- United States

- /

- Capital Markets

- /

- NYSEAM:CET

Undiscovered Gems In The US Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

The United States market has shown resilience with a 1.3% climb in the last week and an impressive 24% rise over the past year, alongside forecasts of annual earnings growth at 15%. In this dynamic environment, identifying promising small-cap stocks that offer unique opportunities for growth can be a rewarding strategy for investors seeking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Climb Global Solutions (NasdaqGM:CLMB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Climb Global Solutions Inc. is a value-added IT distribution and solutions company operating in the United States, Canada, Europe, the United Kingdom, and internationally with a market cap of $570.82 million.

Operations: Climb Global Solutions generates revenue primarily from its distribution segment, contributing $384.88 million, while the solutions segment adds $25.75 million.

Climb Global Solutions, a nimble player in the tech industry, has been making waves with its impressive financial performance. Over the past year, earnings surged by 42%, outpacing the electronic industry's -5%. The company boasts a robust balance sheet with more cash than total debt and an increased debt-to-equity ratio from 0% to 1% over five years. Recent quarterly results reveal sales climbing to US$119 million from US$78 million, while net income rose to US$5.46 million compared to last year's US$2.37 million. Despite potential margin pressure from M&A activities and ERP investments, Climb's strategic expansion could enhance future profitability if managed well.

Central Securities (NYSEAM:CET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Central Securities Corp. is a publicly owned investment manager with a market cap of $1.29 billion.

Operations: Central Securities generates revenue primarily from its financial services segment, specifically closed-end funds, amounting to $23.37 million.

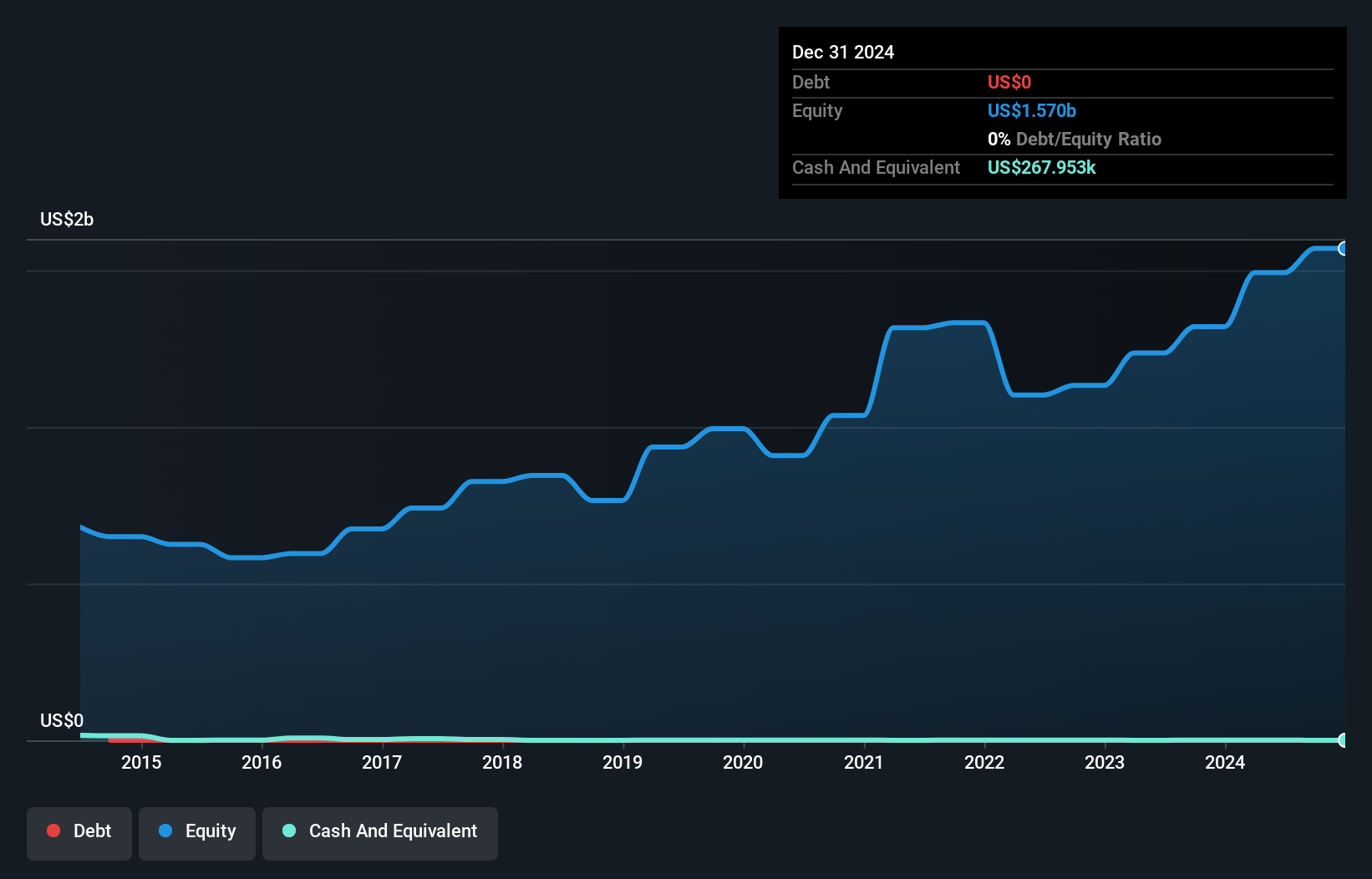

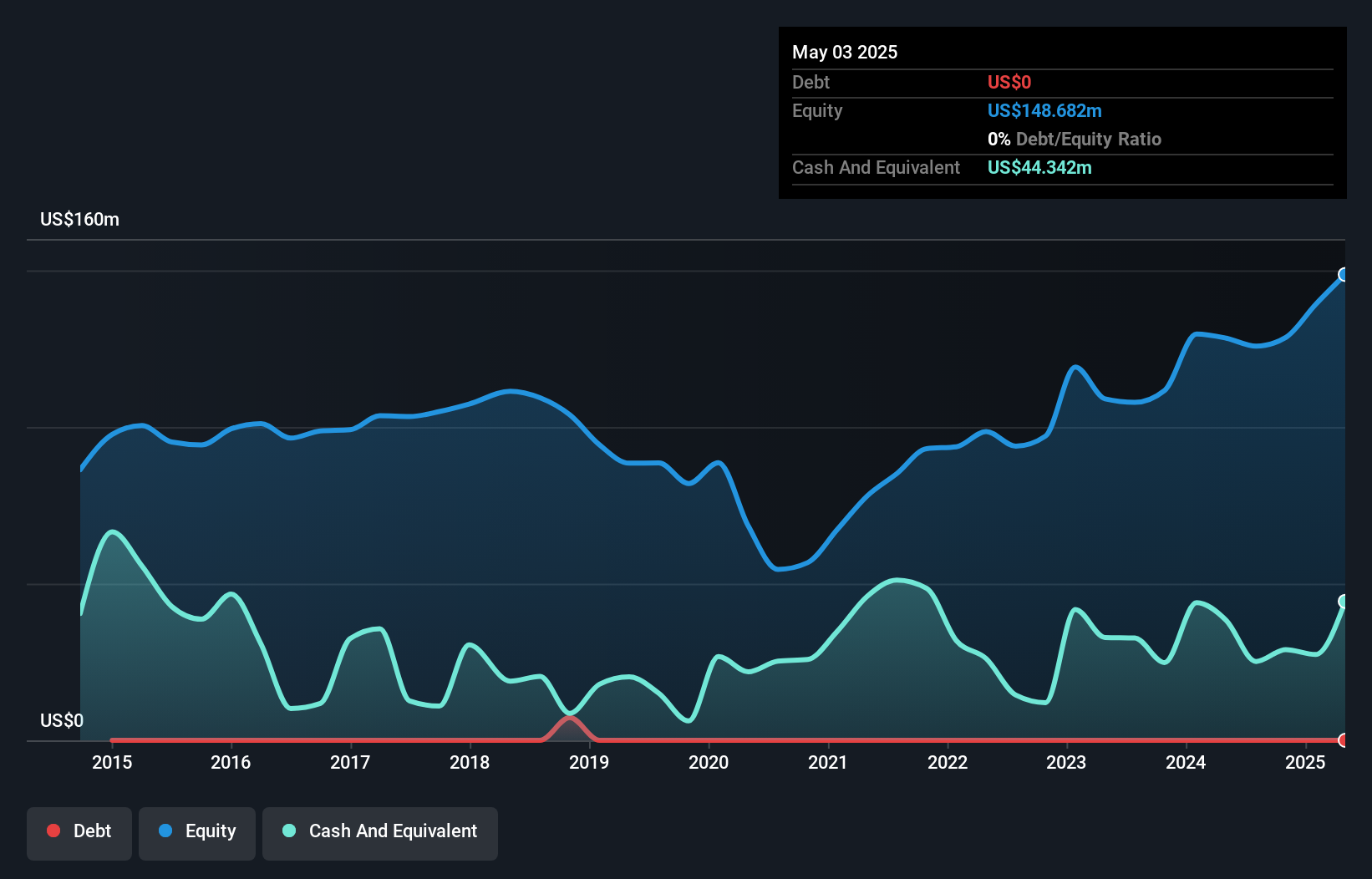

Trading significantly below its estimated fair value, Central Securities stands out with a robust financial position. The company is debt-free and has maintained this status for five years, eliminating concerns over interest payments. Over the past year, earnings surged by 67%, outpacing the Capital Markets industry average of 12.8%. A notable one-off gain of US$277 million impacted recent results, signaling high-quality earnings despite its unusual nature. Additionally, the firm declared a dividend distribution of US$2.05 per share payable in December 2024, reinforcing shareholder value through consistent returns without leveraging debt obligations.

- Click here and access our complete health analysis report to understand the dynamics of Central Securities.

Gain insights into Central Securities' past trends and performance with our Past report.

Build-A-Bear Workshop (NYSE:BBW)

Simply Wall St Value Rating: ★★★★★★

Overview: Build-A-Bear Workshop, Inc. is a multi-channel retailer specializing in plush animals and related products across the United States, Canada, the United Kingdom, Ireland, and other international markets with a market cap of approximately $597.95 million.

Operations: Revenue primarily comes from the Direct-To-Consumer segment, contributing $461.02 million, followed by Commercial at $29.59 million and International Franchising at $4.63 million.

With a focus on expanding both its physical and digital footprint, Build-A-Bear Workshop is aiming to enhance revenue growth and net margins. The company has no debt, which provides financial flexibility for planned expansions, including 65 new locations in fiscal 2024. Recent collaborations with brands like KFC and Hello Kitty highlight its creative marketing strategies. Earnings have grown by 2.4% over the past year, outpacing the Specialty Retail industry average of -5.3%. Despite significant insider selling recently, Build-A-Bear's shares are trading at approximately 3.7% below estimated fair value, suggesting potential investment appeal.

Taking Advantage

- Embark on your investment journey to our 248 US Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CET

Central Securities

Central Securities Corp. is a publicly owned investment manager.

Good value with proven track record.