- United States

- /

- Capital Markets

- /

- NasdaqGS:VCTR

3 US Growth Companies With Strong Insider Confidence

Reviewed by Simply Wall St

As the U.S. stock market experiences a sluggish stretch following a significant post-election rally, investors are closely monitoring Federal Reserve Chair Jerome Powell's comments on the "sometimes-bumpy path" to achieving inflation targets. In this environment, growth companies with high insider ownership can signal strong confidence from those who know the business best, offering potential resilience amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 31.5% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.5% |

| New Fortress Energy (NasdaqGS:NFE) | 32.6% | 83% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.3% |

| On Holding (NYSE:ONON) | 31% | 29.8% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's dive into some prime choices out of the screener.

ChromaDex (NasdaqCM:CDXC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ChromaDex Corporation is a bioscience company that develops healthy aging products and has a market cap of approximately $536.62 million.

Operations: The company generates revenue through three main segments: Ingredients ($16.95 million), Consumer Products ($71.72 million), and Analytical Reference Standards and Services ($3.00 million).

Insider Ownership: 30.5%

ChromaDex is experiencing significant earnings growth, projected at 81.8% annually, outpacing the US market's average. Recent profitability marks a positive shift, with Q3 2024 net income reaching US$1.88 million from a prior loss. The nationwide launch of Niagen® IV enhances its market presence in wellness products. However, its share price remains volatile and lacks recent insider trading activity. Revenue is expected to grow by approximately 15% year-over-year in 2024.

- Click here and access our complete growth analysis report to understand the dynamics of ChromaDex.

- Insights from our recent valuation report point to the potential overvaluation of ChromaDex shares in the market.

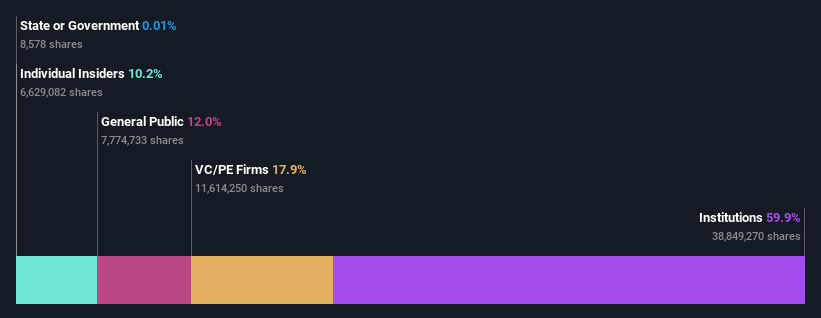

Victory Capital Holdings (NasdaqGS:VCTR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Victory Capital Holdings, Inc. operates as an asset management company both in the United States and internationally, with a market cap of approximately $4.12 billion.

Operations: The company generates revenue of $866.90 million from offering investment management services and products.

Insider Ownership: 10.2%

Victory Capital Holdings shows strong growth potential with revenue expected to increase by 26.7% annually, surpassing the market average. Recent earnings reports highlight significant improvements, with Q3 net income rising to US$81.98 million from US$52.01 million a year ago, and earnings per share increasing accordingly. Despite a high debt level, the stock trades at a good value relative to peers and industry standards, while insider ownership remains substantial without recent trading activity reported.

- Unlock comprehensive insights into our analysis of Victory Capital Holdings stock in this growth report.

- Upon reviewing our latest valuation report, Victory Capital Holdings' share price might be too pessimistic.

Toast (NYSE:TOST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Toast, Inc. operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India with a market cap of approximately $22.67 billion.

Operations: Toast's revenue segment includes Data Processing, which generated $4.66 billion.

Insider Ownership: 20.4%

Toast, Inc. demonstrates robust growth potential with earnings forecasted to increase 57.01% annually, surpassing market averages. Recent Q3 results show a revenue rise to US$1.31 billion and a net income of US$56 million from a previous loss, indicating strong financial recovery. Despite not having substantial recent insider trading activity, the company completed significant share buybacks worth US$56.08 million, reflecting confidence in its ongoing expansion and profitability trajectory.

- Click to explore a detailed breakdown of our findings in Toast's earnings growth report.

- Upon reviewing our latest valuation report, Toast's share price might be too optimistic.

Taking Advantage

- Dive into all 198 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VCTR

Victory Capital Holdings

Operates as an asset management company in the United States and internationally.

Exceptional growth potential with outstanding track record.