- United States

- /

- IT

- /

- NYSE:KD

Exploring High Growth Tech Stocks in January 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.3%, contributing to a substantial 24% increase over the past year, with earnings anticipated to grow by 15% annually in the coming years. In this favorable environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential, aligning well with current market dynamics.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 44.32% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc. is a digital asset technology company operating in the United States with a market capitalization of $2.40 billion.

Operations: TeraWulf generates revenue primarily through digital currency mining, amounting to $128.35 million. The company's focus on this segment is central to its business operations in the digital asset technology sector.

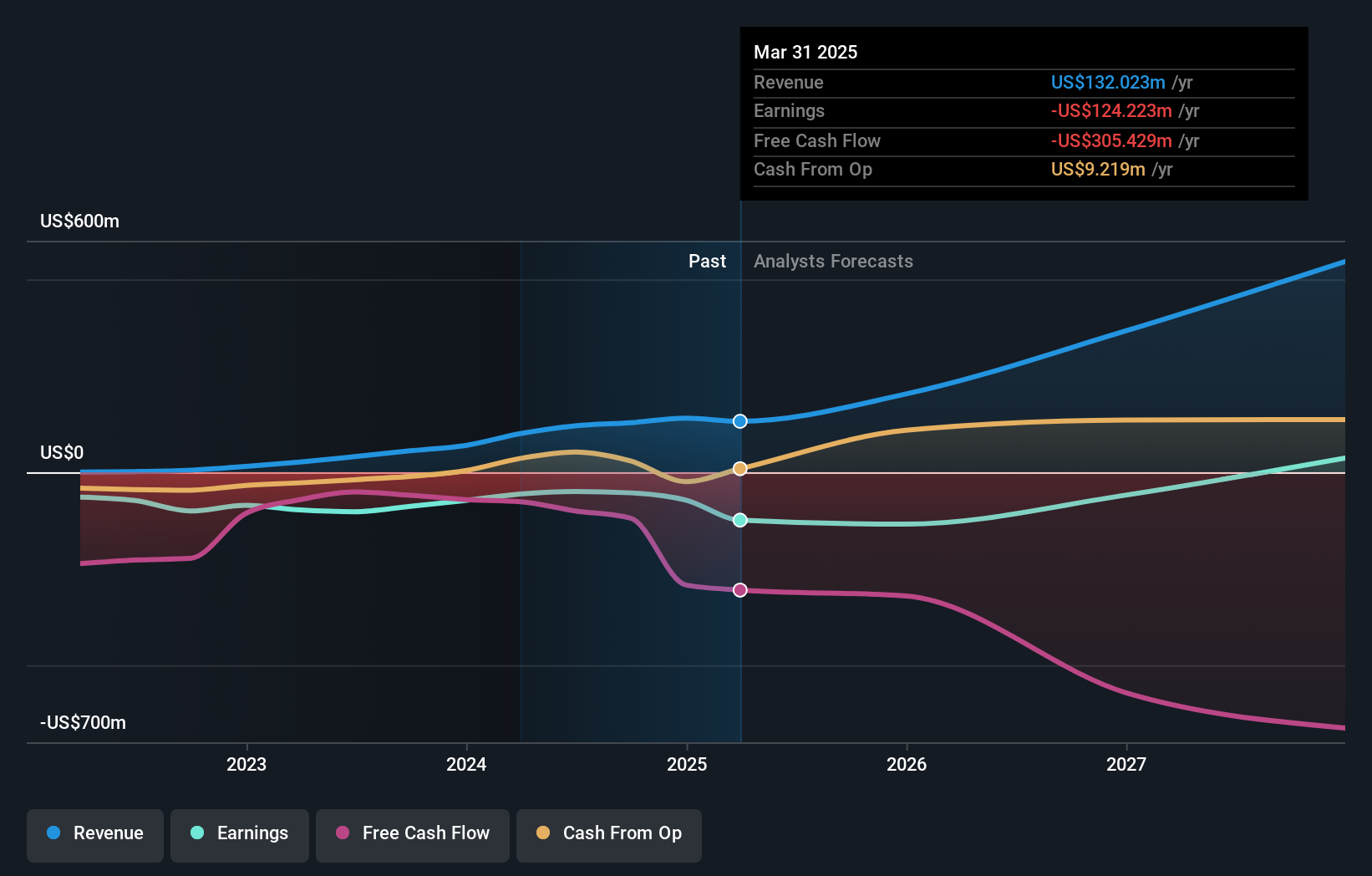

TeraWulf, navigating through a challenging landscape marked by substantial shareholder dilution and ongoing unprofitability, is making strategic strides in high-performance computing (HPC) and AI. With revenue growth forecasted at 29.8% annually, outpacing the US market's 9%, the company recently inked significant data center lease agreements to support AI-driven computing with Core42. This move not only diversifies its revenue streams beyond Bitcoin mining but also aligns with its sustainable energy mission. Additionally, TeraWulf's aggressive expansion plans are underscored by a new long-term ground lease that expands their Lake Mariner facility significantly, ensuring ample capacity for future growth and technological deployments in AI and HPC sectors.

- Take a closer look at TeraWulf's potential here in our health report.

Assess TeraWulf's past performance with our detailed historical performance reports.

Nutanix (NasdaqGS:NTNX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nutanix, Inc. offers an enterprise cloud platform across various global regions including North America, Europe, and Asia Pacific with a market capitalization of approximately $16.79 billion.

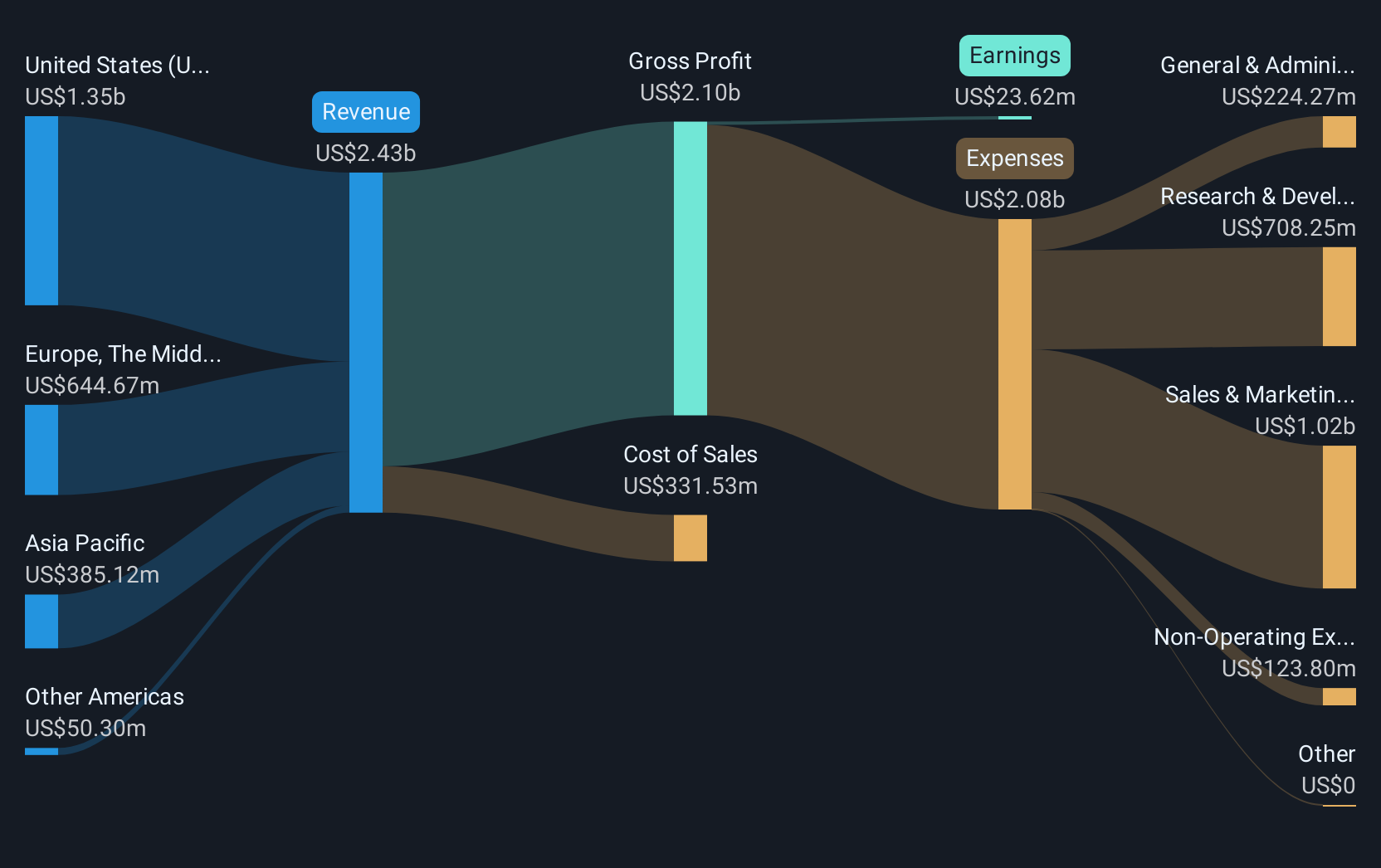

Operations: Nutanix generates revenue primarily from its Internet Software & Services segment, totaling approximately $2.23 billion. The company's operations span multiple regions, including the Middle East and Latin America, in addition to North America, Europe, and Asia Pacific.

Amidst a dynamic tech landscape, Nutanix has shown resilience and adaptability, recently completing a significant $750 million fixed-income offering aimed at bolstering its financial structure. This move, coupled with an impressive 88.9% forecasted annual earnings growth and the launch of Nutanix Enterprise AI—a platform enhancing AI infrastructure across hybrid environments—positions the company to capitalize on burgeoning AI demands effectively. Moreover, with a consistent revenue uptick of 13% annually outpacing the broader US market's growth, Nutanix is not just surviving but strategically expanding its technological footprint in critical future-facing sectors.

- Click to explore a detailed breakdown of our findings in Nutanix's health report.

Review our historical performance report to gain insights into Nutanix's's past performance.

Kyndryl Holdings (NYSE:KD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kyndryl Holdings, Inc. is a global technology services and IT infrastructure services provider with a market cap of $8.65 billion.

Operations: Kyndryl generates revenue through its operations across various regions, with the United States contributing $3.97 billion, Japan $2.34 billion, Principal Markets $5.69 billion, and Strategic Markets $3.31 billion.

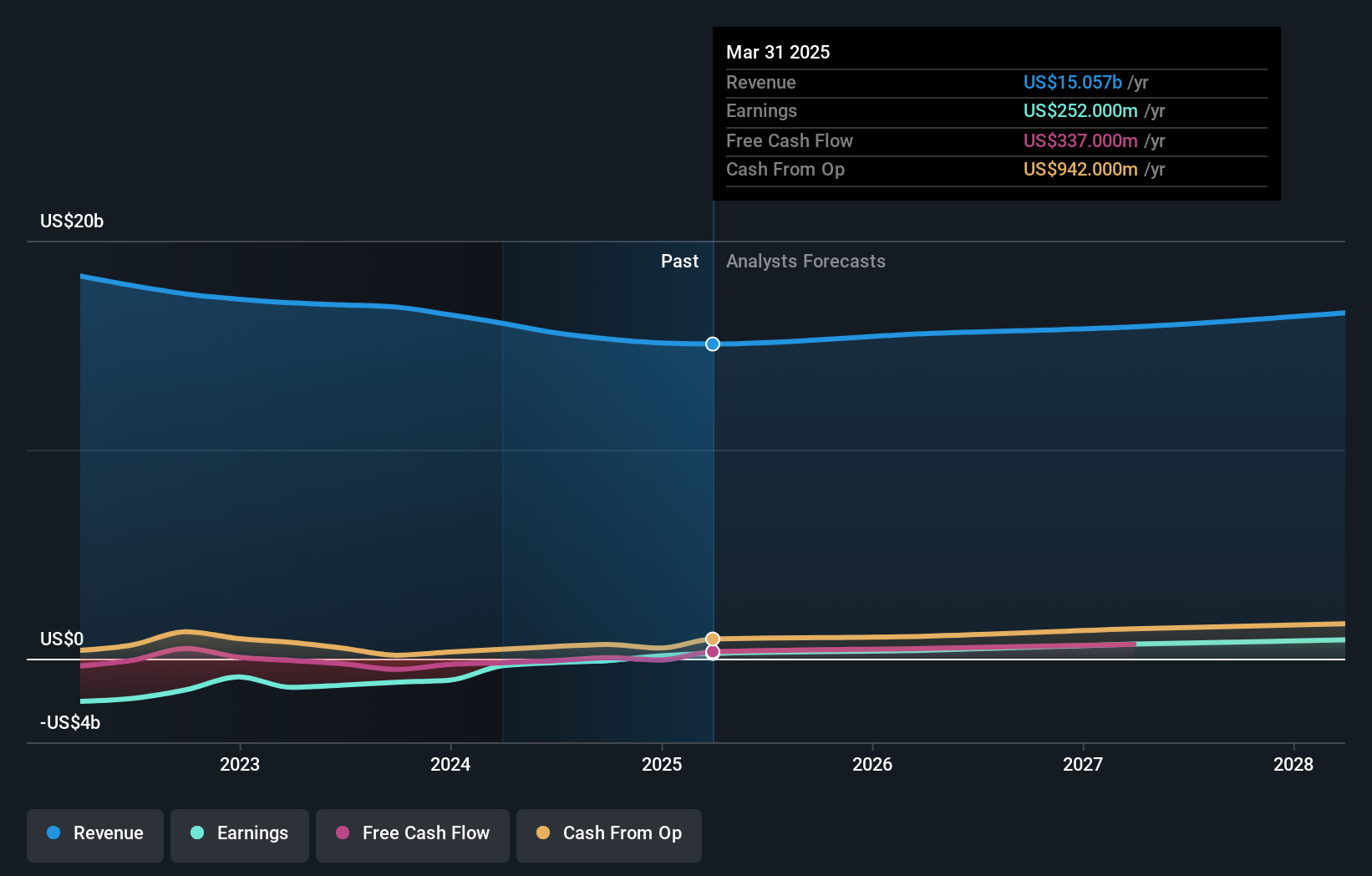

Kyndryl Holdings is navigating a complex tech landscape with strategic agility, notably through its expanded partnership with Nokia to enhance data center solutions, signaling a robust approach to hybrid cloud and network management. Despite modest revenue growth projections of 1.6% annually, Kyndryl's earnings are expected to surge by 66.9% per year, showcasing potential profitability improvements. The company also recently announced a substantial $300 million share repurchase program, underscoring confidence in its financial strategy and future prospects. These initiatives reflect Kyndryl's commitment to integrating cutting-edge technologies like AI and machine learning across its service platforms, positioning it well for future tech demands despite current profitability challenges.

- Dive into the specifics of Kyndryl Holdings here with our thorough health report.

Examine Kyndryl Holdings' past performance report to understand how it has performed in the past.

Seize The Opportunity

- Gain an insight into the universe of 236 US High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kyndryl Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives