- United States

- /

- Consumer Finance

- /

- NYSE:COF

How Capital One’s (COF) $4.28B Net Loss Despite Higher Interest Income Changed Its Investment Story

Reviewed by Simply Wall St

- On July 22, 2025, Capital One Financial reported results for the second quarter and first half of the year, revealing higher net interest income of US$9.99 billion for the quarter but recording a quarterly net loss of US$4.28 billion, compared to net income in the prior year.

- A striking detail is that even with increased interest income, the company shifted from profit to a very large net loss, indicating significant financial headwinds or extraordinary charges impacting performance.

- Let's examine how the substantial net loss, despite robust net interest income, challenges Capital One's previously optimistic investment narrative.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Capital One Financial Investment Narrative Recap

To be a shareholder in Capital One Financial right now, you need confidence in the company’s ability to withstand short-term financial setbacks while capitalizing on expected synergies from the Discover acquisition and its leading consumer finance platform. The recent sharp net loss in Q2, despite record net interest income, could directly affect the company’s biggest near-term catalyst: successful integration of Discover. At the same time, the primary risk, escalating credit losses or extraordinary charges, has grown more pronounced and may merit close attention from investors following these results.

The completion of the Discover Financial Services acquisition on May 18, 2025, stands out as the most pertinent recent announcement, given that integration success was a primary narrative catalyst and a central challenge. This transaction sets up a unique platform for earnings and revenue expansion, but with the unexpected magnitude of the net loss in Q2, investors may begin to scrutinize how Discover-related costs and credit risks interact with Capital One’s profitability outlook.

In contrast to rising net interest income, the spike in net losses this quarter should remind investors to look more closely at ...

Read the full narrative on Capital One Financial (it's free!)

Capital One Financial's narrative projects $47.1 billion revenue and $9.5 billion earnings by 2028. This requires 18.5% yearly revenue growth and a $4.9 billion increase in earnings from $4.6 billion today.

Exploring Other Perspectives

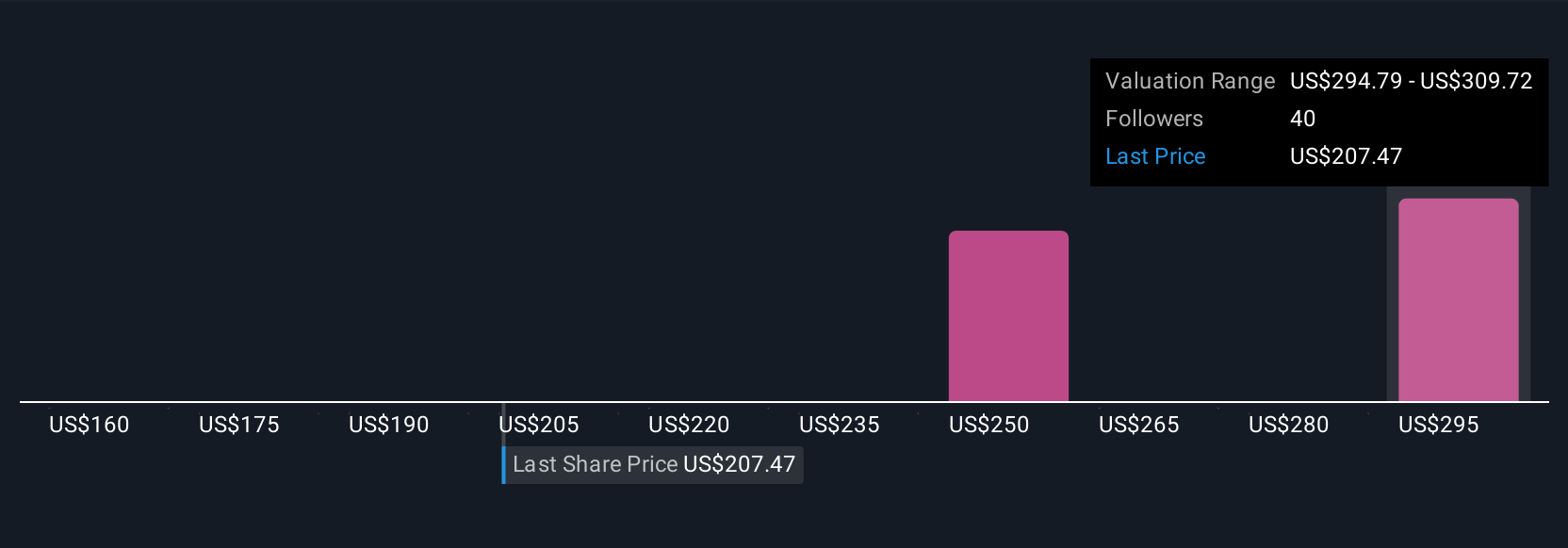

Six fair value estimates from the Simply Wall St Community range from US$144.93 to US$276.42. While opinions differ widely, many are now watching how rising credit losses could influence future performance and investor sentiment.

Build Your Own Capital One Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Capital One Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital One Financial's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives