- United States

- /

- Consumer Finance

- /

- NYSE:ALLY

How the New Auto Loan Delinquencies Surge Impacts Ally Financial's Current Stock Value

Reviewed by Bailey Pemberton

Thinking about what to do with Ally Financial stock? You’re definitely not alone. With the share price closing at $39.70, it’s caught the attention of plenty of investors who wonder if now is the time to buy, hold, or move on. Over just the past week, the stock has nudged up by 1.6%, but zoom out and that picture gets a little more complicated. There’s been a drop of 7.8% over the past month, yet the longer-term numbers tell a different story: up 11% year-to-date, 14.2% over the last year, and a big 67% gain over both three and five years. These kinds of swings make it easy to see why Ally Financial keeps coming up in investment conversations.

Some of those moves align with broader market shifts and changes in investor sentiment, particularly as financial stocks react to interest rate outlooks and consumer demand. Even with the ups and downs, the long-term trend is clearly upward. But what about value? If you’re weighing whether there’s untapped potential or hidden risk, you might want to know Ally’s valuation score is just 1 out of 6. That means it only checks one box for being undervalued by standard measures.

Of course, simply sizing up valuation scores is just the start. Next, let’s break down what actually goes into these valuation approaches, and a bit later on, I’ll share an even better way to get a handle on what Ally is worth.

Ally Financial scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ally Financial Excess Returns Analysis

The Excess Returns valuation model looks at whether a company is generating returns on its invested capital that exceed the cost of equity capital. Simply put, it examines if the business is creating value beyond what investors require, based on measures like return on equity and projected long-term growth.

For Ally Financial, the numbers lay out a clear picture: its current Book Value per share is $39.71, with a Stable EPS of $4.40 per share. These estimates draw on data from nine analysts projecting future Return on Equity. The cost of equity stands at $5.22 per share, but the excess return comes out negative at $-0.82 per share. This suggests that recent and estimated returns do not consistently exceed the threshold investors expect for risk. The average Return on Equity is 9.96%, and the Stable Book Value estimate is $44.13 per share. Both figures point to solid underlying performance, but not quite enough to generate robust excess returns.

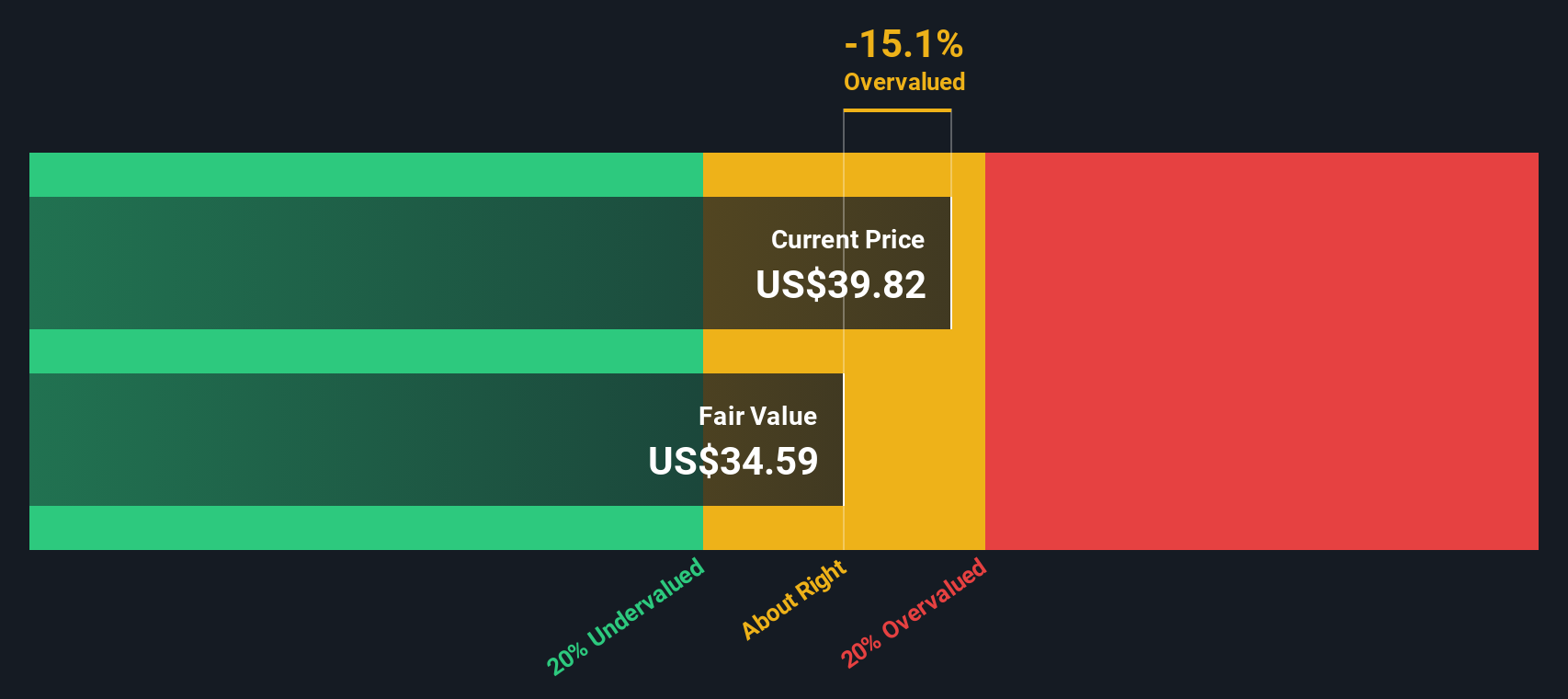

When the math is done, the intrinsic value using this approach is $34.76 per share. With Ally trading at $39.70, the Excess Returns model shows the stock is about 14.2% overvalued at today's price. For now, this model argues there may not be enough value upside, at least using this lens.

Result: OVERVALUED

Our Excess Returns analysis suggests Ally Financial may be overvalued by 14.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ally Financial Price vs Earnings

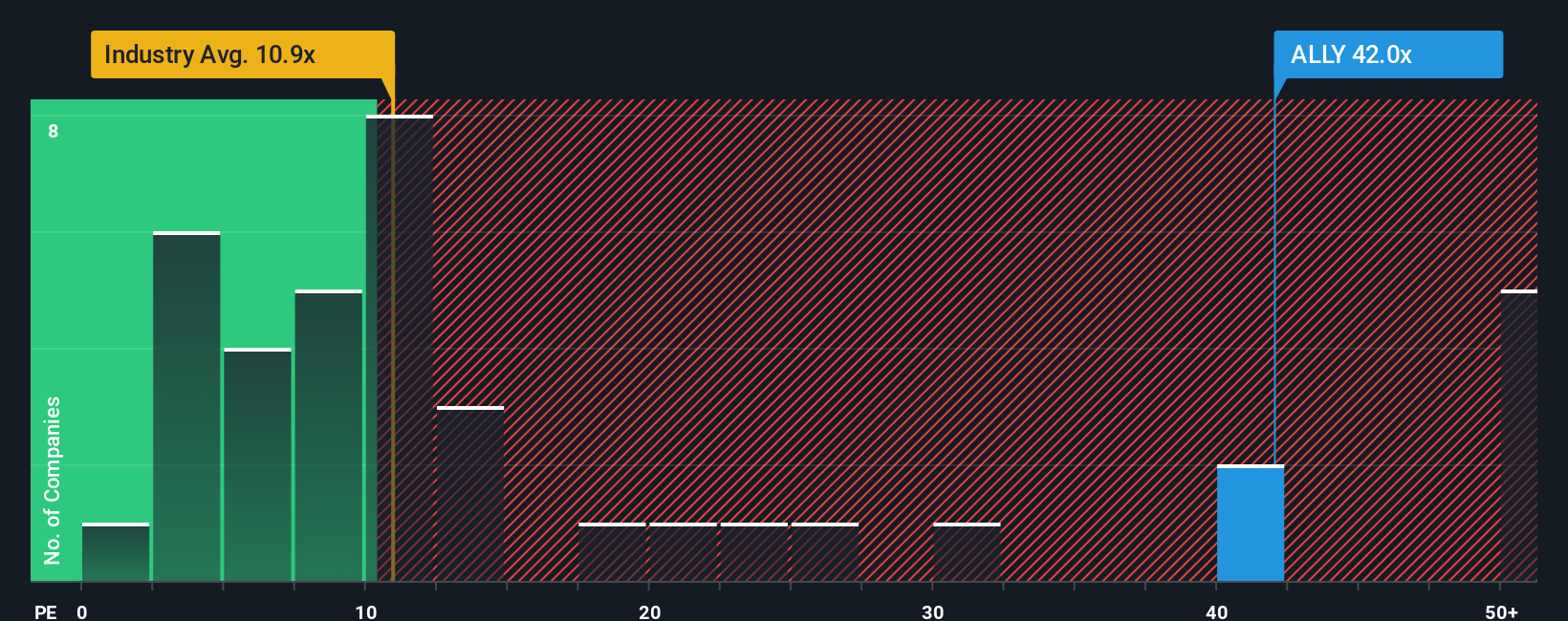

The Price-to-Earnings (PE) ratio is a common way to value profitable companies like Ally Financial, since it ties the company’s stock price directly to its actual earnings. For businesses generating steady profits, the PE ratio helps investors assess how much they’re paying per dollar of earnings, making it a natural benchmark for comparison.

It’s important to note that what counts as a “fair” PE ratio can fluctuate depending on growth expectations and perceived risks. Companies anticipated to grow quickly often justify higher PE ratios, while those facing uncertainty or slower growth may trade at lower multiples. For context, Ally’s current PE ratio sits at 37.7x, which is well above the Consumer Finance industry average of 10.3x and higher than the peer group average of 51.6x.

Instead of just looking at raw comparisons, Simply Wall St’s “Fair Ratio” digs deeper. This proprietary multiple, calculated here as 23.2x, factors in Ally’s earnings growth prospects, industry dynamics, profit margins, market capitalization, and unique business risks. This approach aims to provide a better tailored benchmark, rather than relying solely on broad industry or peer averages that may not capture the full picture.

Putting it all together, Ally’s actual PE ratio (37.7x) stands noticeably above its Fair Ratio (23.2x). This suggests the stock is trading at a premium to its calculated fair value based on fundamentals and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ally Financial Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your opportunity to tell the story behind Ally Financial's numbers, connecting your perspective on its future, such as your own forecasts for revenue, earnings, and margins, to a fair value estimate.

Narratives bridge the gap between a company's story and the numbers by linking your view of key business drivers, future outlook, and financial performance all the way through to your estimated fair value for the stock. This approach turns a static valuation into a living and breathing decision tool, making it much easier for investors of all experience levels to weigh buy or sell opportunities.

Available right on the Simply Wall St Community page, Narratives are used by millions of investors to craft, view, and compare investment stories, all in an accessible and easy-to-use format. As new news, earnings results, or financial data emerge, Narratives update in real time so your thesis is always current.

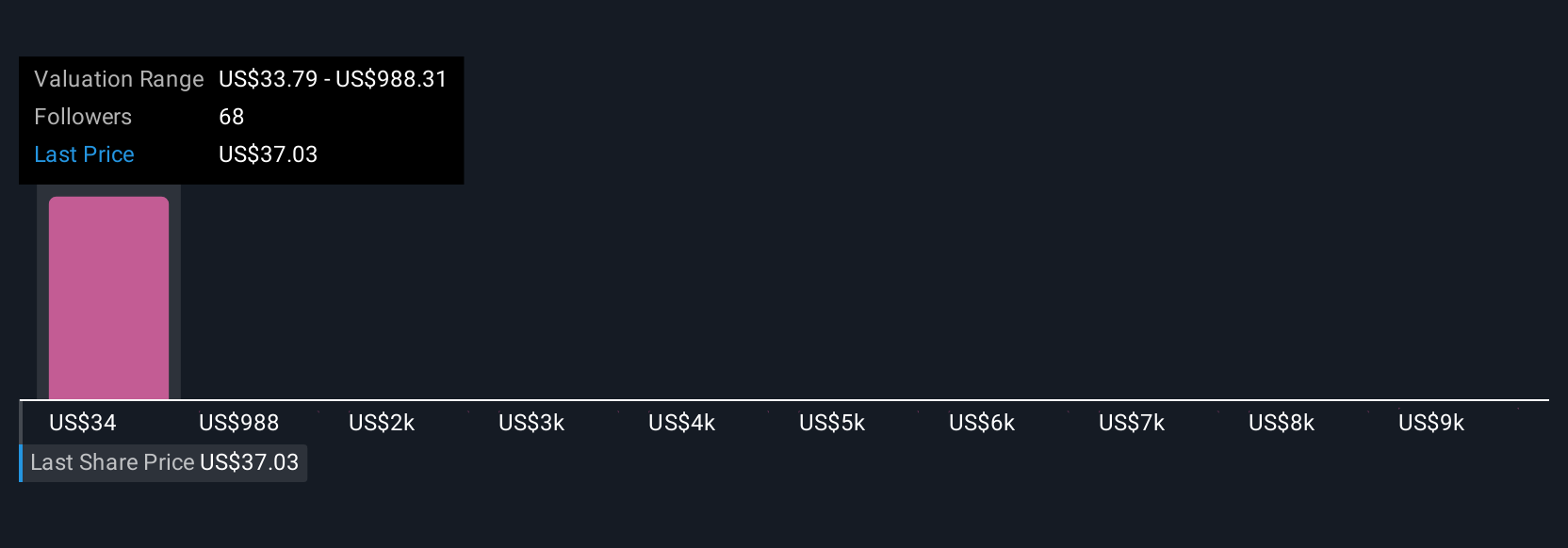

For example, one investor might believe Ally's auto finance technology and digital growth will drive earnings higher and set a bullish fair value around $59, while another sees competition and regulation as limiting factors, estimating fair value closer to $39. By comparing these Narratives side by side, you can decide which one best matches your outlook and act with more confidence.

Do you think there's more to the story for Ally Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLY

Ally Financial

A digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives