- United States

- /

- Diversified Financial

- /

- NYSE:TOST

Toast (NYSE:TOST) Stock Dips 9% Despite Strong Earnings in Recent Quarter

Reviewed by Simply Wall St

Toast (NYSE:TOST) recently announced a series of significant developments, including strong fourth-quarter earnings results and strategic client agreements, despite the company's stock price declining by 9% during the last quarter. The market overall has been experiencing turbulence, with major indexes like the S&P 500 posting a 3% decline over the same period, potentially influencing Toast's performance. Despite promising financials and new partnerships, such as with Ascent Hospitality Management, the absence of any stock repurchase during the last quarter and the broader market downturn may have affected investor sentiment. Additionally, executive changes, including the appointment of a new Chief Accounting Officer, could have introduced a degree of uncertainty. Overall, while Toast’s financial metrics showed marked improvement from the previous year, external market pressures and a lack of share buyback activities might have contributed to the downward trend in its stock price.

Click here and access our complete analysis report to understand the dynamics of Toast.

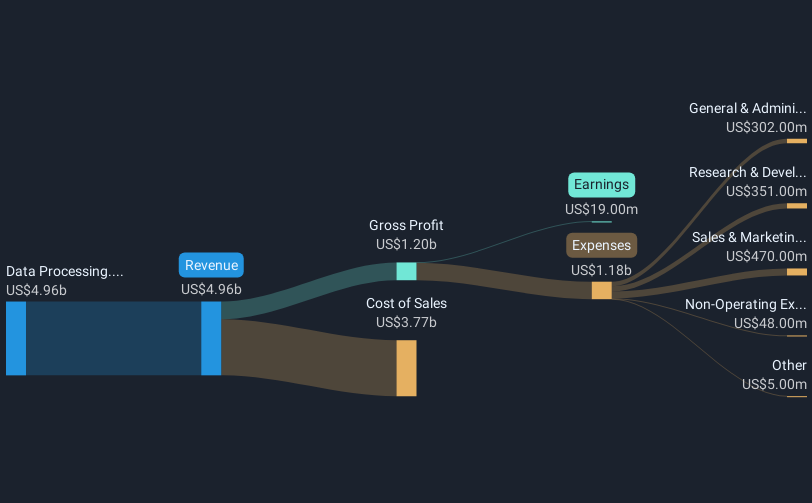

Despite the recent dip in Toast's share price, the company's long-term performance has been robust, with total shareholder returns reaching nearly 97% over the past three years. During this time, key developments have driven the company’s growth. February 2025 marked a turnaround in profitability, with Toast reporting full-year revenue of US$4.96 billion and a net income of US$19 million—a significant improvement from prior losses. This financial strength was complemented by strategic partnerships, such as the February 2025 alliance with Ascent Hospitality Management, augmenting Toast's market presence.

Additionally, the expansion of the partnership with Uber in December 2024 served to broaden service offerings, aiming to improve delivery capabilities and cost efficiency for clients. The authorized share buyback program announced in February 2024, valued up to US$250 million, underscores Toast’s commitment to shareholder value. These factors, among others, have positioned Toast strongly over the longer term, exceeding both the US Market and the US Diversified Financial industry in performance over the past year.

- Understand the fair market value of Toast with insights from our valuation analysis—click here to learn more.

- Analyze the downside risks for Toast and understand their potential impact—click to learn more.

- Are you invested in Toast already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with high growth potential.