- United States

- /

- Diversified Financial

- /

- NasdaqCM:MBIN

Undervalued Small Caps With Insider Action Across Regions For December 2025

Reviewed by Simply Wall St

As the U.S. market continues to navigate mixed economic signals, with major indices like the Dow Jones Industrial Average nearing record highs despite a decline in private employment, small-cap stocks present unique opportunities for investors seeking growth amid volatility. In this environment, identifying promising stocks often involves looking at companies with strong fundamentals and strategic insider actions that may signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shore Bancshares | 10.4x | 2.8x | 41.06% | ★★★★★☆ |

| Wolverine World Wide | 16.4x | 0.8x | 39.34% | ★★★★★☆ |

| First United | 10.1x | 3.0x | 44.17% | ★★★★★☆ |

| Merchants Bancorp | 7.9x | 2.6x | 48.44% | ★★★★★☆ |

| Metropolitan Bank Holding | 12.4x | 3.0x | 31.54% | ★★★★☆☆ |

| Citizens & Northern | 13.6x | 3.3x | 31.30% | ★★★☆☆☆ |

| CNB Financial | 18.4x | 3.5x | 44.73% | ★★★☆☆☆ |

| Omega Flex | 17.9x | 2.9x | 3.22% | ★★★☆☆☆ |

| S&T Bancorp | 11.6x | 3.9x | 36.46% | ★★★☆☆☆ |

| Farmland Partners | 6.5x | 8.1x | -89.82% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

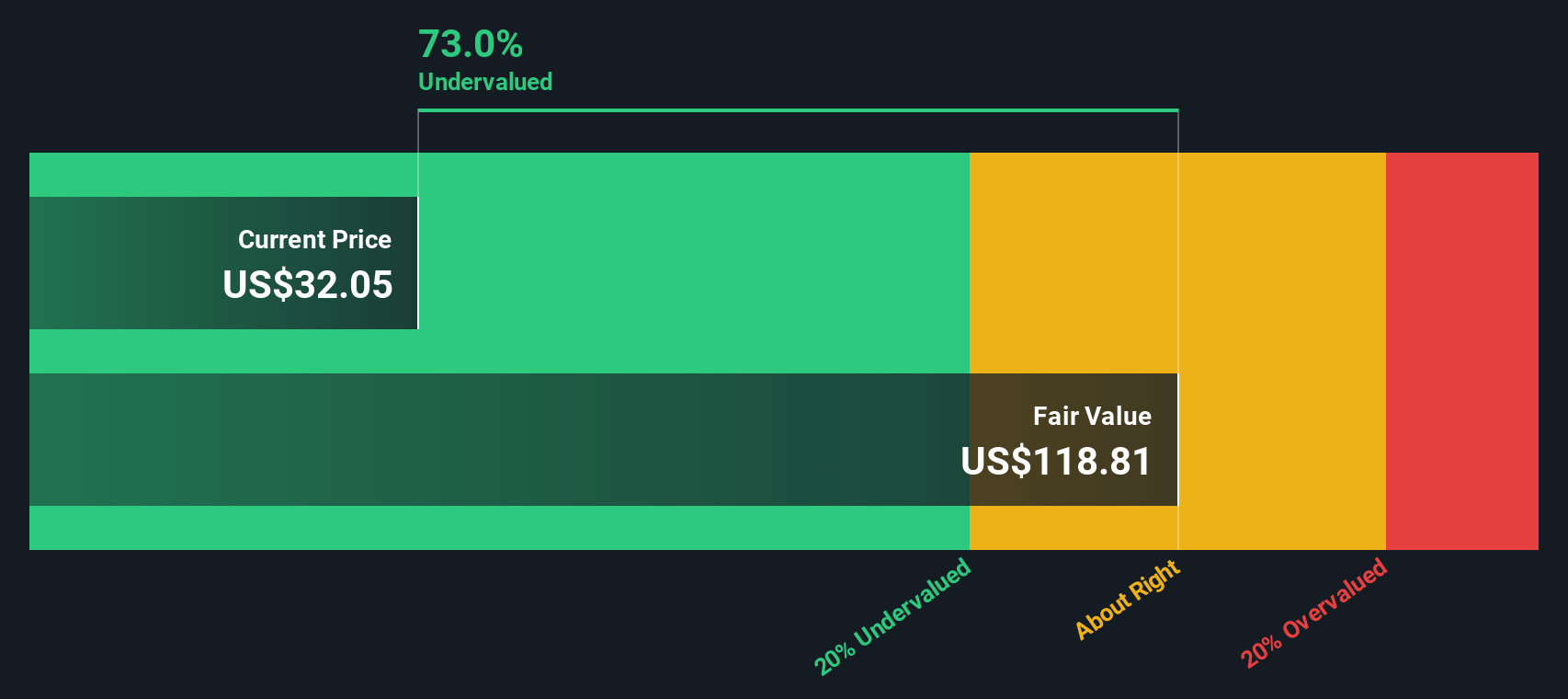

Merchants Bancorp (MBIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Merchants Bancorp is a financial services company primarily engaged in banking, mortgage warehousing, and multi-family mortgage banking operations with a market capitalization of $1.11 billion.

Operations: The company generates revenue primarily from its Banking, Mortgage Warehousing, and Multi-Family Mortgage Banking segments. Operating expenses are a significant cost component, with General & Administrative Expenses forming a substantial part of these costs. The net income margin has shown variability over the periods observed, reaching as high as 50.99% and as low as 33.44%.

PE: 7.9x

Merchants Bancorp, a smaller player in the financial sector, presents potential value with insider confidence shown by Michael Dury's purchase of 16,000 shares for approximately US$504,936. Despite recent earnings dips—net income fell to US$54.7 million in Q3 2025 from US$61.27 million a year prior—the company maintains growth prospects with an anticipated 15.54% annual earnings increase. However, challenges exist with high bad loans at 2.8% and low allowance coverage of just 31%. Recent dividend affirmations reflect commitment to shareholder returns amidst these dynamics.

- Click here to discover the nuances of Merchants Bancorp with our detailed analytical valuation report.

Assess Merchants Bancorp's past performance with our detailed historical performance reports.

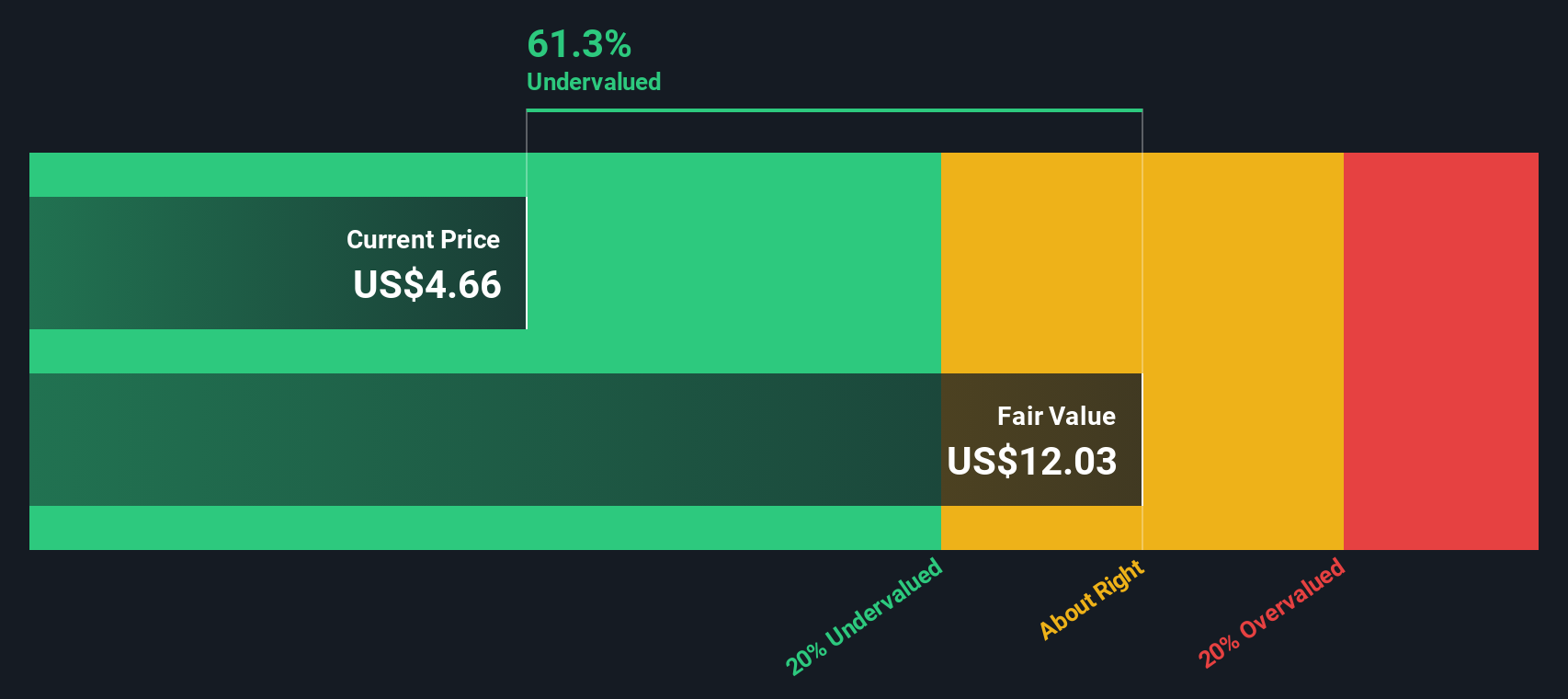

Alamo Group (ALG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Alamo Group is a company specializing in the manufacturing of industrial and vegetation management equipment, with a market capitalization of approximately $2.06 billion.

Operations: The company generates revenue primarily from its Industrial Equipment and Vegetation Management segments, with recent figures showing a gross profit margin of 26.68%. Operating expenses have been consistently significant, comprising costs such as general and administrative expenses and sales & marketing. The company's net income margin recently reached 8.07%, indicating profitability after accounting for all operating and non-operating expenses.

PE: 17.2x

Alamo Group, a smaller U.S. company, recently reported Q3 2025 sales of US$420.04 million, up from US$401.3 million the previous year, though net income slightly dipped to US$25.38 million from US$27.41 million. Despite no recent share buybacks, insider confidence has been noted with purchases earlier this year, suggesting belief in future potential. Earnings are projected to grow annually by 17.2%, indicating possible growth opportunities despite reliance on external borrowing for funding needs.

- Dive into the specifics of Alamo Group here with our thorough valuation report.

Gain insights into Alamo Group's past trends and performance with our Past report.

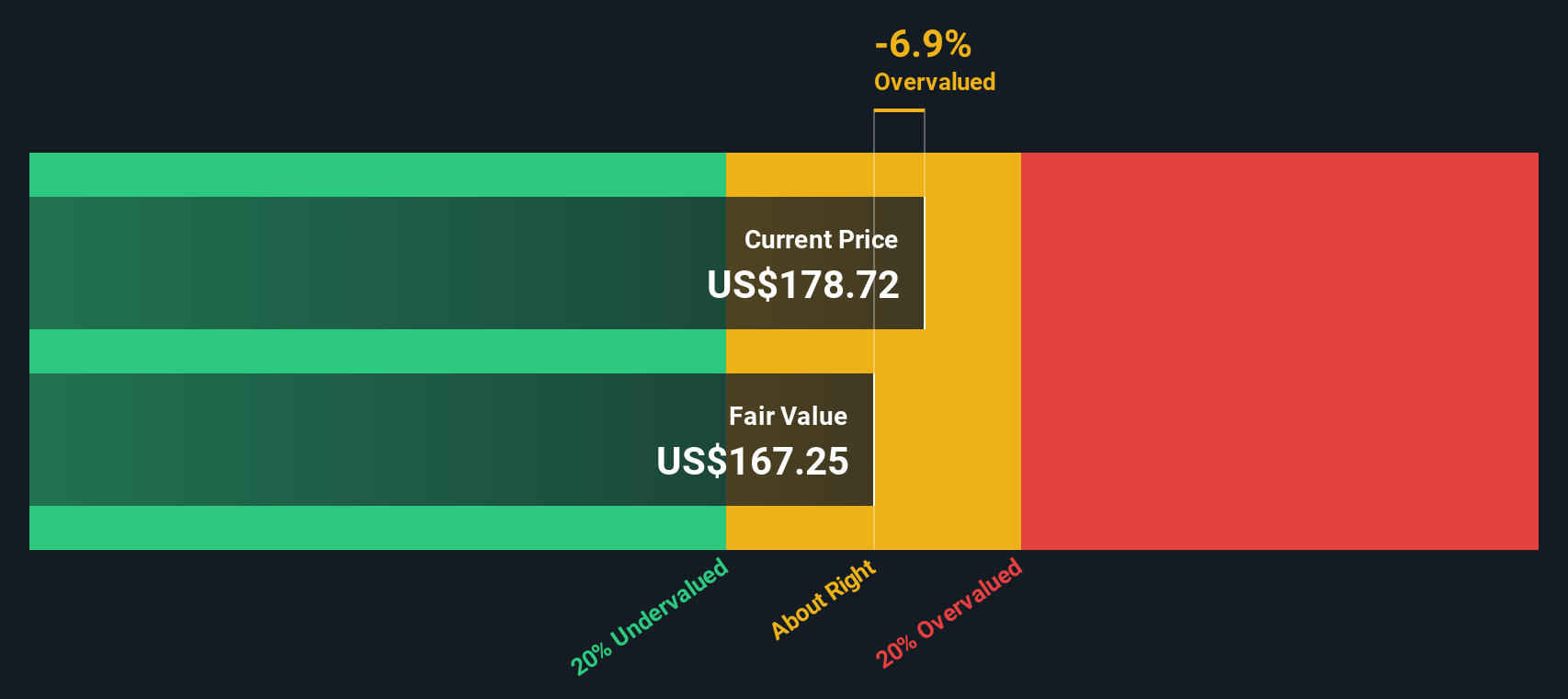

Ready Capital (RC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ready Capital is a financial services company focusing on small business lending and commercial real estate, with a market cap of approximately $1.24 billion.

Operations: The company generates revenue primarily from Small Business Lending and Lmm Commercial Real Estate, with recent figures showing a significant negative contribution from the latter. The net income margin has shown notable fluctuations, reaching as high as 98.65% in late 2023 before turning negative in mid-2024. Operating expenses have consistently been a significant portion of costs, with General & Administrative Expenses being a major component.

PE: -1.5x

Ready Capital, a smaller U.S. company, recently faced financial challenges with a net loss of US$18.75 million for Q3 2025, compared to US$9.31 million the previous year. Despite these setbacks, the company shows insider confidence through share repurchases totaling 2.5 million shares from July to September 2025 for US$10.49 million and has completed a larger buyback plan since January 2025 involving over 14 million shares worth US$65.26 million. Although its liabilities are entirely funded through higher-risk external borrowing, Ready Capital continues to distribute dividends and anticipates significant revenue growth in the future at an annual rate of over 50%.

- Click here and access our complete valuation analysis report to understand the dynamics of Ready Capital.

Examine Ready Capital's past performance report to understand how it has performed in the past.

Make It Happen

- Delve into our full catalog of 78 Undervalued US Small Caps With Insider Buying here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MBIN

Merchants Bancorp

Operates as the diversified bank holding company in the United States.

Undervalued with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026