- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Upstart Holdings' (NASDAQ:UPST one-year decrease in earnings delivers investors with a 89% loss

It's not a secret that every investor will make bad investments, from time to time. But it should be a priority to avoid stomach churning catastrophes, wherever possible. We wouldn't blame Upstart Holdings, Inc. (NASDAQ:UPST) shareholders if they were still in shock after the stock dropped like a lead balloon, down 89% in just one year. That'd be a striking reminder about the importance of diversification. Upstart Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 38% in the last 90 days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since Upstart Holdings has shed US$130m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Our analysis indicates that UPST is potentially overvalued!

While Upstart Holdings made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Upstart Holdings grew its revenue by 59% over the last year. That's a strong result which is better than most other loss making companies. So the hefty 89% share price crash makes us think the company has somehow offended market participants. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

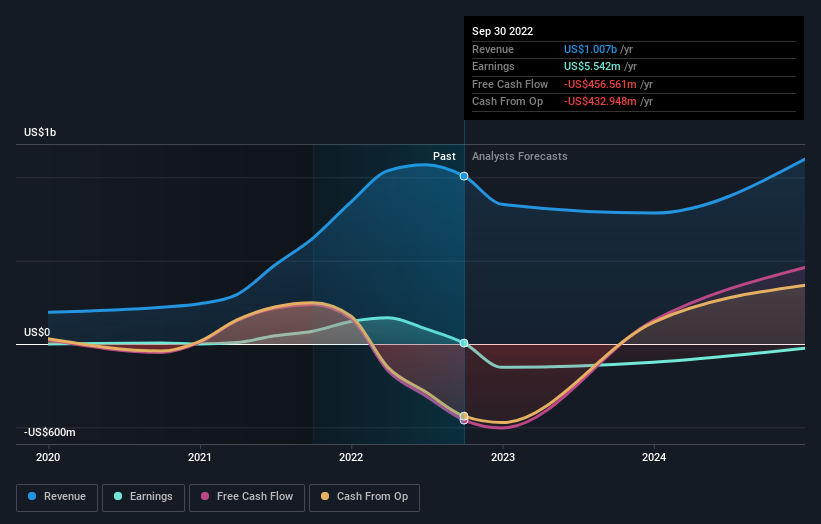

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Upstart Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Upstart Holdings shareholders are down 89% for the year, even worse than the market loss of 19%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 38% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Upstart Holdings (of which 1 makes us a bit uncomfortable!) you should know about.

But note: Upstart Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives