- United States

- /

- Healthcare Services

- /

- NasdaqCM:VMD

Undiscovered Gems In The US Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 3.5% decline, yet it remains up by 22% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying promising small-cap stocks that are poised for growth can offer unique opportunities for investors seeking to capitalize on emerging potential within the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Viemed Healthcare (NasdaqCM:VMD)

Simply Wall St Value Rating: ★★★★★★

Overview: Viemed Healthcare, Inc. offers home medical equipment and post-acute respiratory healthcare services across the United States, with a market capitalization of approximately $316.55 million.

Operations: Viemed generates revenue primarily from its Sleep and Respiratory Disorders Sector, amounting to $214.30 million. The company's financial performance is characterized by its net profit margin trends, which are essential for evaluating profitability.

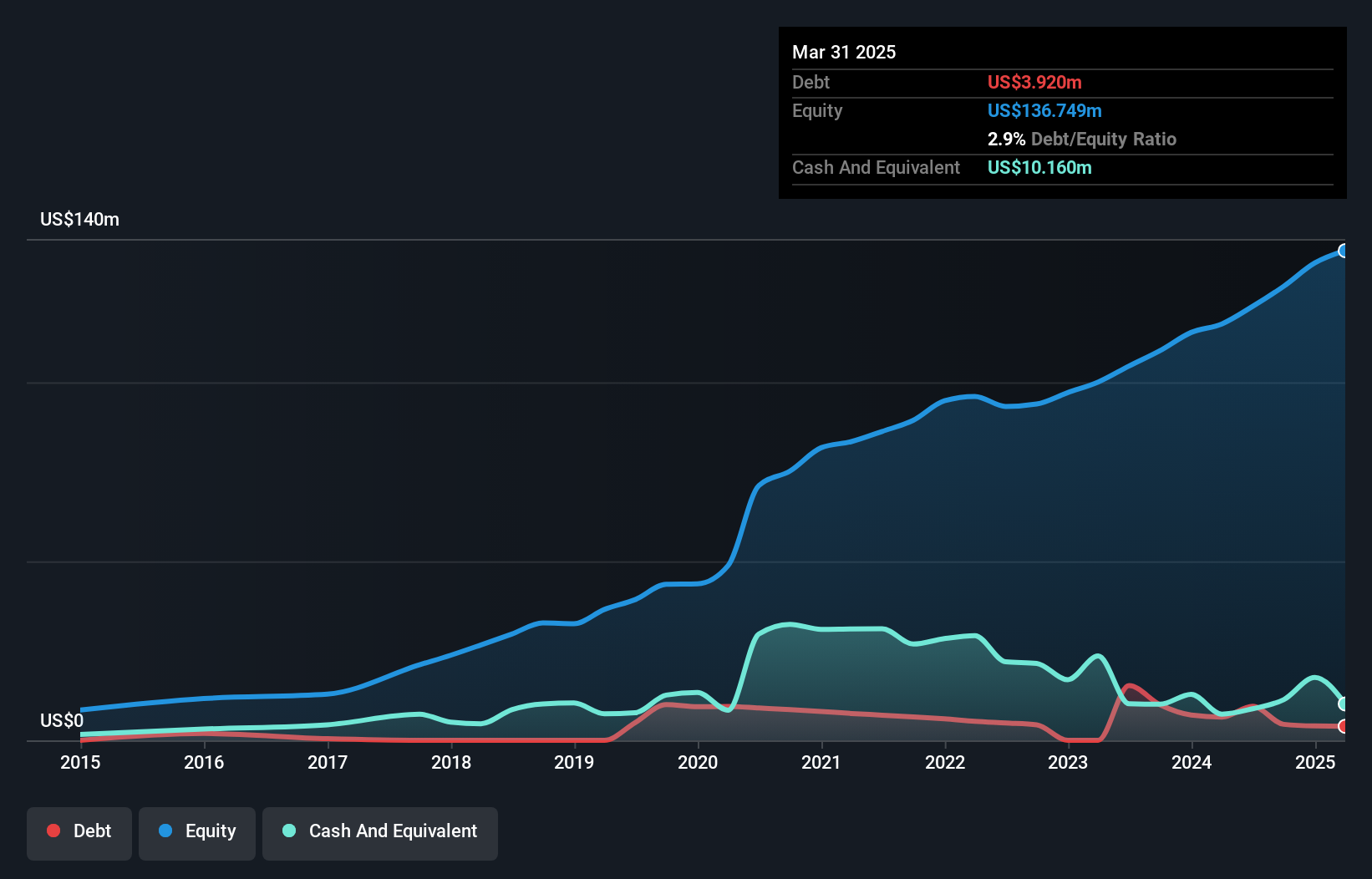

Viemed Healthcare seems poised for growth, with recent earnings showing a jump to US$58 million in Q3 2024 from US$49.4 million the previous year, and net income rising to US$3.88 million from US$2.92 million. Its debt-to-equity ratio has impressively decreased from 23% to 3.5% over five years, while EBIT covers interest payments nearly 20 times over, highlighting financial stability. The company's Engage platform and potential M&A activities could drive further expansion, although reliance on regulatory changes introduces some uncertainty in revenue forecasts amidst ongoing capital expenditures related to ventilator recalls and restructuring efforts.

ASA Gold and Precious Metals (NYSE:ASA)

Simply Wall St Value Rating: ★★★★★☆

Overview: ASA Gold and Precious Metals Limited is a publicly owned investment manager with a market cap of $370.61 million.

Operations: ASA Gold and Precious Metals generates revenue primarily from its financial services segment, specifically through closed-end funds amounting to $1.99 million.

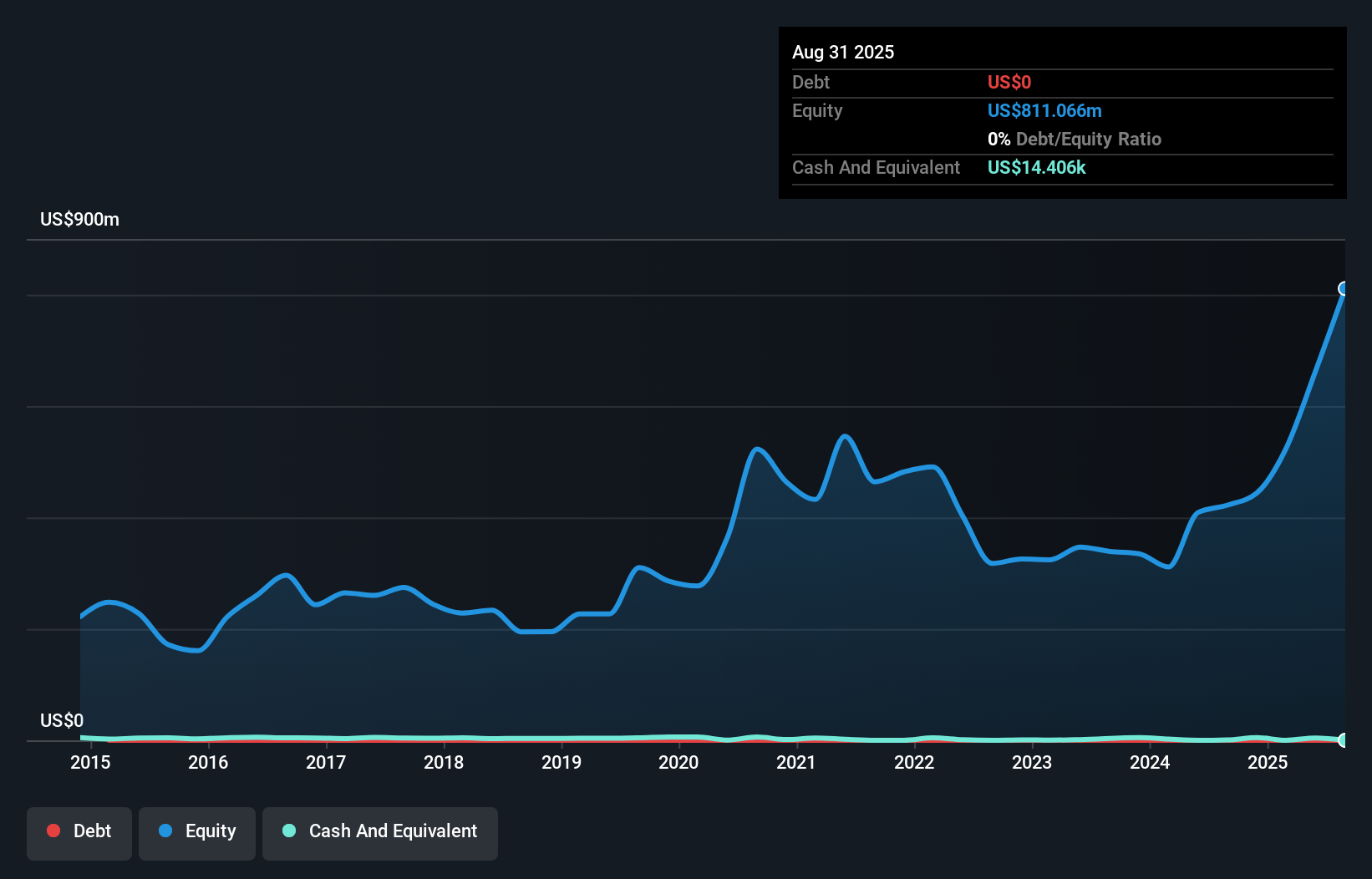

ASA Gold and Precious Metals, a niche player in the precious metals investment space, has seen its earnings surge by 299% over the past year, significantly outpacing the Capital Markets industry's growth. Despite this impressive performance, its revenue remains modest at US$2 million. The company is debt-free and boasts a favorable price-to-earnings ratio of 4.3x compared to the broader US market's 18.2x. A notable one-off gain of US$91.3 million has impacted recent results, highlighting potential volatility in earnings quality. Recent events include a dividend declaration of $0.02 per share and upcoming board nominations by Saba Capital Management LP for 2025's AGM.

Safe Bulkers (NYSE:SB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Safe Bulkers, Inc., along with its subsidiaries, offers marine drybulk transportation services and has a market capitalization of $382.26 million.

Operations: The primary revenue stream for Safe Bulkers comes from its transportation-shipping segment, generating $318.43 million.

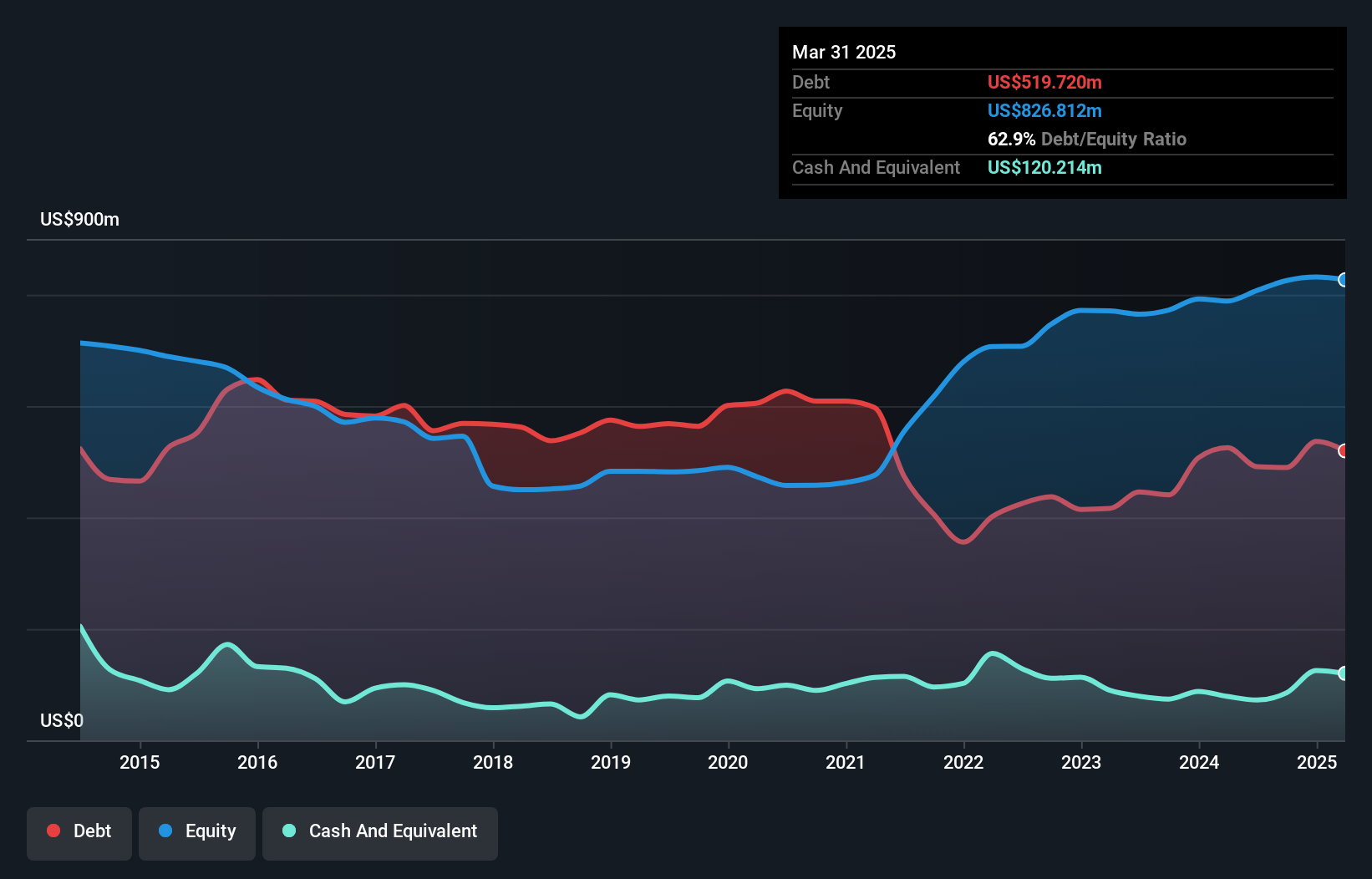

Safe Bulkers has been making waves with a strategic focus on fleet upgrades and environmental initiatives, positioning itself for future growth. The company reported a net income of US$25 million in the third quarter, up from US$15 million the previous year, reflecting strong earnings growth of 27.4% over the past year. Despite a high net debt to equity ratio of 49%, its interest payments are well-covered by EBIT at 4.1 times. With a revenue backlog of $175 million from long-term charters and trading at good value compared to peers, Safe Bulkers seems poised for stable cash flow ahead.

Next Steps

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 240 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VMD

Viemed Healthcare

Provides home medical equipment (HME) and post-acute respiratory healthcare services to patients in the United States.

Flawless balance sheet with reasonable growth potential.