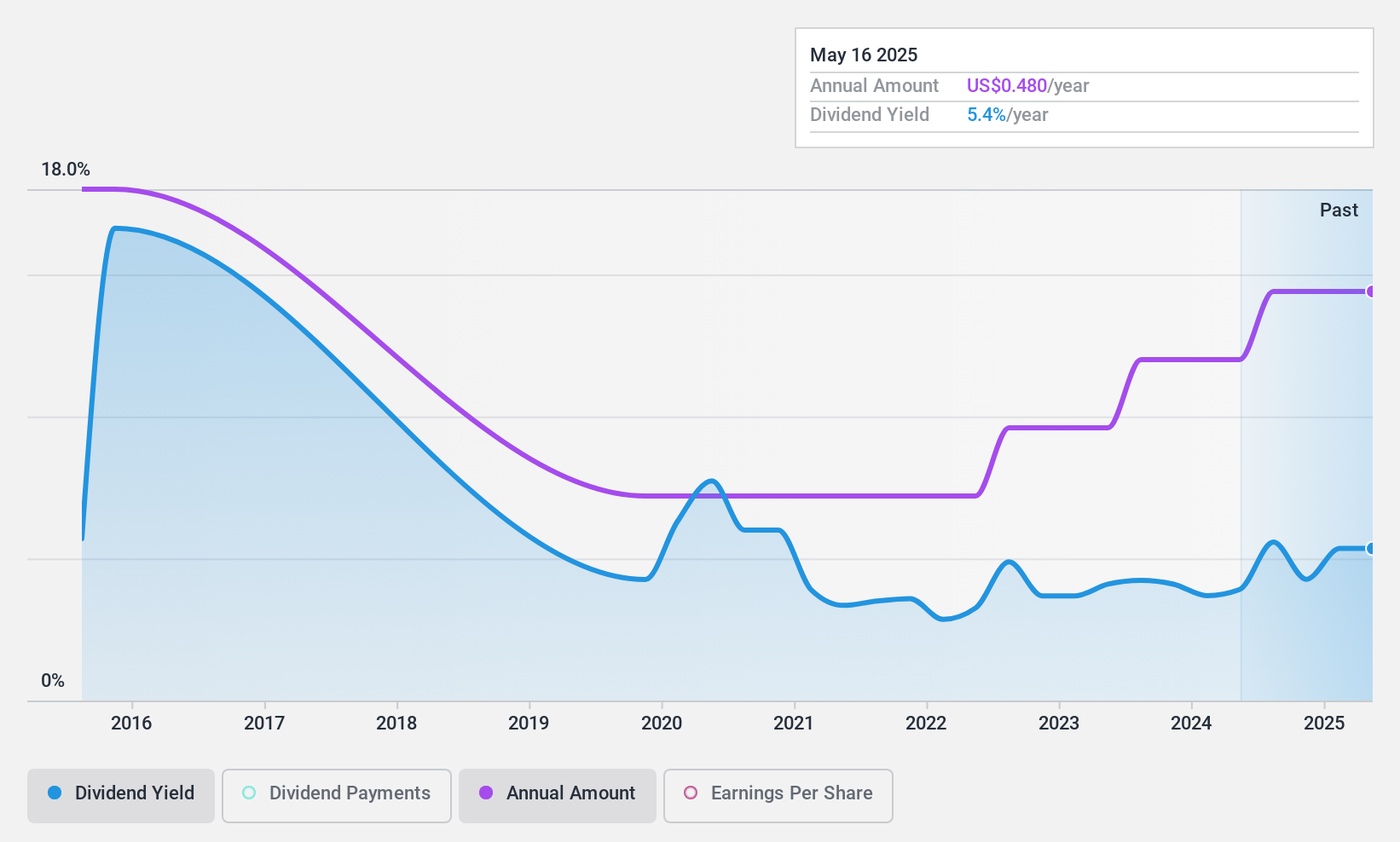

Chord Energy (NasdaqGS:CHRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chord Energy Corporation is an independent exploration and production company in the United States with a market cap of approximately $7.82 billion.

Operations: Chord Energy Corporation generates revenue primarily from the exploration and production of crude oil, NGLs, and natural gas, amounting to $4.45 billion.

Dividend Yield: 7.8%

Chord Energy's dividend yield is among the top 25% in the US, supported by a payout ratio of 52.1%, indicating coverage by earnings. Despite only four years of dividend history and volatility, recent affirmations include a base-plus-variable cash dividend totaling $1.44 per share. The company completed significant share repurchases worth $305.11 million and announced an additional buyback program up to $750 million, which may support shareholder value alongside its improved production figures and revenue growth.

- Navigate through the intricacies of Chord Energy with our comprehensive dividend report here.

- Our expertly prepared valuation report Chord Energy implies its share price may be lower than expected.

SunCoke Energy (NYSE:SXC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SunCoke Energy, Inc. is an independent producer of coke operating in the Americas and Brazil, with a market cap of approximately $1.05 billion.

Operations: SunCoke Energy generates revenue from its segments with $102.80 million from Logistics, $35.60 million from Brazil Coke, and $1.85 billion from Domestic Coke.

Dividend Yield: 3.8%

SunCoke Energy's recent dividend affirmation of $0.12 per share reflects its ongoing commitment to shareholder returns, despite a history of volatile payments. With a payout ratio of 41.5%, dividends are well-covered by earnings and cash flows, though the yield remains below top-tier levels in the US market. The company reported Q3 net income growth to $30.7 million from $7 million year-over-year, yet faces future earnings decline forecasts and maintains high debt levels.

- Get an in-depth perspective on SunCoke Energy's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, SunCoke Energy's share price might be too pessimistic.

Make It Happen

- Investigate our full lineup of 138 Top US Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PKBK

Parke Bancorp

Operates as the bank holding company for Parke Bank that provides personal and business financial services to individuals and small to mid-sized businesses.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives