- United States

- /

- Banks

- /

- NasdaqCM:CZNC

Undiscovered Gems In The US Three Small Caps With Promising Potential

Reviewed by Simply Wall St

The United States market has shown robust performance, climbing 1.8% in the past week and 25% over the last year, with earnings projected to grow by 15% annually in the coming years. In this thriving environment, identifying small-cap stocks with strong fundamentals and growth potential can offer investors unique opportunities for diversification and long-term gains.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Citizens & Northern (NasdaqCM:CZNC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Citizens & Northern Corporation is a bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate clients, with a market cap of $319.63 million.

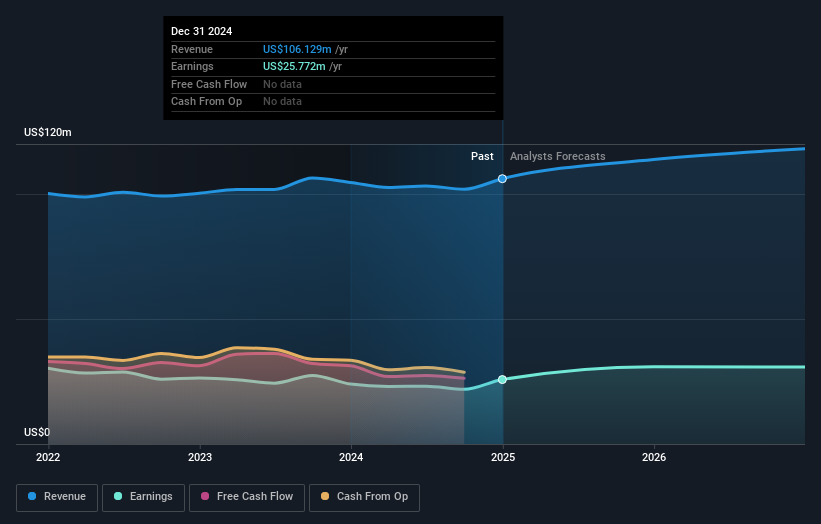

Operations: The primary revenue stream for Citizens & Northern Corporation comes from its community banking segment, generating $106.13 million. The company has a market cap of $319.63 million.

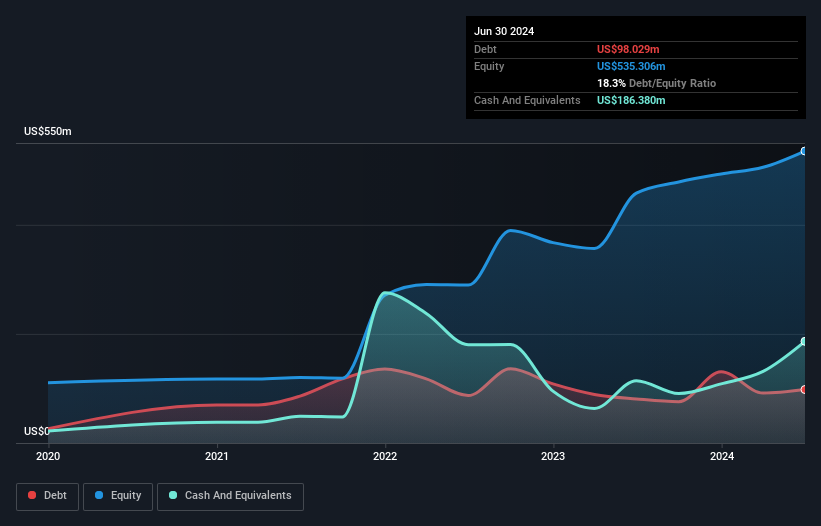

Citizens & Northern, with total assets of US$2.6 billion and equity of US$275.3 million, stands out for its robust financial health despite being a smaller player in the banking sector. The bank's earnings grew by 7.6% last year, surpassing the industry average decline of 8%, highlighting its resilience and growth potential. Its funding structure is primarily low risk, with 90% liabilities from customer deposits, making it less vulnerable to external borrowing risks. Trading at nearly 45% below estimated fair value suggests potential undervaluation while maintaining an appropriate level of bad loans at 1.3%.

- Take a closer look at Citizens & Northern's potential here in our health report.

Assess Citizens & Northern's past performance with our detailed historical performance reports.

ASA Gold and Precious Metals (NYSE:ASA)

Simply Wall St Value Rating: ★★★★★☆

Overview: ASA Gold and Precious Metals Limited is a publicly owned investment manager with a market capitalization of $433.84 million.

Operations: The company generates revenue of approximately $1.99 million from its financial services segment, specifically through closed-end funds.

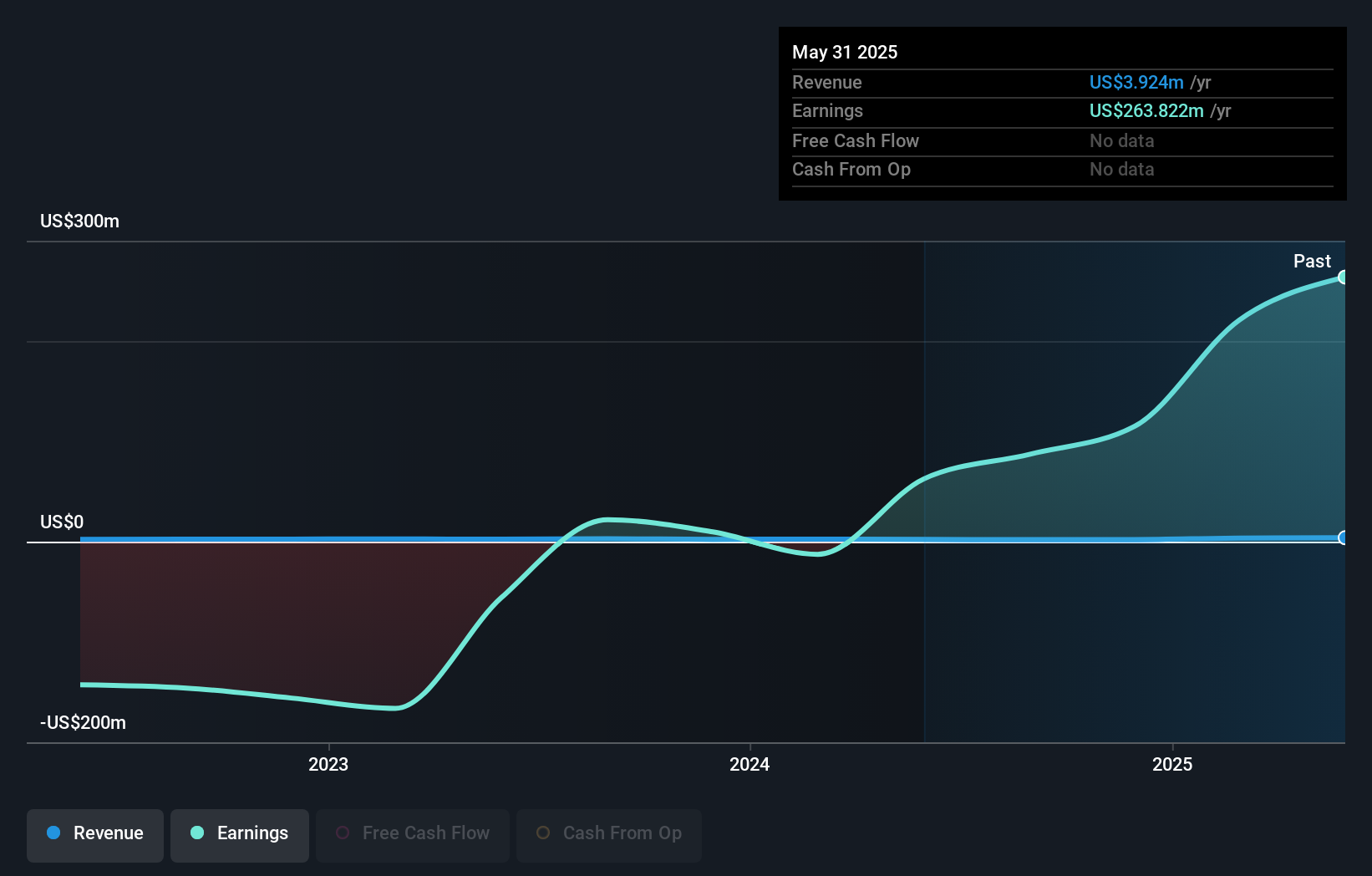

ASA Gold and Precious Metals, a small player in the market, has shown impressive earnings growth of 299% over the past year, outpacing the Capital Markets industry average of 15%. Despite this surge, its earnings have declined by 36% annually over five years. A significant one-off gain of US$91.3M recently skewed its financial results. The company operates without debt, eliminating concerns about interest payments. However, it lacks meaningful revenue streams with only US$2M reported. Its price-to-earnings ratio sits at a low 5x compared to the broader US market's 19x, suggesting potential value for investors seeking opportunities in precious metals sectors.

Hagerty (NYSE:HGTY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hagerty, Inc. offers insurance agency services globally and has a market capitalization of approximately $882.32 million.

Operations: Hagerty generates revenue primarily through its insurance brokerage segment, which reported $1.15 billion in revenue.

Hagerty, a niche player in the insurance sector, has recently shown promising growth signs. The company reported third-quarter sales of US$165.69 million, up from US$139.79 million last year, and nine-month revenues of US$908.31 million compared to US$755.17 million previously. Despite a slight dip in quarterly net income to US$4.89 million from US$5.35 million, Hagerty's annual earnings are projected to grow by 25%. With free cash flow turning positive at US$169 million and strategic partnerships bolstering its market presence, Hagerty seems well-positioned for future profitability despite some execution risks and competitive pressures.

Next Steps

- Click this link to deep-dive into the 266 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Citizens & Northern, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZNC

Citizens & Northern

Operates as the bank holding company for Citizens & Northern Bank that provides various banking and related services to individual and corporate customers.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives