- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Did Charles Schwab's (SCHW) New $20 Billion Buyback Just Redefine Its Long-Term Capital Strategy?

Reviewed by Simply Wall St

- In late July 2025, Charles Schwab’s board authorized a new share repurchase program of up to US$20 billion and declared regular quarterly and preferred dividends, with payments scheduled for August and September 2025.

- This series of capital return announcements highlights Schwab’s ongoing focus on shareholder value, reinforced by continued investor confidence and robust board actions.

- Next, we’ll assess how the new US$20 billion buyback authorization shapes the long-term investment narrative for Charles Schwab.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Charles Schwab Investment Narrative Recap

To be a shareholder in Charles Schwab right now is to believe in the ongoing integration of Ameritrade clients, the company’s efforts to drive organic asset growth, and its ability to manage capital efficiently. The recent US$20 billion buyback adds momentum to Schwab’s capital return initiatives, but it does not significantly alter the immediate catalyst: the successful adoption of Schwab’s services by incoming Ameritrade clients. The primary risk remains any disruption to client transition or slower-than-expected asset flows.

Among recent announcements, the renewed buyback authorization is most relevant, given its size compared to ongoing repurchases and steady dividend payments. This move reinforces board confidence and adds flexibility, supporting the company’s capital management efforts while client onboarding continues. Still, the central focus for near-term performance is the pace and quality of Ameritrade integration, a factor fundamental to Schwab’s revenue and earnings outlook.

However, there are important questions investors should be aware of if the Ameritrade client transition does not proceed as expected...

Read the full narrative on Charles Schwab (it's free!)

Charles Schwab's narrative projects $30.3 billion in revenue and $10.9 billion in earnings by 2028. This requires 11.9% yearly revenue growth and a $4.1 billion earnings increase from the current $6.8 billion.

Uncover how Charles Schwab's forecasts yield a $107.11 fair value, a 10% upside to its current price.

Exploring Other Perspectives

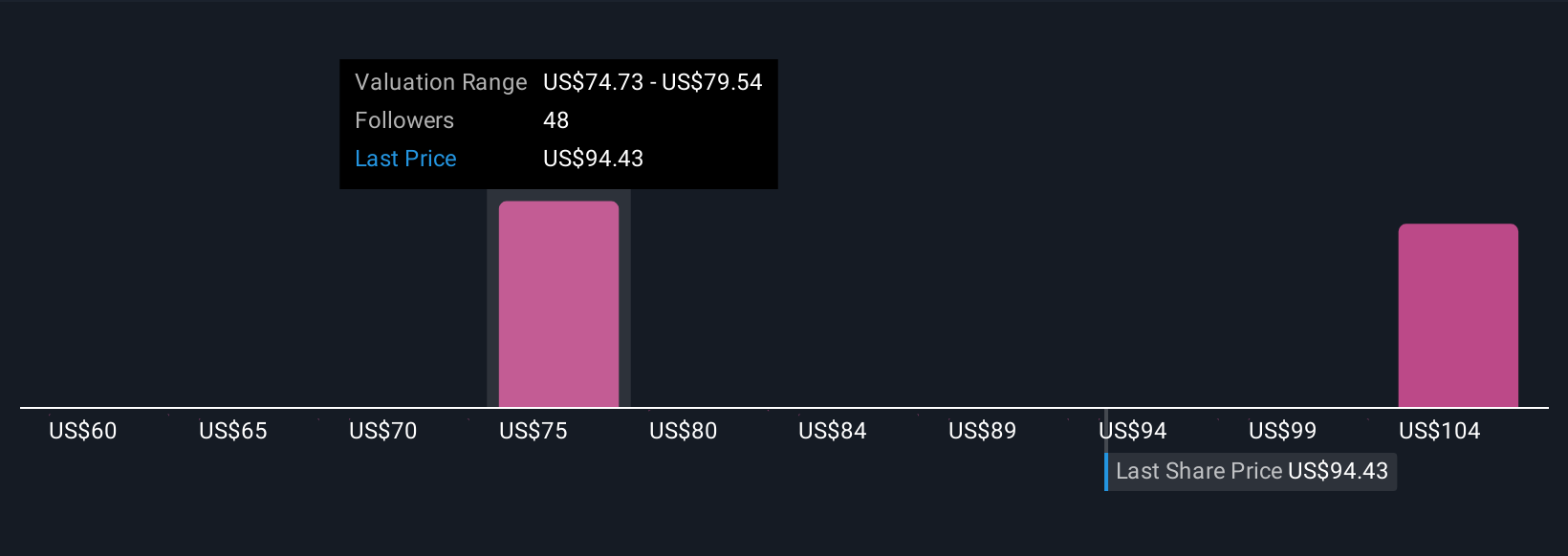

Nine fair value estimates from the Simply Wall St Community place Charles Schwab shares between US$60.32 and US$107.11. While these individual views show wide variance, the biggest near-term consideration is whether Schwab can fully realize cross-selling opportunities and revenue growth from incoming Ameritrade clients.

Explore 9 other fair value estimates on Charles Schwab - why the stock might be worth as much as 10% more than the current price!

Build Your Own Charles Schwab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charles Schwab research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charles Schwab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charles Schwab's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives