- United States

- /

- Consumer Finance

- /

- NYSE:ENVA

Further Upside For Enova International, Inc. (NYSE:ENVA) Shares Could Introduce Price Risks After 25% Bounce

Enova International, Inc. (NYSE:ENVA) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 42%.

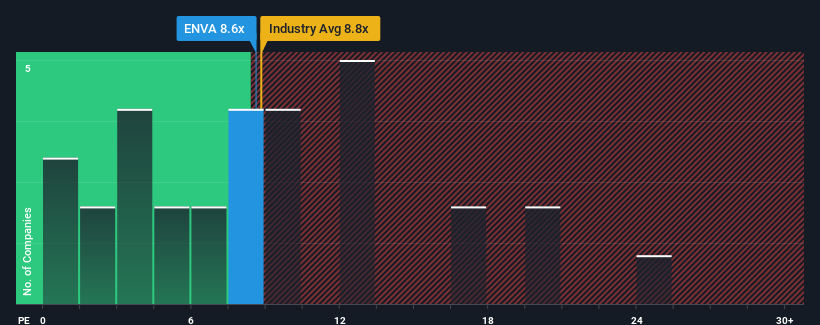

In spite of the firm bounce in price, Enova International's price-to-earnings (or "P/E") ratio of 8.6x might still make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 32x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Enova International has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Enova International

Is There Any Growth For Enova International?

There's an inherent assumption that a company should underperform the market for P/E ratios like Enova International's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Regardless, EPS has managed to lift by a handy 14% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 17% during the coming year according to the six analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 9.8%, which is noticeably less attractive.

With this information, we find it odd that Enova International is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Enova International's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Enova International's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 1 warning sign for Enova International that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Enova International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ENVA

Enova International

A technology and analytics company, provides online financial services in the United States, Brazil, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives