- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (SOFI): Rethinking Valuation After Earnings Momentum and New Crypto, Blockchain Initiatives

Reviewed by Simply Wall St

If you’re trying to figure out what to do with SoFi Technologies (SOFI) shares as the new NFL season kicks off, you’re not alone. The company just announced a splashy partnership with NFL MVP Josh Allen, adding marketing muscle to its growing financial ecosystem. More than a headline grab, this move comes as SoFi rolls out initiatives like the relaunch of crypto trading, blockchain-based global remittances, and perks for its expanding SoFi Plus membership. This raises questions about where the stock could go next.

SoFi’s growth narrative has picked up speed this year, driven by accelerating revenue and net income, as well as a surge in its customer base, especially among younger professionals. The company’s shares have climbed 68% year to date, far outpacing most of the financial sector, supported by consecutive quarters of earnings beats and steady product innovation. While broader market volatility and higher interest rates have paused some fintech rallies, SoFi’s momentum seems to be building rather than fading.

Given all this positive energy, the real question is whether SoFi is still undervalued or if today’s price already accounts for all that future growth.

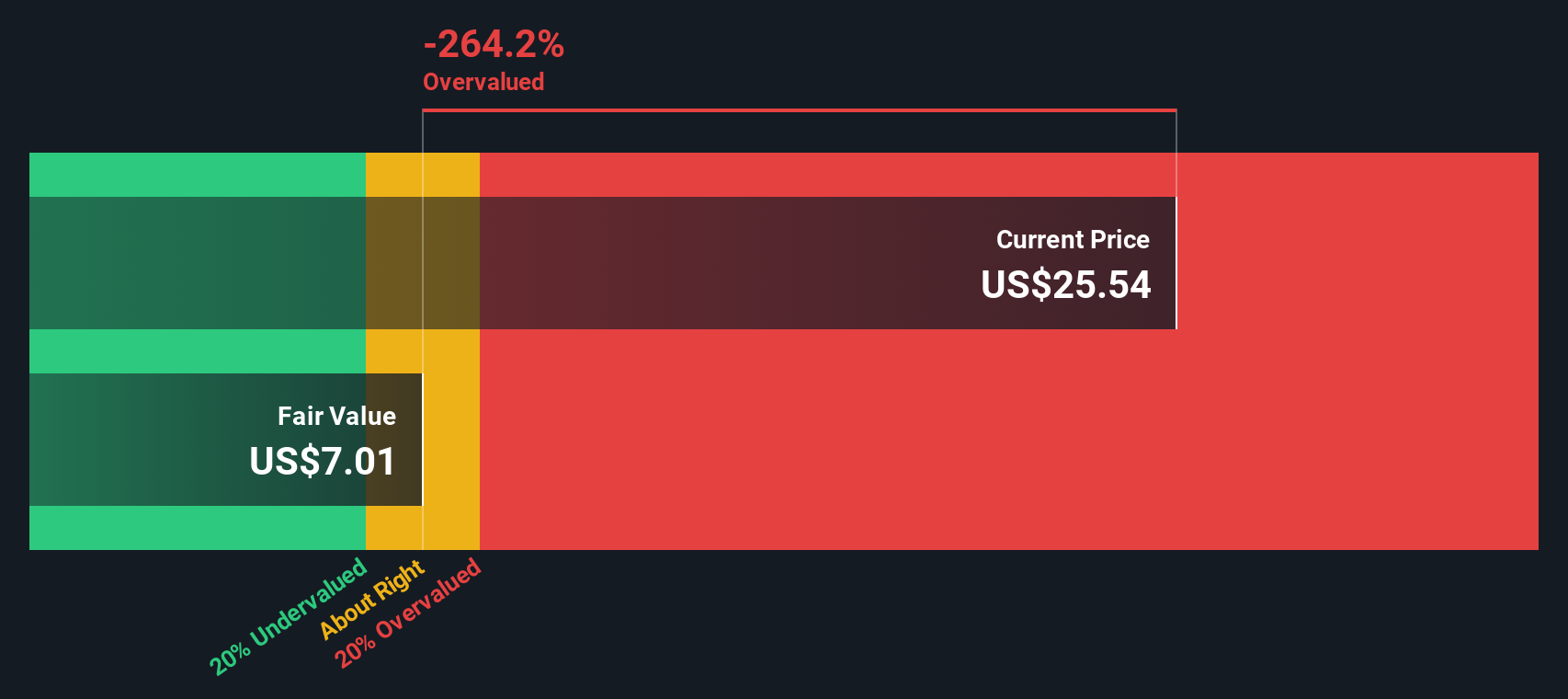

Most Popular Narrative: 82.9% Overvalued

The most widely followed narrative sees SoFi Technologies trading well above its fair value. According to the narrative, the stock's price carries a substantial premium compared to what underlying business performance may justify.

SoFi increased its annual revenue growth guidance for 2024 to 22% to 23% year over year, up from an initial projection of 14% to 16%. This upward revision reflects confidence in maintaining growth in both lending and non-lending segments. The ratio of financial services products to the number of lending products doubled from 3.1 in 2021 to 6.2 in 2024, demonstrating efforts toward a more balanced and diversified revenue model.

Think SoFi’s price is only about hype? The real surprise lies in the bold revenue, profit margin, and future growth assumptions powering this valuation call. Interested in the full breakdown and the actual numbers behind this eye-catching target? Explore this narrative to uncover which financial metrics are shaping the market’s expectations.

Result: Fair Value of $14.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressures or a broader economic slowdown could challenge SoFi’s growth outlook. This could prompt a possible rethink of its current valuation.

Find out about the key risks to this SoFi Technologies narrative.Another View: Discounted Cash Flow Perspective

Looking at SoFi using the SWS DCF model, the result again points to a stock trading above fair value. This method, which is based on projected cash flows, raises questions about whether current optimism is sustainable. Will growth truly deliver, or is the market overreaching?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SoFi Technologies Narrative

If you see things differently or want to put your own findings to the test, it’s quick and easy to craft your own take in minutes. Do it your way

A great starting point for your SoFi Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one opportunity when there are many compelling stocks to consider. Use these smart tools to find your next favorite investment idea before the crowd catches on.

- Uncover the breakouts among high-potential, resilient small-caps with penny stocks with strong financials to spot hidden gems bucking market trends.

- Target tomorrow’s leaders in innovation by tapping into AI penny stocks, a list packed with companies harnessing artificial intelligence for real-world growth.

- Pick out stocks trading below their true worth using undervalued stocks based on cash flows and position yourself to benefit if the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)