- United States

- /

- Consumer Finance

- /

- NYSE:OPFI

OppFi (NYSE:OPFI) Reports US$136 Million Revenue But Faces US$6 Million Loss as Stock Gains 37% Last Quarter

Reviewed by Simply Wall St

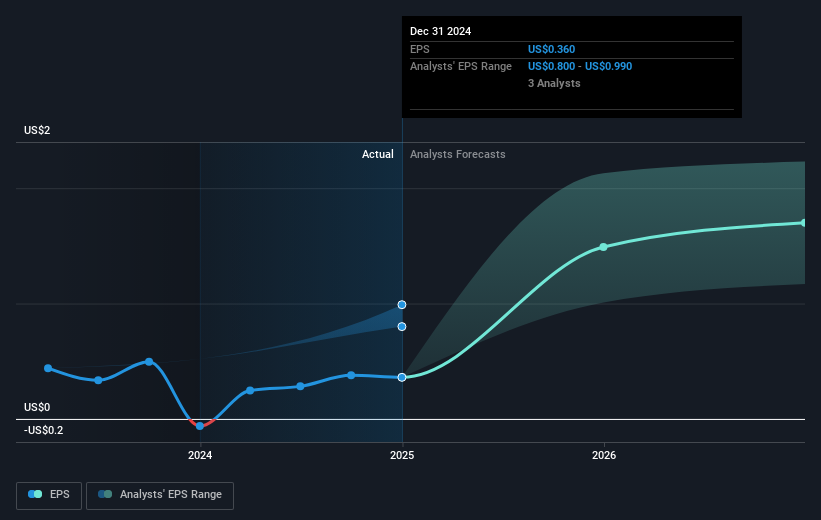

OppFi (NYSE:OPFI) recently reported its fourth-quarter 2024 earnings, showing a slight year-over-year revenue increase to $136 million, despite a net loss of $5.6 million. The company’s 2025 guidance anticipates 7% to 13% revenue growth. Although the recent buyback tranche involved no share repurchases, cumulative buybacks reached over 1 million shares. Concurrently, market conditions have seen improvements, with the major indexes rebounding after the Federal Reserve's decision to maintain interest rates. Against a backdrop of recovering indexes, such as the S&P 500 ending its four-week decline, OppFi's shares rose 37% last quarter.

We've spotted 3 weaknesses for OppFi you should be aware of.

Over the past year, OppFi has delivered an impressive total shareholder return of 313.39%, significantly outperforming both the US market and the Consumer Finance industry, which returned 7.6% and 18.6%, respectively. A key contributor to this remarkable performance was the company's Q1 2024 earnings, which saw a sharp increase in net income to US$5.54 million from just US$0.251 million the previous year. Furthermore, a special dividend announced in April 2024 added value for shareholders.

The company's proactive approach to debt management, illustrated by extending a loan maturity in September 2024, further supports its financial stability. Additionally, ongoing share buybacks, totaling 1.035 million shares within the past year, have enhanced shareholder value. The introduction of improved credit evaluation processes and strategic expansions, as announced in March 2025, are also expected to sustain long-term revenue growth, thus reinforcing investor confidence.

Explore historical data to track OppFi's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade OppFi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OPFI

OppFi

Operates as a specialty finance platform for community banks to extend credit access in the United States.

High growth potential with adequate balance sheet.