- United States

- /

- Capital Markets

- /

- NYSE:LAZ

A Look at Lazard’s Valuation Following the Appointment of Tech Executive Dmitry Shevelenko to Its Board

Reviewed by Simply Wall St

Lazard (NYSE:LAZ) just shook things up by appointing Dmitry Shevelenko, Chief Business Officer of Perplexity, to its Board of Directors. Shevelenko’s background, spanning leadership stints at Uber, LinkedIn, and Meta, points to a boardroom that is getting serious about technology and operational innovation. While executive appointments do not always move the needle overnight, this one hints at intentions beyond tradition, namely, adapting fast to the tech-driven shifts reshaping global finance.

This addition to Lazard’s board comes at a time when the company’s stock has seen a steady climb this year, up 11% on a year-to-date basis and an impressive 25% over the past twelve months. Momentum really picked up in the past 3 months, with shares rising nearly 32%. Meanwhile, annual revenue and net income have both shown healthy growth, which may be encouraging investors to reconsider how Lazard is valued compared to peers.

With new tech expertise now at the table and shares on the move, does Lazard still have room to run, or has the market already accounted for its innovation pivot?

Most Popular Narrative: 3.5% Undervalued

According to the most widely followed narrative, Lazard appears to be trading modestly below its estimated fair value. Analysts believe the company’s recent expansion efforts, improving margins, and robust forecasted growth justify a higher price than the current market level.

“Efforts to broaden financial advisory services with additions in healthcare, financial sponsors, and restructuring suggest increased investment in personnel, which might lead to temporary elevated expenses without corresponding revenue growth. Continued geopolitical advisory expansion and recruitment may increase operating costs faster than revenue from these services materializes, adversely affecting net margins in the short term.”

Curious about the engine behind Lazard’s valuation story? One big bet: the company’s future profit margin and earnings growth are set to sprint ahead of today’s levels, driving up projected value. Want the playbook behind this ‘undervalued’ rating? The real surprise is how ambitious these financial estimates are, as well as the shift required to make them reality.

Result: Fair Value of $58.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued diversification and expansion in Lazard’s advisory business or asset management flows could help offset short-term cost pressures and support future growth.

Find out about the key risks to this Lazard narrative.Another View: DCF Model Weighs In

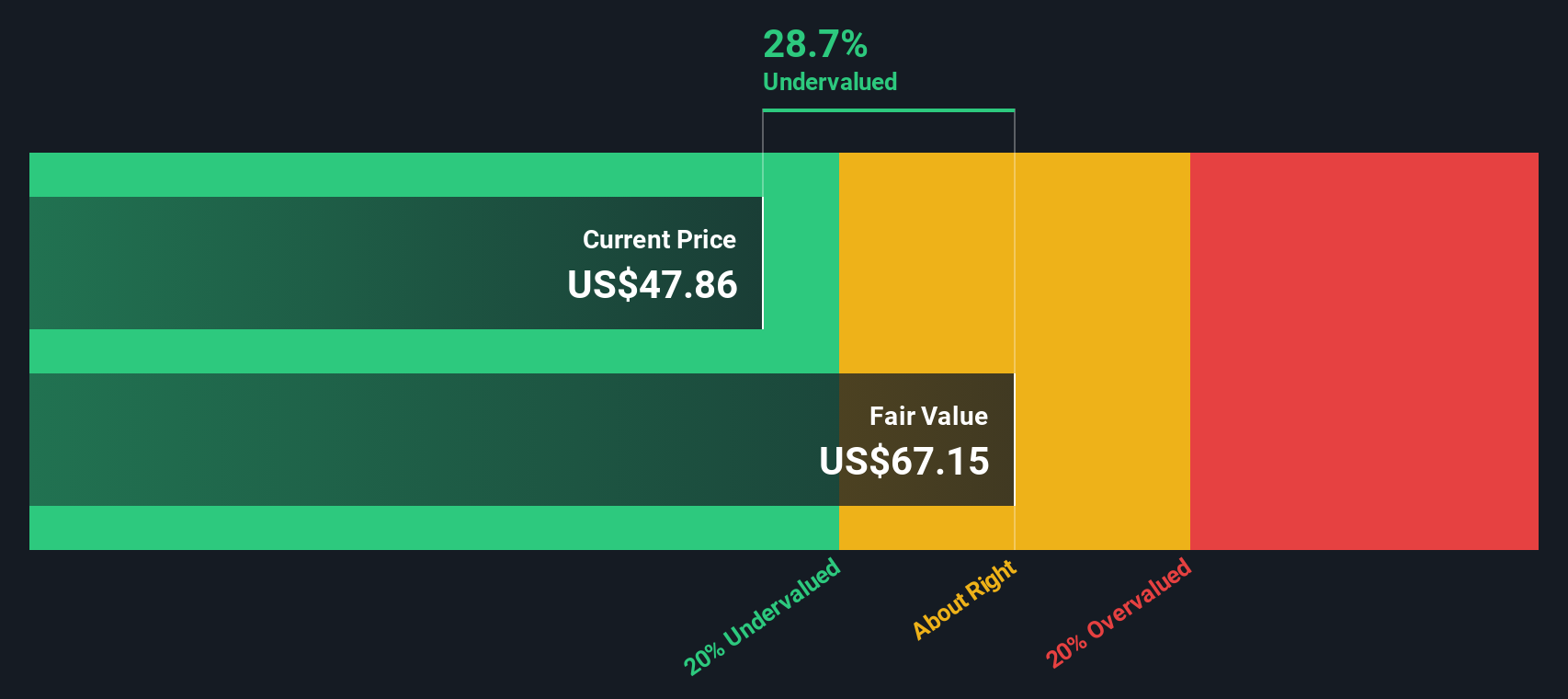

While analyst targets suggest only modest upside, our DCF model offers a second opinion. It points to Lazard being even further below its fair value and challenges whether the market is fully pricing in the future. Which lens tells the truer story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lazard Narrative

If you think the numbers tell a different story, or want to dig into the details yourself, you can craft your own Lazard narrative in under three minutes. Do it your way

A great starting point for your Lazard research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your opportunities to just one stock? Set yourself up for smarter decisions by tapping into new trends and bold prospects that others might miss.

- Spot hidden gems primed for potential with undervalued stocks based on cash flows before they catch everyone else's attention.

- Tap into unstoppable innovation by seeking out AI penny stocks at the forefront of artificial intelligence breakthroughs.

- Lock in steady returns by checking out dividend stocks with yields > 3% aiming for yields above 3% to reinforce your financial foundation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:LAZ

Lazard

Operates as a financial advisory and asset management firm in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)