- United States

- /

- Capital Markets

- /

- NYSE:SCHW

How Schwab’s Private Company Equity Platform Could Shape Long-Term Growth for SCHW Investors

Reviewed by Sasha Jovanovic

- Earlier this week, Schwab Stock Plan Services launched Schwab Private Issuer Equity Services, a comprehensive equity management solution aimed at supporting private late-stage companies before their IPO, leveraging Schwab’s expertise and Qapita’s platform integration.

- This offering gives private companies access to public-level equity management tools, robust employee resources, and a scalable path to public markets, marking a significant move in Schwab’s expansion into private company services.

- We’ll explore how Schwab’s entry into private company equity management could enhance its diversification and long-term growth narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Charles Schwab Investment Narrative Recap

To be a shareholder in Charles Schwab, investors typically look for sustained household wealth growth, deepening digital engagement, and consistent expansion in advisory and wealth management solutions. The recent launch of Schwab Private Issuer Equity Services broadens Schwab’s footprint into private company equity management but is not likely to materially change the main short-term catalyst: strong earnings momentum fueled by robust asset and client growth. It also does not reduce exposure to the firm’s biggest near-term risk, sensitivity to adverse interest rate shifts.

Among recent announcements, the authorization of a US$20 billion share repurchase program is especially relevant, as it underscores Schwab’s ongoing commitment to shareholder returns while supporting earnings per share. While both this buyback and the new equity management solution point to Schwab’s financial strength and diversification, they do not directly address the pressure of fee compression or margin risks linked to digital competition.

Yet, investors should also consider the flip side: ongoing fintech disruption could increase costs and put continued pressure on...

Read the full narrative on Charles Schwab (it's free!)

Charles Schwab's outlook anticipates $30.2 billion in revenue and $11.0 billion in earnings by 2028. This projection requires revenue growth of 11.8% annually and an earnings increase of $4.2 billion from the current $6.8 billion.

Uncover how Charles Schwab's forecasts yield a $108.37 fair value, a 16% upside to its current price.

Exploring Other Perspectives

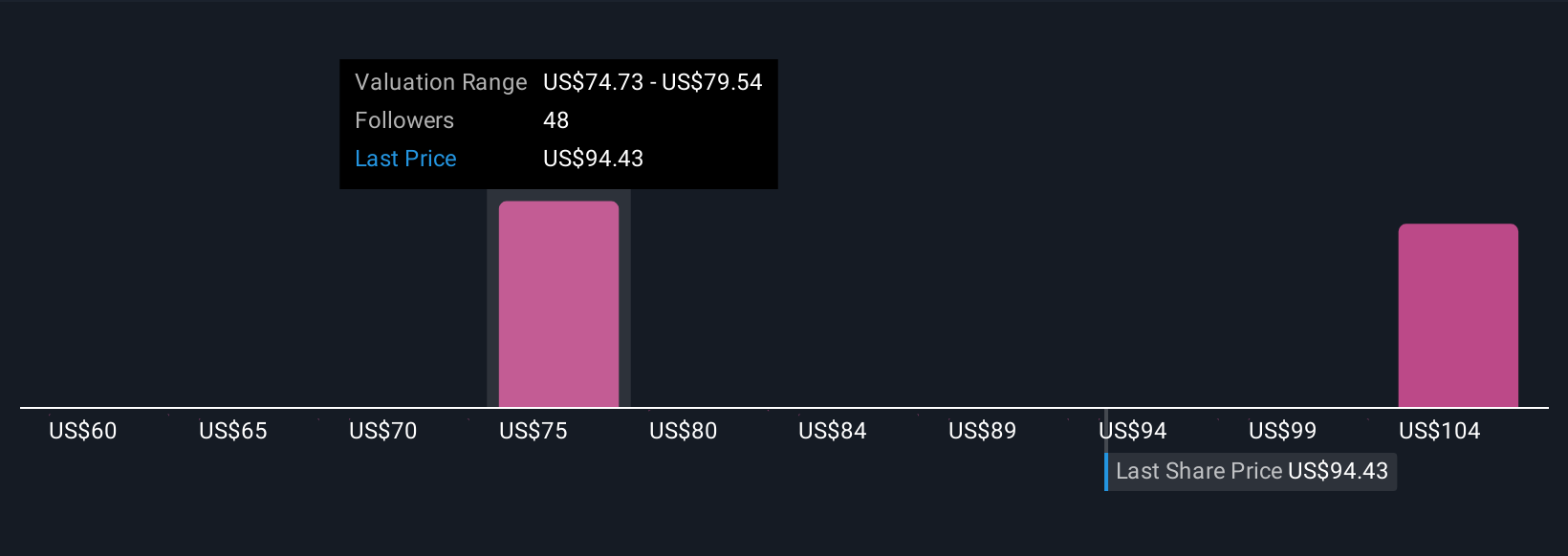

Simply Wall St Community members provided 11 fair value estimates for Schwab’s stock, ranging from US$60.32 to US$108.37. While opinions span a broad range, keep in mind that fierce brokerage competition remains a risk to Schwab’s future margin expansion, shaping how investors assess its longer-term outlook.

Explore 11 other fair value estimates on Charles Schwab - why the stock might be worth 35% less than the current price!

Build Your Own Charles Schwab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charles Schwab research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charles Schwab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charles Schwab's overall financial health at a glance.

No Opportunity In Charles Schwab?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives