Last Update01 May 25Fair value Increased 15%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Climb Global Solutions' strategic initiatives, including vendor relationships and M&A, aim to strengthen market presence and drive revenue growth.

- New leadership and systems enhancements target operational efficiency, potentially increasing profitability and supporting strategic growth initiatives.

- The departure of Citrix and reliance on volatile deals may threaten Climb Global Solutions' revenue stability, while significant SG&A costs could pressure net income.

Catalysts

About Climb Global Solutions- Operates as a value-added information technology (IT) distribution and solutions company in the United States, Canada, Europe, and the United Kingdom.

- Climb Global Solutions is focusing on organic growth by deepening relationships with existing vendors and customers, as well as signing agreements with new emerging vendors specializing in innovative technologies. This initiative is expected to drive revenue growth and expand the company's market presence, thus potentially boosting earnings.

- The company has implemented a new ERP system aimed at streamlining processes and enhancing real-time data accessibility across operations. Improvements in transactional efficiency and operational effectiveness should lead to increased net margins and overall profitability.

- Climb Global is actively evaluating M&A opportunities to enhance services and solutions offerings and expand geographic footprint, both in North America and internationally. Successful acquisitions could contribute to revenue growth, operating leverage improvements, and increased earnings.

- Recent changes in executive leadership, including a new CFO and the appointment of a Chief Marketing Officer and Chief Alliance Officer, are targeted at driving growth and executing strategic initiatives more effectively. These leadership changes may enhance operational excellence and contribute to improved net margins and earnings.

- The company is capitalizing on the growing demand for AI components and security solutions, which are expected to continue leading growth segments. Increased investment in these areas suggests potential for significant revenue expansion and margin improvements in future periods.

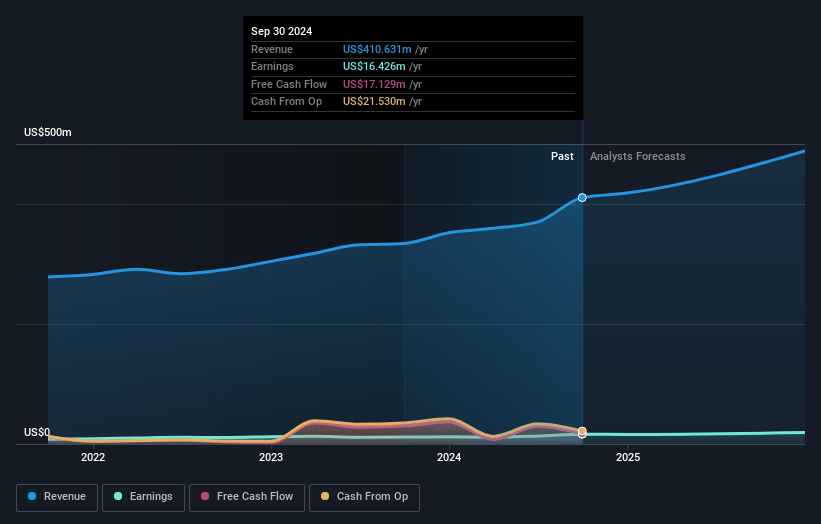

Climb Global Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Climb Global Solutions's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.9% today to 5.4% in 3 years time.

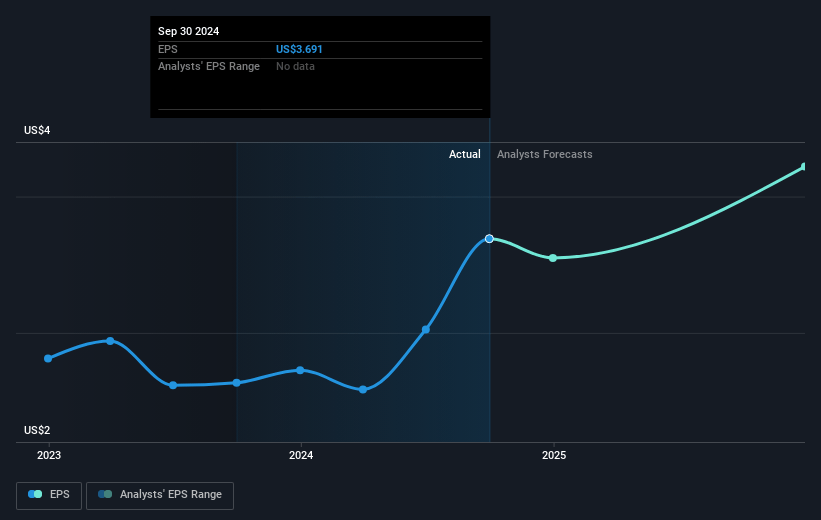

- Analysts expect earnings to reach $30.3 million (and earnings per share of $6.34) by about May 2028, up from $18.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, down from 26.5x today. This future PE is greater than the current PE for the US Electronic industry at 20.6x.

- Analysts expect the number of shares outstanding to grow by 0.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.3%, as per the Simply Wall St company report.

Climb Global Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The departure of Citrix from the channel poses a potential threat as Climb Global Solutions will need to fill this gap, which could lead to challenges in retaining current revenue levels and maintaining growth.

- Adjustments in leadership, with a new CFO and executive team promotions, may lead to transitional challenges and affect operational stability and net margins during the adjustment period.

- A reliance on large, potentially volatile deals (e.g., with the VAST vendor) could lead to uneven revenue streams, which may impact financial stability and predictability of earnings.

- Although SG&A expenses as a percentage of gross billings decreased, overall SG&A costs have risen significantly, which could pressure net income if not managed alongside revenue growth.

- Despite a good liquidity position, the significant decrease in cash and cash equivalents due to acquisitions like DSS indicates a heavy reliance on cash for growth, which could strain financial reserves and impact future net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $136.0 for Climb Global Solutions based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $561.3 million, earnings will come to $30.3 million, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 7.3%.

- Given the current share price of $107.4, the analyst price target of $136.0 is 21.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.