- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Charles Schwab (SCHW): Revisiting Valuation After Earnings Upgrades and a $2 Billion Senior Notes Issue

Reviewed by Simply Wall St

Charles Schwab (SCHW) just caught fresh attention after successfully issuing nearly $2 billion in senior notes, a move that pairs with upgraded earnings expectations and stock performance that is beating the broader Finance sector.

See our latest analysis for Charles Schwab.

Schwab’s latest debt raise sits on top of a strong run, with a year to date share price return of about 24.7 percent and a five year total shareholder return near 94.4 percent, suggesting momentum is still very much in its favor.

If Schwab’s trajectory has you thinking bigger, this could be a smart moment to see which other financial names are showing similar strength. You can start with fast growing stocks with high insider ownership.

Yet with the stock already up strongly this year and trading only modestly below analyst targets, the key question now is whether Schwab still offers upside or if the market is already pricing in its future growth.

Most Popular Narrative: 18% Undervalued

With the most widely followed narrative putting Charles Schwab’s fair value comfortably above its last close of $92.07, the story hinges on sustained growth and richer margins ahead.

Ongoing digital transformation and operational enhancements (e.g., AI-powered efficiency and automation) are expected to sustainably reduce cost-to-serve and improve client experience at scale, underpinning long-term operating margin expansion.

Want to see what powers that higher valuation bar? The narrative leans on faster top line growth, thicker margins, and a future earnings multiple that assumes durable scale advantage. Curious how those moving parts combine into today’s fair value call? Read on and test whether those building blocks match your own expectations.

Result: Fair Value of $111.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Schwab still faces pressure from low cost digital rivals and potential regulatory changes that could squeeze transaction economics and net interest margins.

Find out about the key risks to this Charles Schwab narrative.

Another View on Value

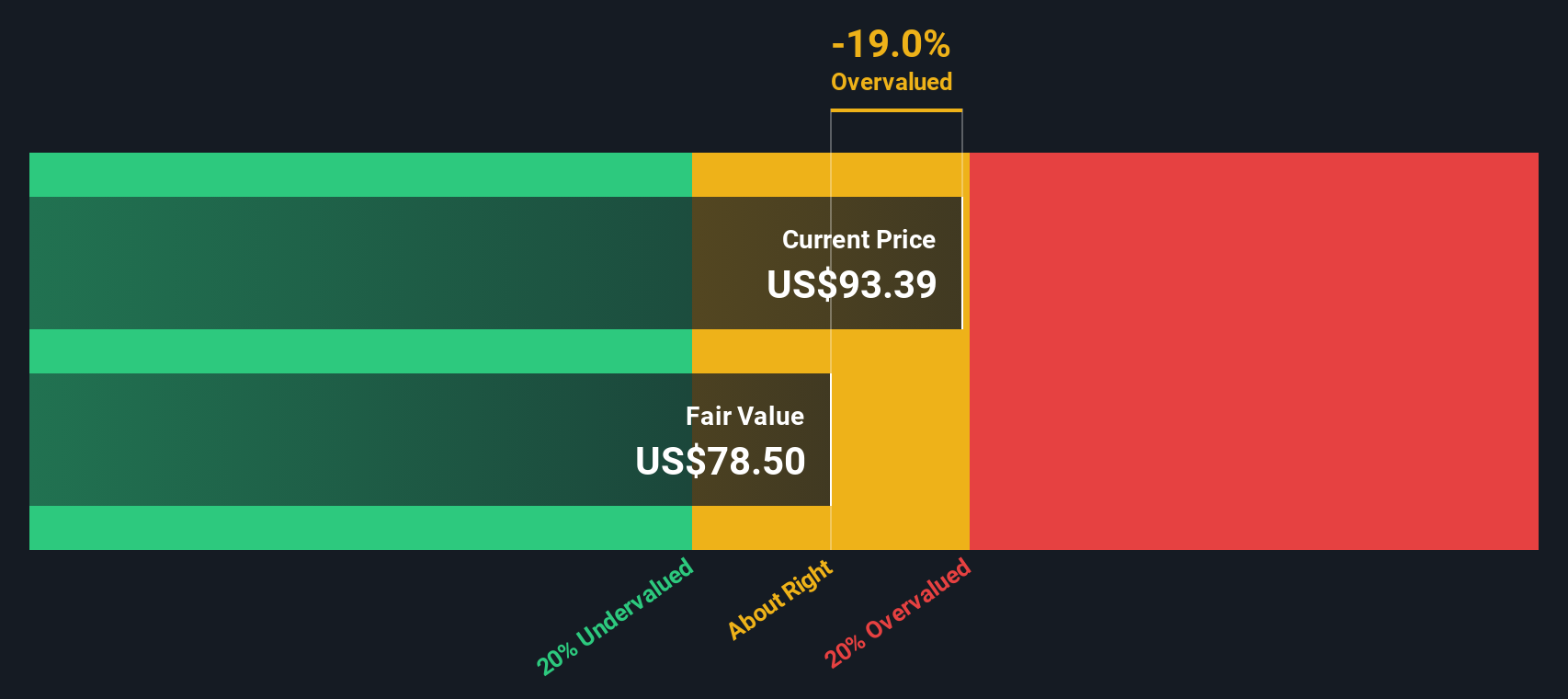

Our SWS DCF model is less enthusiastic than the narrative, putting Schwab’s fair value around $91.19, slightly below the current $92.07 share price and signaling mild overvaluation rather than an 18 percent discount. Which story do you trust more: the cash flows or the crowd?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Charles Schwab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Charles Schwab Narrative

If these conclusions do not line up with your own thinking, review the numbers yourself and create a custom story in minutes, Do it your way.

A great starting point for your Charles Schwab research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Investing Opportunities?

Schwab is just one angle, and the real edge comes from comparing it with other strong setups. Do not miss these carefully filtered ideas today.

- Capture potential bargains early by scanning these 933 undervalued stocks based on cash flows that markets may be mispricing relative to their underlying cash flows and fundamentals.

- Position yourself at the front of structural change by targeting these 24 AI penny stocks poised to benefit from accelerating adoption of artificial intelligence.

- Lock in reliable income potential by focusing on these 14 dividend stocks with yields > 3% that combine solid yields with room for continued payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026