Key Takeaways

- Expanded physical and digital presence aims to boost revenue growth and improve net margins through omnichannel strategies and AI integration.

- Diversified revenue streams through international expansion and partnerships target a broader consumer base, enhancing earnings and shareholder value.

- Elevated inventory and early-stage digital initiatives pose risks to revenue growth, while rising costs threaten margins amidst weak web demand.

Catalysts

About Build-A-Bear Workshop- Operates as a multi-channel retailer of plush animals and related products in the United States, Canada, the United Kingdom, Ireland, and internationally.

- Build-A-Bear Workshop is expanding its experience location footprint, including 110 net new locations over three years and over 65 expected new locations in fiscal 2024, which should drive revenue growth by increasing their physical presence and accessibility.

- The company's acceleration of a multiyear comprehensive digital transformation, including omnichannel capabilities and data integration with AI, is expected to enhance overall sales performance and improve net margins by efficiently merging physical and online sales strategies.

- Increased focus on international market expansion, with new partner-operated stores in various countries, diversifies revenue streams and mitigates risk, potentially leading to higher earnings through a broader addressable market.

- Expanding its product offerings and partnerships, such as the new Build-A-Bear Mini Beans line and collaborations like the Sanrio Hello Kitty Collection, is intended to attract a wider, multigeneration consumer base, supporting revenue and margin growth.

- Continued capital return initiatives, including stock repurchases and dividends, reflect strong cash flow generation and may improve earnings per share (EPS) by reducing the number of shares outstanding and increasing shareholder value.

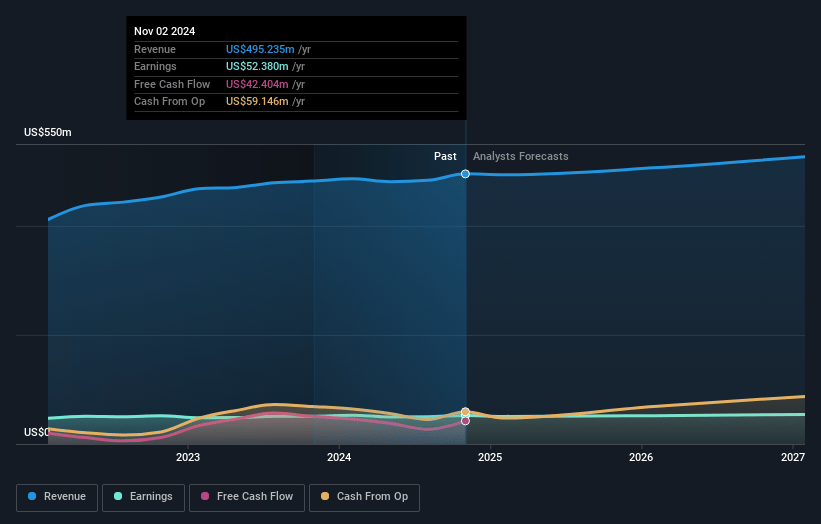

Build-A-Bear Workshop Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Build-A-Bear Workshop's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 10.6% today to 10.4% in 3 years time.

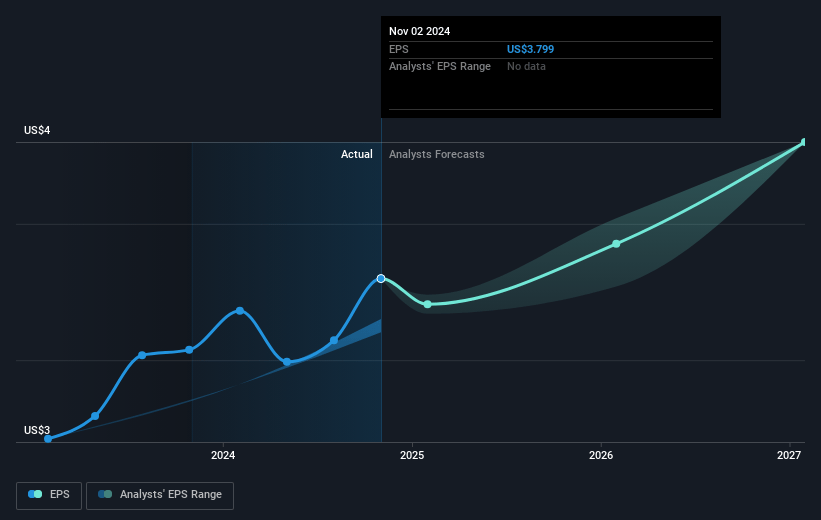

- Analysts expect earnings to reach $55.8 million (and earnings per share of $4.56) by about January 2028, up from $52.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, up from 11.0x today. This future PE is lower than the current PE for the US Specialty Retail industry at 16.3x.

- Analysts expect the number of shares outstanding to decline by 2.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.13%, as per the Simply Wall St company report.

Build-A-Bear Workshop Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is facing ongoing challenges with its web demand, which has softened and is expected to remain weak, potentially impacting total revenue growth and overall profitability.

- Increased SG&A expenses due to rising medical insurance costs and wage pressures could reduce net margins and earnings.

- Build-A-Bear's inventory levels are elevated due to anticipating potential tariffs and there is also geographic supply chain diversification underway, which might lead to inventory management risks affecting future costs and margins.

- The digital transformation and omnichannel optimization are still in early stages, with potential execution risks that could limit expected benefits for revenue growth if not fully realized.

- The international expansion largely depends on partner-operated models, introducing potential dependence and risks associated with partners' performance and decision-making, which could affect revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.33 for Build-A-Bear Workshop based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $538.7 million, earnings will come to $55.8 million, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 7.1%.

- Given the current share price of $43.95, the analyst's price target of $54.33 is 19.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives