- United States

- /

- Consumer Finance

- /

- NYSE:AXP

American Express (NYSE:AXP) Welcomes New Board Member And Raises Dividend By 17 Percent

Reviewed by Simply Wall St

American Express (NYSE:AXP) recently welcomed Michael J. Angelakis to its Board of Directors and announced a 17% increase in its quarterly dividend, raising it from $0.70 to $0.82 per share. Despite these positive developments, the company's stock price experienced a slight decline of 0.01% over the past week. This minor drop in share price might reflect broader market trends rather than company-specific factors, as the financial sector saw widespread declines last week due to new U.S. tariffs affecting market sentiment. The overall market fell 2.5% during this period, significantly influencing stocks like Goldman Sachs, JPMorgan Chase, and AXP, which each experienced declines greater than 5%. The broader financial context, including investor concerns over tariff impacts and potential inflation, likely overshadowed the positive internal developments at American Express, leading to the minimal movement in its share price.

Take a closer look at American Express's potential here.

Over the past five years, American Express has delivered impressive total shareholder returns of 221.67%. During this period, the company capitalized on several key opportunities, such as forming strategic partnerships, including its recent collaboration with Alipay, enhancing its payment flexibility for cardholders. This move likely strengthened its market presence in China.

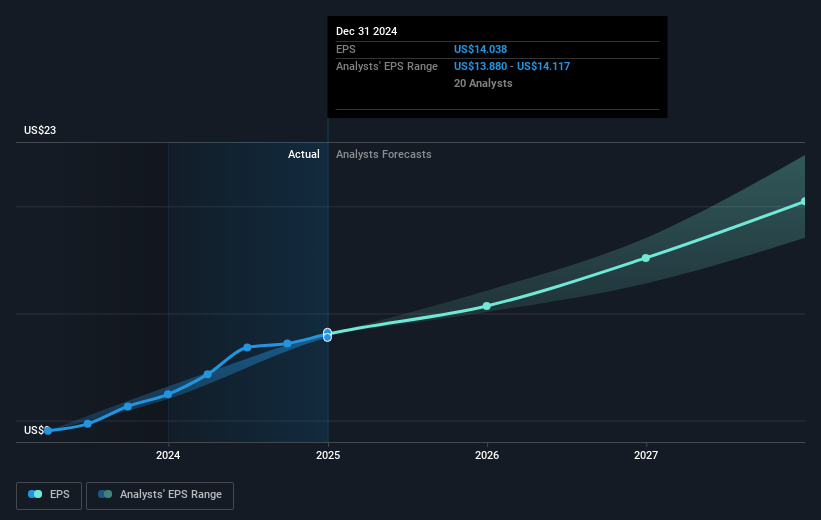

The company's robust financial performance, highlighted by a year-over-year growth in net income for Q4 2024 from US$1.93 billion to US$2.17 billion, also played a significant role in its share performance. Additionally, the share repurchase initiative, which has seen the buyback of 44.83 million shares, underscored investor confidence. Throughout the last year, American Express not only matched the Consumer Finance industry return of 35.5% but also exceeded the broader US market return of 13.1%, further emphasizing its strong market positioning.

- Understand the fair market value of American Express with insights from our valuation analysis—click here to learn more.

- Explore the potential challenges for American Express in our thorough risk analysis report.

- Have a stake in American Express? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives