- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

High Insider Ownership Growth Stocks On US Exchange In January 2025

Reviewed by Simply Wall St

As the United States market grapples with rising Treasury yields and a tech sector selloff, investors are closely monitoring economic data that could influence Federal Reserve rate decisions. In this environment, growth companies with high insider ownership can offer unique insights into potential resilience and long-term value, as insiders often have a vested interest in the company's success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 49% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.6% | 34.7% |

| Similarweb (NYSE:SMWB) | 25.4% | 126.3% |

| OS Therapies (NYSEAM:OSTX) | 17.6% | 13.6% |

Here's a peek at a few of the choices from the screener.

Robinhood Markets (NasdaqGS:HOOD)

Simply Wall St Growth Rating: ★★★★☆☆

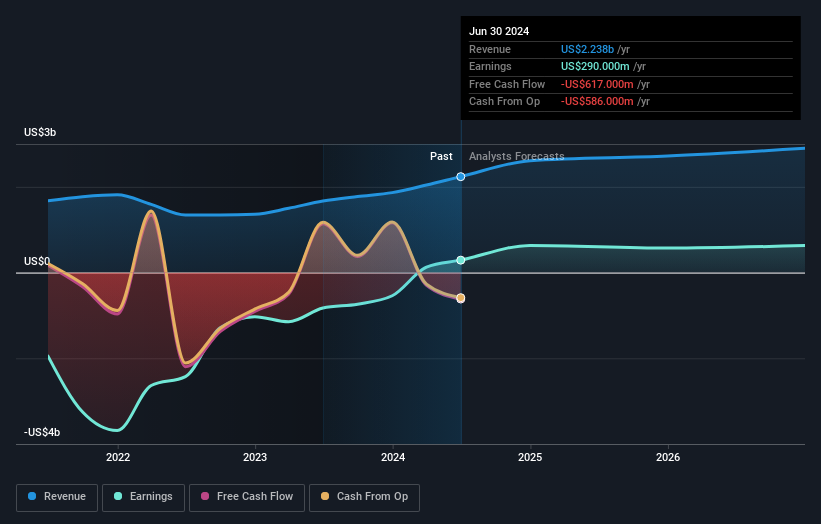

Overview: Robinhood Markets, Inc. operates a financial services platform in the United States with a market cap of approximately $37.75 billion.

Operations: The company's revenue is primarily generated from its brokerage segment, amounting to $2.41 billion.

Insider Ownership: 14.2%

Revenue Growth Forecast: 16.4% p.a.

Robinhood Markets demonstrates characteristics of a growth company with high insider ownership, though it has experienced significant insider selling recently. The company's earnings are expected to grow significantly at 20.63% annually over the next three years, outpacing the US market average. Recent strategic moves include acquisitions like Bitstamp and TradePMR to enhance revenue streams and shareholder value. The appointment of Christopher Payne as an independent director strengthens its board with extensive digital platform expertise.

- Unlock comprehensive insights into our analysis of Robinhood Markets stock in this growth report.

- In light of our recent valuation report, it seems possible that Robinhood Markets is trading beyond its estimated value.

Jefferies Financial Group (NYSE:JEF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jefferies Financial Group Inc. is an investment banking and capital markets firm operating across the Americas, Europe, the Middle East, and Asia-Pacific with a market cap of approximately $16.71 billion.

Operations: The company's revenue segments include $5.62 billion from Investment Banking and Capital Markets and $629.50 million from Asset Management.

Insider Ownership: 20.6%

Revenue Growth Forecast: 15.5% p.a.

Jefferies Financial Group shows potential as a growth company with significant insider ownership, despite no substantial insider buying recently. The company's earnings grew by 60.2% last year and are forecast to grow significantly at 34.84% annually, surpassing the US market average. Recent fixed-income offerings totaling over $200 million indicate strategic financial maneuvers to support growth initiatives, though its dividend coverage remains weak due to limited free cash flow availability.

- Click here and access our complete growth analysis report to understand the dynamics of Jefferies Financial Group.

- The analysis detailed in our Jefferies Financial Group valuation report hints at an inflated share price compared to its estimated value.

Cloudflare (NYSE:NET)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market cap of approximately $39.12 billion.

Operations: Cloudflare generates revenue from its Internet Telephone segment, which amounts to $1.57 billion.

Insider Ownership: 11%

Revenue Growth Forecast: 19% p.a.

Cloudflare is expected to achieve profitability within three years, with earnings projected to grow 31.21% annually, outpacing the market. Despite significant insider selling recently and past shareholder dilution, the company's revenue growth of 19% per year surpasses the US market average. Recent expansions in Lisbon and strategic hires like Chirantan CJ Desai aim to bolster operations towards a $5 billion revenue target, demonstrating commitment to scaling its global network and enhancing product innovation.

- Take a closer look at Cloudflare's potential here in our earnings growth report.

- Our valuation report here indicates Cloudflare may be overvalued.

Turning Ideas Into Actions

- Get an in-depth perspective on all 199 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives