- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (NasdaqGS:SOFI) Sees 10% Price Drop Despite Optimistic 2026 EPS Guidance

Reviewed by Simply Wall St

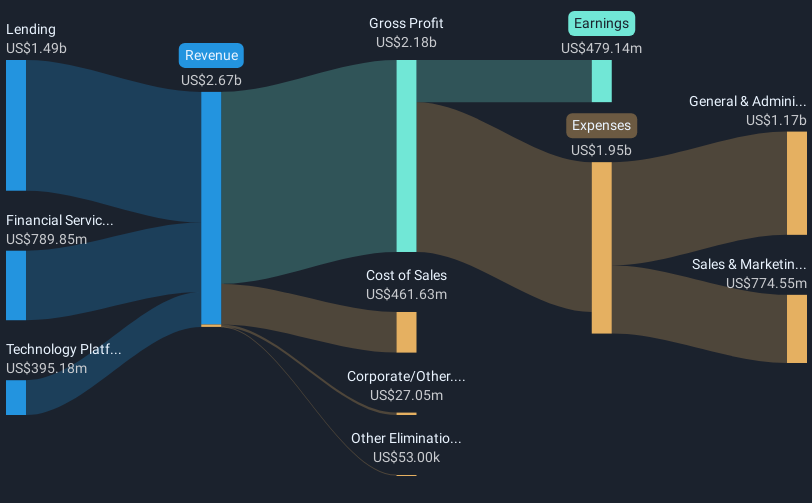

SoFi Technologies (NasdaqGS:SOFI) recently provided earnings guidance for the fiscal year 2026, projecting an EPS range of $0.55 to $0.80, reflecting optimism for growth. Despite this forward-looking financial projection, the company's share price fell 10% over the past month. This decline may be partially influenced by broader market trends, as major U.S. indices had mixed performances amid economic concerns and new tariff announcements by President Trump. Investors have been reacting to a range of volatile legislative measures and their potential implications on the economy, contributing to fluctuations across the stock market. Additionally, influential tech stocks, such as Nvidia, have seen mixed results, which likely added to the sector's uncertainty. While SoFi Technologies might be positioning itself for future revenue growth, current market conditions might have overshadowed its upbeat guidance, affecting its on-market returns.

Get an in-depth perspective on SoFi Technologies's performance by reading our analysis here.

Over the past year, SoFi Technologies' total shareholder return reached 63.32%, significantly outperforming the US market, which returned 16.9%, and the Consumer Finance industry, which posted a 36.8% return. This robust performance can be attributed to a series of positive financial disclosures and improved profitability. Notably, for the full year ending December 31, 2024, SoFi reported net income of US$498.67 million compared to a net loss the previous year. This transition to profitability, paired with earnings per share of US$0.46, suggested a strengthening financial position.

Additionally, the company's revenue for the third quarter of 2024 reached US$723.37 million, up from US$564.27 million, reflecting enhanced operational performance. SoFi's ability to maintain earnings growth, with forecasts suggesting outpaced growth compared to both the broader market and the Consumer Finance industry, may have bolstered long-term investor confidence. Furthermore, the revised earnings guidance in October 2024 signaled continued optimism, likely supporting its strong total returns.

- See how SoFi Technologies measures up with our analysis of its intrinsic value versus market price.

- Explore the potential challenges for SoFi Technologies in our thorough risk analysis report.

- Have a stake in SoFi Technologies? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, and Canada.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives