- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Charles Schwab (SCHW) Declares Dividends & Announces US$20 Billion Share Buyback

Reviewed by Simply Wall St

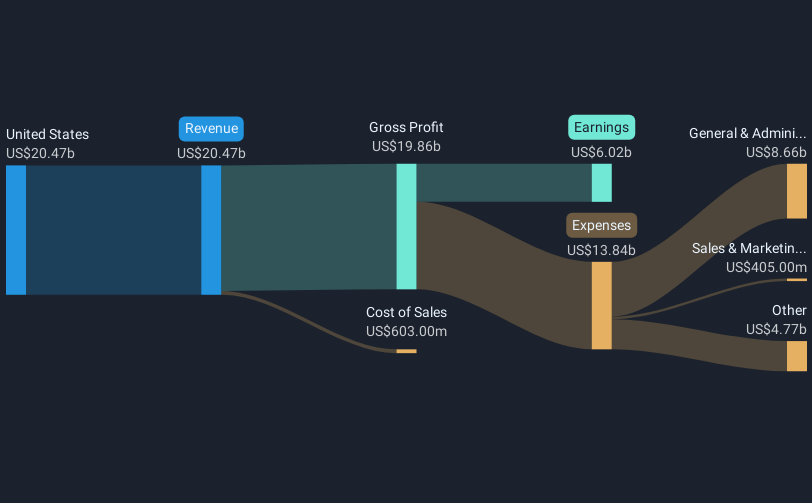

On July 24, 2025, The Charles Schwab Corporation (SCHW) declared dividends on common and preferred stocks and announced a $20 billion share repurchase plan, with its previous buyback program expiring the same day. The company's share price rose by 21% over the past quarter, a period marked by robust second-quarter earnings, where net income soared to $2,126 million from $1,332 million the previous year. While the broader market, including the S&P 500 and Nasdaq, hit new highs due to strong corporate earnings and economic data, Schwab's financial maneuvers likely reinforced its positive quarterly stock performance.

Charles Schwab's announcement of dividends and a substantial US$20 billion share buyback plan indicates potential for further shareholder value enhancement. These actions could positively impact revenue and earnings forecasts by boosting investor confidence, potentially improving capital management and aligning with the company's strategic objectives. The reinforcement of Schwab's financial position is likely to support ongoing investments in initiatives such as the Ameritrade integration and AI deployment.

Over the past five years, Schwab's total shareholder return reached 207.83%, highlighting robust performance in the capital markets landscape. The company's shares rose 21% in the recent quarter, surpassing the broader market's returns over the past year. The share price increase, alongside the recent dividend declaration and buyback, positions it favorably compared to its peers within the US Capital Markets industry.

The current share price of US$96.50, while below the consensus analyst price target of US$106.17, suggests a possible upward movement potential. However, Schwab's forecasted revenue and earnings growth must align with industry trends and analysts' expectations to justify this target. Investors should consider these factors when evaluating Schwab's future performance and total shareholder returns.

Examine Charles Schwab's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives