- United States

- /

- Consumer Finance

- /

- NYSE:COF

Will Legal Uncertainty Alter Capital One’s Risk Profile More Than Tech Innovation Can Offset (COF)?

Reviewed by Sasha Jovanovic

- In recent days, Capital One Financial participated in several high-profile industry events and faced renewed scrutiny over a proposed US$425 million legal settlement, which 18 U.S. states have opposed as inadequate compared to depositor losses. iHeartMedia, not Capital One, announced a music event at the Kia Forum featuring exclusive benefits for Capital One cardholders, while broader optimism ahead of major bank earnings and unsettled legal matters have drawn investor attention to the company.

- A key takeaway is that Capital One’s exposure to sector-wide earnings trends and unresolved litigation risk may weigh on near-term investor sentiment, despite the company’s ongoing focus on technology and payments innovation.

- We'll examine how ongoing legal uncertainty surrounding the US$425 million settlement could impact the company’s investment outlook and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Capital One Financial Investment Narrative Recap

To be a Capital One Financial shareholder today means believing in the company's potential to capitalize on secular growth in digital banking, payments, and premium credit cards, while managing challenges tied to technology investments and the integration of Discover. The latest legal scrutiny surrounding the proposed US$425 million class action settlement represents a meaningful short-term risk; it may weigh on sentiment, but the company’s technology and payments innovation focus remains central to long-term value creation. For now, the litigation overhang is material, especially with a final settlement hearing set for November.

Among recent announcements, Capital One’s participation in the 2025 Auto Finance Summit stands out, highlighting its push to expand lending and digital capabilities, both critical for boosting scale following the Discover acquisition. Although these innovation efforts may not offset the headline risk of unresolved litigation in the near term, investor attention is likely to remain focused on updates about legal proceedings and their impact on capital deployment and profitability.

But investors should not overlook the potential for legal outcomes to shape the company’s financial flexibility going forward, especially if...

Read the full narrative on Capital One Financial (it's free!)

Capital One Financial's outlook projects $66.2 billion in revenue and $16.9 billion in earnings by 2028. This scenario relies on a 32.7% annual revenue growth rate and a $12.3 billion increase in earnings from the current $4.6 billion level.

Uncover how Capital One Financial's forecasts yield a $250.70 fair value, a 17% upside to its current price.

Exploring Other Perspectives

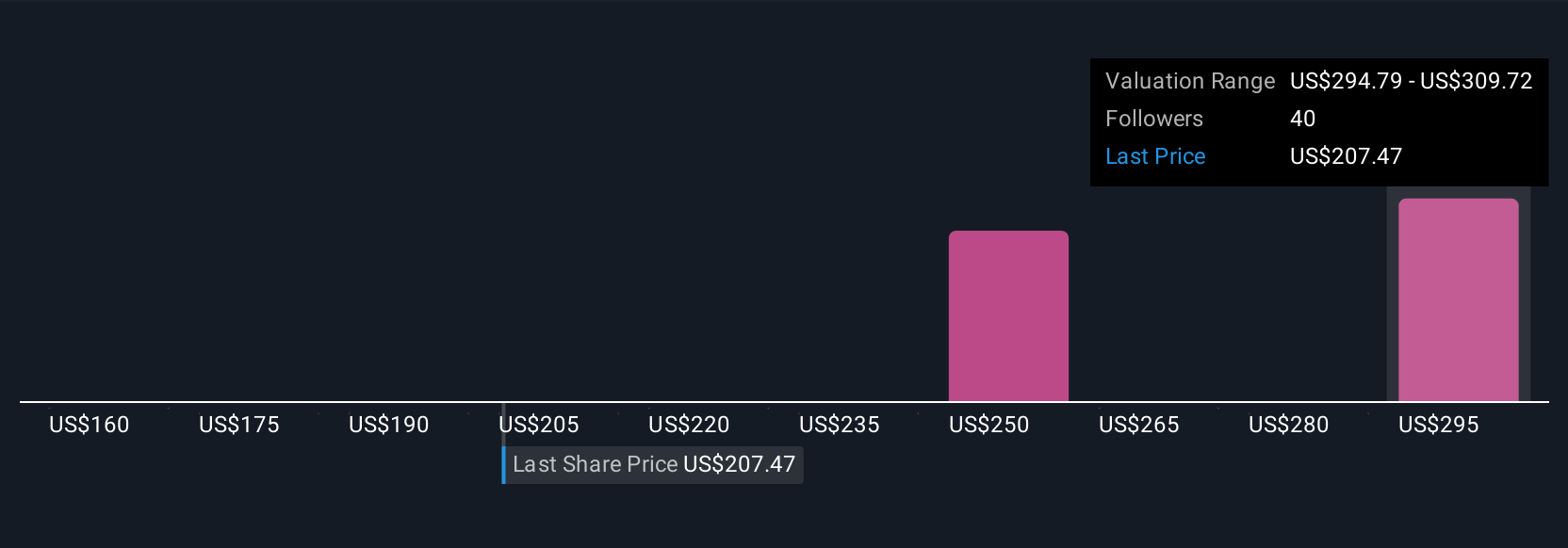

Simply Wall St Community members set fair value estimates for Capital One Financial between US$160 and US$276 from five viewpoints. With legal risks in the spotlight, these contrasting perspectives reflect how investor sentiment about regulatory outcomes may influence long-term confidence in the stock.

Explore 5 other fair value estimates on Capital One Financial - why the stock might be worth 25% less than the current price!

Build Your Own Capital One Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Capital One Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital One Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives