- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (NYSE:MS) Sells Last US$1.23B X Holdings Debt Amid Market Volatility

Reviewed by Simply Wall St

Morgan Stanley (NYSE:MS) saw a 6% increase in its stock price over the past week, mirroring a period of bullish market activity that included a 4% rise. The company initiated the sale of $1.23 billion in debt related to Elon Musk’s acquisition of X Holdings Corp, which could have bolstered investor confidence amid overall market gains driven by tariff-related news. Although broader market conditions exhibited mixed efficiency with some stocks faltering and others rising, Morgan Stanley's strategic debt sale aligns with a general resurgence in investor interest, particularly as the Dow, S&P 500, and Nasdaq experienced upward movement.

We've spotted 2 warning signs for Morgan Stanley you should be aware of.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

The recent announcement regarding Morgan Stanley's US$1.23 billion debt sale, linked to Elon Musk’s acquisition of X Holdings Corp, is potentially boosting investor sentiment, aligning with the broader market's bullish trends. This move might indicate Morgan Stanley's capability to leverage strategic opportunities for capital deployment, directly impacting investor confidence and reflecting positively on its revenue and earnings forecasts. Over the past five years, Morgan Stanley’s total shareholder return, which includes both share price and dividends, was very large at 241.62%, highlighting a strong growth trajectory in the long term. This performance includes a solid recent history, with a 6% increase in the stock price over the last week alone.

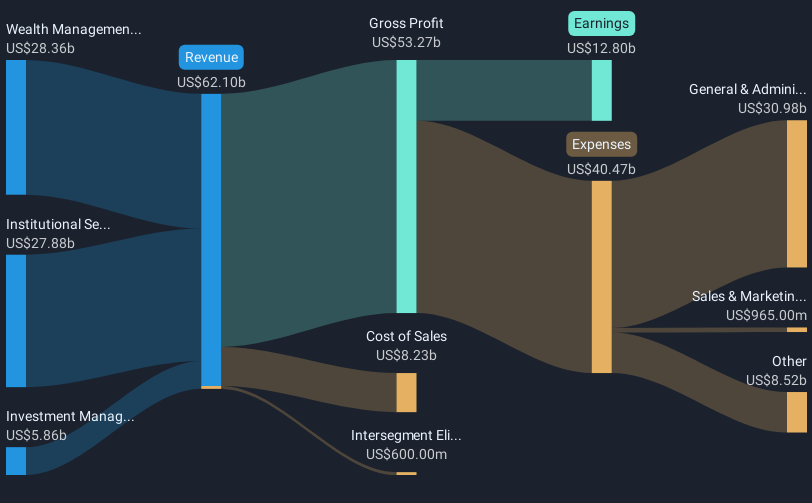

Comparatively, Morgan Stanley's earnings growth over the past year has significantly exceeded the broader US Capital Markets industry, showcasing its robust financial health amidst challenging global conditions. The consensus analyst price target of US$125.33, being 11.9% higher than the current share price of US$110.38, implies potential for further appreciation. If the anticipated rebounds in M&A and IPO activities materialize, supported by the company's strong position in global equities and Asia, revenue growth could align well with these forecasts. This would likely reinforce the company's profit margins and overall financial outlook as analysts predict an increase in earnings to US$15.2 billion by 2028. Amidst these developments, it's crucial for investors to continually evaluate how such news and market movements integrate into broader revenue and earnings forecasts.

Examine Morgan Stanley's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Morgan Stanley, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives