- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (NasdaqGS:SOFI) Up 10% As It Seals US$5 Billion Deal With Blue Owl Capital

Reviewed by Simply Wall St

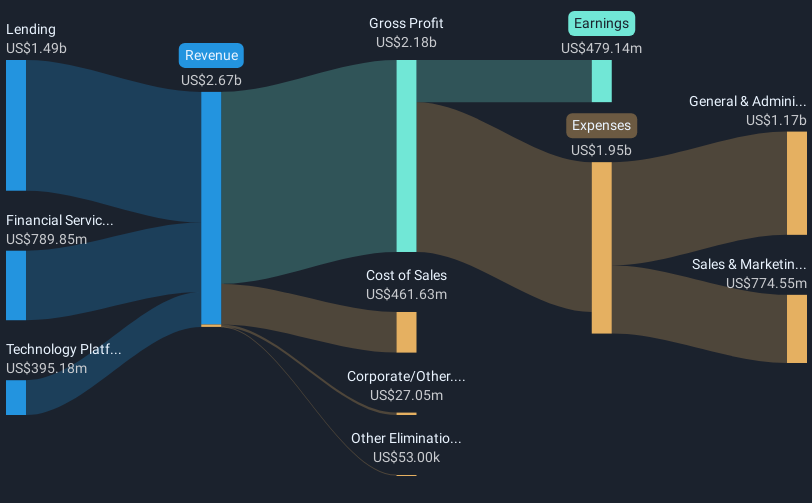

SoFi Technologies (NasdaqGS:SOFI) saw a notable price movement with its stock increasing by 10% over the past week, which coincides with the finalization of an agreement for a $5 billion Loan Platform Business with Blue Owl Capital. This agreement represents the company's largest Loan Platform Business deal to date, highlighting an expansion in its personal loan offerings and a move towards less capital-intensive, fee-based income streams. In contrast, major indices, including the Dow Jones, S&P 500, and Nasdaq, experienced declines due to broader market pressures, such as concerns over tariffs and potential recession fears. Despite these headwinds, SoFi's stock demonstrated resilience, backed by its new partnership, while technology-heavy stocks were particularly hit hard with shares of companies like Tesla experiencing substantial declines. The strategic shift by SoFi into personal loans might have contributed positively amid an otherwise volatile market backdrop.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past year, SoFi Technologies has delivered a total return of 74.01%, significantly outperforming both the US market, which returned 10%, and the US Consumer Finance industry, which returned 20.8%. Several key developments have influenced this performance. SoFi's transition to profitability and remarkable earnings growth in 2024, marked by a full-year net income of US$498.67 million compared to a net loss of US$300.74 million the previous year, has been pivotal. Additionally, launching new platforms like the robo-advisor with BlackRock and expanding partnerships with Nova Credit for better credit assessments strengthened its market position.

The company's strategic moves, including the finalization of a major US$5 billion Loan Platform Business agreement with Blue Owl Capital, have further driven investor confidence. This, along with revised earnings guidance and expanding revenue streams through less capital-intensive operations, has contributed to investor optimism despite broader market challenges. The resignation of Michael Bingle from the Board in January 2025 may not have had a significant impact given the backdrop of positive financial and strategic developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Adequate balance sheet with moderate growth potential.