- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies, Inc. (NASDAQ:SOFI) has High but Risky Growth from Personal Loans and Investment Accounts

SoFi Technologies, Inc. (NASDAQ:SOFI) stock received a lot of attention from a substantial price movement over the last few months, increasing to US$23.89 at one point, and dropping to the lows of US$13.75. The price seems to be highly volatile, and we are going to examine what can be behind these movements.

View our latest analysis for SoFi Technologies

What does the future of SoFi Technologies look like?

We are first going to take a look at the main financials and estimates for the future, in order to get a good anchor of what we are dealing with.

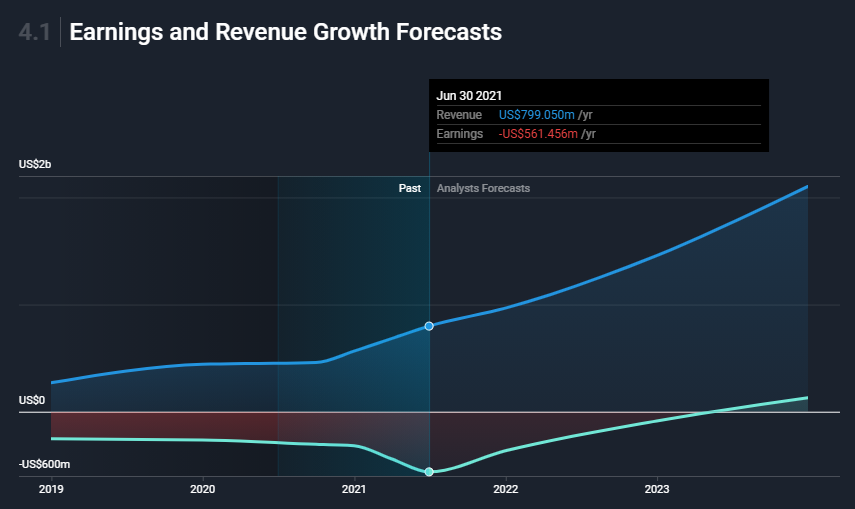

In the upcoming year, SoFi Technologies' earnings are expected to increase by 60%, indicating a highly optimistic future ahead. Likewise, revenue growth is expected to reach some 32%.

In management's Q2 commentary, they affirmed their full 2021-year guidance of adjusted net revenue of $980 million and adjusted EBITDA of $27 million. In the next quarter, they expect a steady increase to adjusted net revenue of $245 to $255 million.

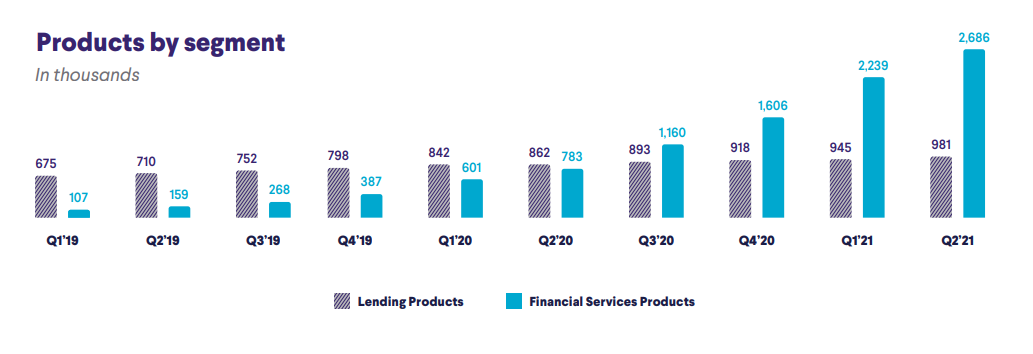

Using the table below, we will see the basis for their estimates as well as the performance of their products by quarter:

The chart above is quite informative because it showcases where the growth of SoFi comes from. We can see that financial service products have rapidly taken off, while lending products are slowly growing.

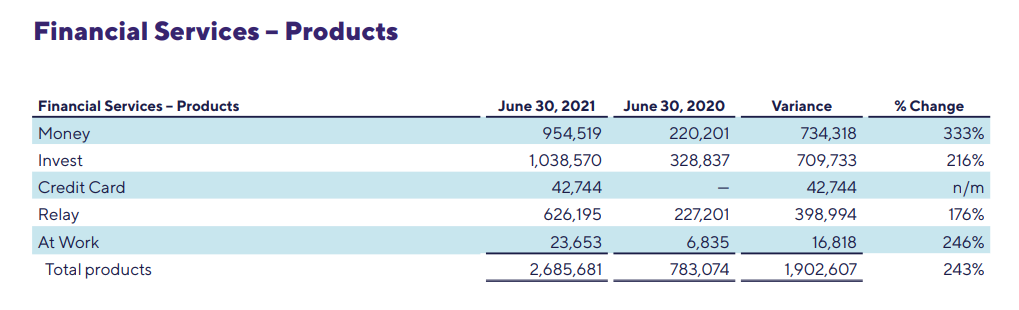

The financial products are mostly driven by increases in their investing service, as members have created more accounts and started using the platform to invest in securities:

Total products refer to the number SoFi accounts, including accounts with a zero dollar balance at the reporting date, that have been opened. We can see that the YoY growth is 243%, which gives SoFi a nice basis to generate future revenue from.

Be mindful that, even though the segment grew quite a bit, it is only responsible for $17m in revenue, while the lending segment, contributes a $166.3m in revenue. We can argue that the investing platform isn't currently the most lucrative segment, buy may well serve the company in order to onboard more members!

This increases the probability of members from one segment to use other SoFi Services as well.

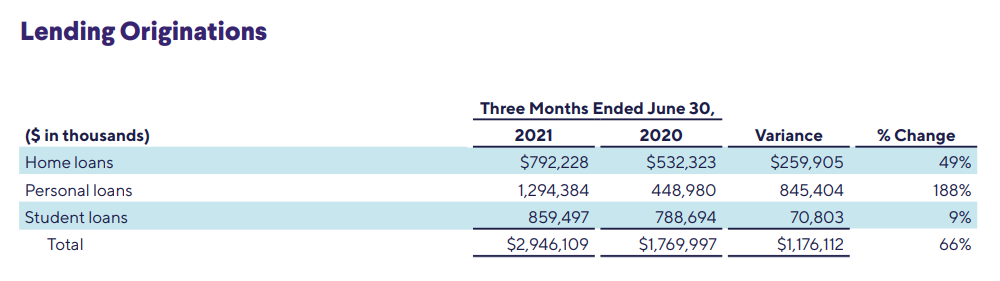

Looking at the lending segment, we can see that Personal Loans were in high demand this quarter, with a 188% increase in the amount lent. Keep in mind that these loans are not current revenue numbers, but will produce income from interest over the installment period.

Examining the figures above, we can make a few points:

- SoFi seems to be gaining as a platform, and members seem to be growing. The further development of their app and platform should increase user satisfaction and create networking benefits.

- Segment growth varies by current trends and user preferences. This means that the company has created a diversified product portfolio which will de-risk their growth, because segments may vary in popularity going forward. The drawback of this, is that the platform must focus on multiple features simultaneously, keep them intact, and well integrated. This is harder than it seems, as it requires intense focus both from managers and developers.

- The 2 highest growing services (Personal Loans and Investing), are driven by current trends and are the first iteration for users. We must closely monitor user satisfaction and recurrent use of services. After this period, we will see if the users are satisfied with the rates, functionalities, customer support etc. This will most likely be expressed in app reviews, which may be a great place for investors to monitor the performance of the platform. Too much negative reviews have been known to pose a serious risk for platforms like this.

- Personal loans are a risky category, because they tend to be taken by people with lower credit rating.

Conclusion

SoFi is just starting its journey and will have a lot to prove before it can become what it sees itself as - an automated banking and financial service platform.

The last quarter showed some encouraging growth, but should be taken with a grain of salt because it seems to be reflective of current trends for investing and financial distress because of COVID.

Analysts are estimating close to $2b in revenue and a break in profitability after 2023. However, the current market cap for SoFi is US$11.8b, which is reflective of the very long term potential of the company. It may be too early to assess if the company can actually reach that potential, and the current valuation seems a bit speculative.

If you'd like to know more about SoFi Technologies as a business, it's important to be aware of any risks it's facing. At Simply Wall St, we found 2 warning signs for SoFi Technologies and we think they deserve your attention.

If you are no longer interested in SoFi Technologies, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives