- United States

- /

- Wireless Telecom

- /

- NasdaqGS:SPOK

US Market Undiscovered Gems For September 2025

Reviewed by Simply Wall St

As the U.S. market navigates a period of volatility with major indices like the S&P 500 and Dow Jones retreating from record highs amid tech sector pressures, investors are keenly observing economic indicators such as inflation rates and potential interest rate adjustments by the Federal Reserve. In this environment, identifying undiscovered gems among small-cap stocks can be particularly rewarding, as these companies often offer unique growth opportunities that may not yet be reflected in broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Value Line (VALU)

Simply Wall St Value Rating: ★★★★★★

Overview: Value Line, Inc. focuses on producing and selling investment periodicals and related publications, with a market cap of $357.15 million.

Operations: Value Line, Inc. generates revenue primarily through its publishing segment, which reported $35.08 million in sales. The company's financial performance is highlighted by a net profit margin of 33.61%.

Value Line, a nimble player in the financial sector, showcases robust financial health with no debt and high-quality earnings. Its price-to-earnings ratio of 17.3x is appealing compared to the broader US market's 19.3x. Over the past year, earnings grew by 8.8%, though they lagged behind industry peers at 15.8%. Recently, Value Line reported a net income increase to US$20.69 million from US$19.02 million last year despite revenue dipping slightly to US$35.08 million from US$37.49 million prior year; it also completed share buybacks worth $2.68 million and declared a quarterly dividend of $0.325 per share.

- Take a closer look at Value Line's potential here in our health report.

Understand Value Line's track record by examining our Past report.

Spok Holdings (SPOK)

Simply Wall St Value Rating: ★★★★★★

Overview: Spok Holdings, Inc., operating through its subsidiary Spok, Inc., delivers healthcare communication solutions across multiple regions including the United States, Europe, Canada, Australia, Asia, and the Middle East with a market cap of approximately $373.93 million.

Operations: Spok Holdings generates revenue primarily from its Clinical Communication and Collaboration Business, amounting to $140.74 million. The company's market cap stands at approximately $373.93 million.

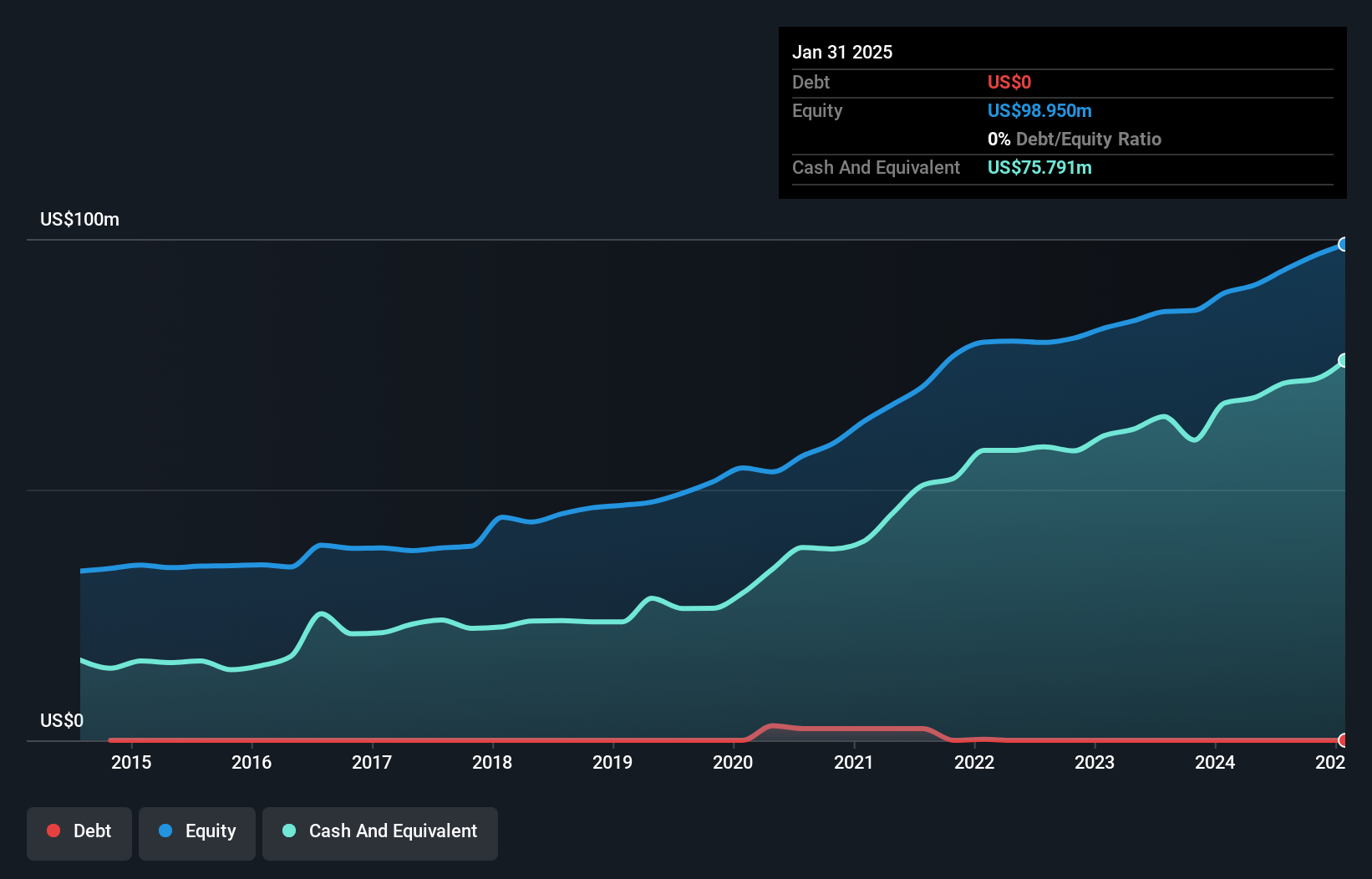

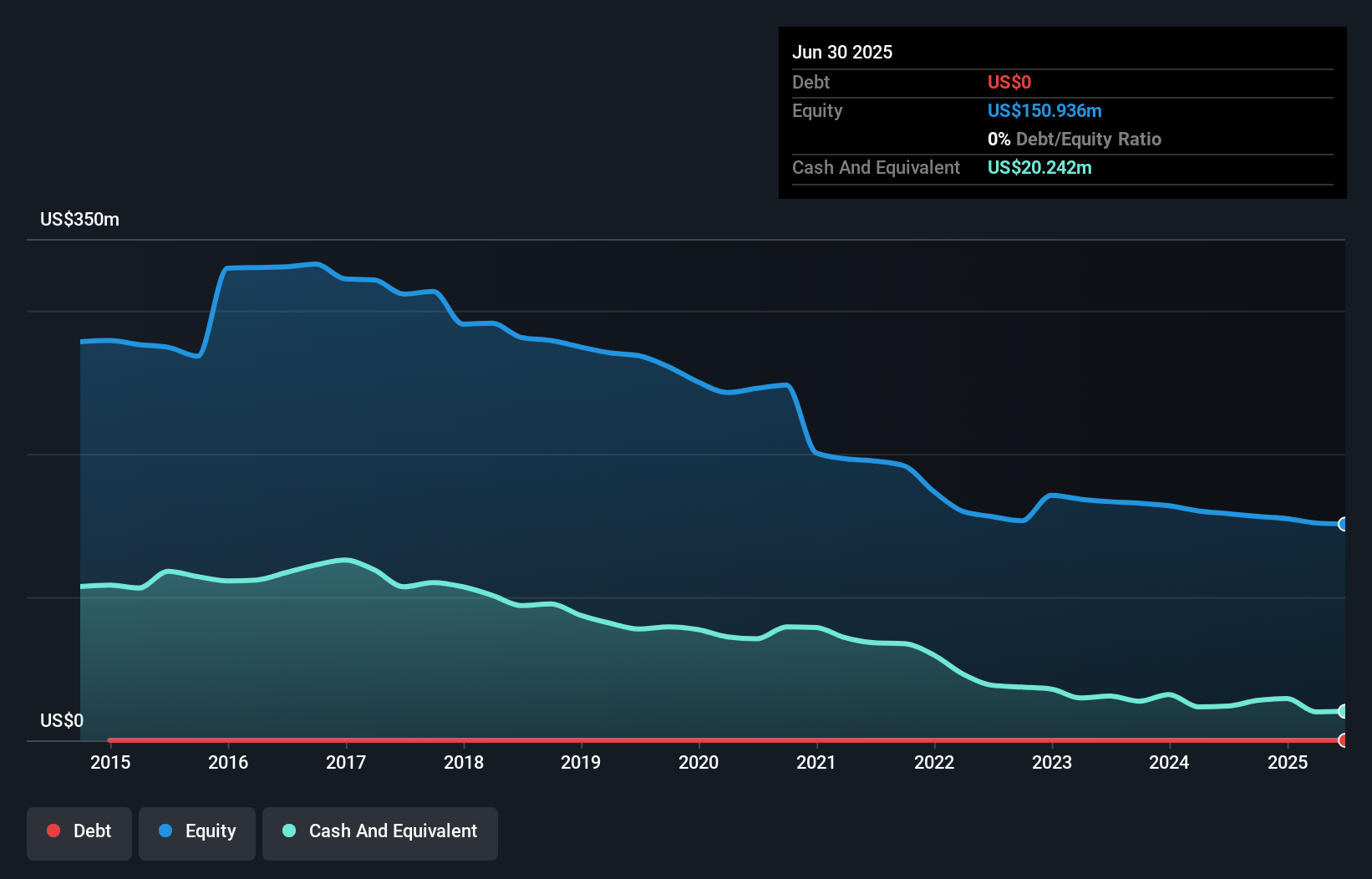

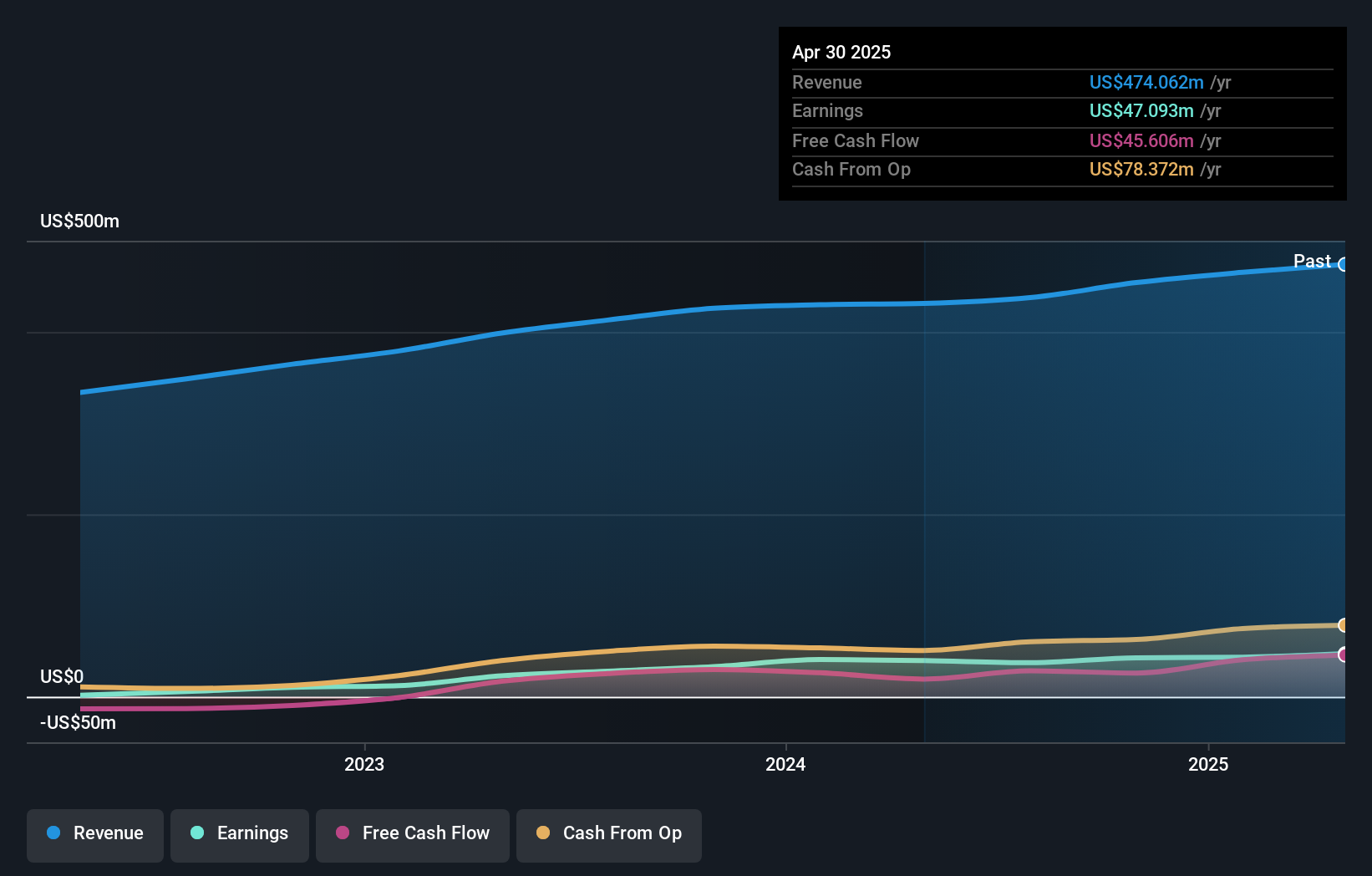

Spok Holdings, a nimble player in the healthcare communication space, is making strides with its Software as a Service (SaaS) model. The company is trading at 54.4% below its estimated fair value and has been debt-free for five years, which strengthens its financial position. Recent earnings reports show sales of US$17 million for Q2 2025, up from US$15.7 million the previous year, while net income rose to US$4.6 million from US$3.4 million. However, challenges like declining wireless services and significant insider selling could impact future performance despite projected modest revenue growth of 1.1% annually over three years.

Oil-Dri Corporation of America (ODC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Oil-Dri Corporation of America, along with its subsidiaries, specializes in the development, manufacturing, and marketing of sorbent products on a global scale and has a market capitalization of approximately $869.22 million.

Operations: ODC generates revenue primarily from two segments: Business to Business Products ($173.39 million) and Retail and Wholesale Products ($300.67 million).

Oil-Dri Corporation of America, a player in the household products sector, has been making waves with a net income rise to US$11.64 million for the recent quarter, up from US$7.78 million previously. Earnings per share also climbed to US$0.8 from US$0.53 last year, showcasing robust growth compared to industry averages of 4.9%. Despite an increase in debt-to-equity ratio over five years from 2.1% to 16.5%, their net debt remains satisfactory at 1.8%. The company’s earnings are high quality and interest payments are well-covered by EBIT at 31 times coverage, indicating financial health and resilience amidst market dynamics.

- Get an in-depth perspective on Oil-Dri Corporation of America's performance by reading our health report here.

Learn about Oil-Dri Corporation of America's historical performance.

Summing It All Up

- Navigate through the entire inventory of 287 US Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SPOK

Spok Holdings

Through its subsidiary, Spok, Inc., provides healthcare communication solutions in the United States, Europe, Canada, Australia, Asia, and the Middle East.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)