- United States

- /

- Healthcare Services

- /

- NasdaqGS:BLLN

High Insider Ownership Fuels Growth Stocks In December 2025

Reviewed by Simply Wall St

As the U.S. markets navigate a mixed landscape ahead of a crucial Federal Reserve decision on interest rates, investor optimism remains buoyant despite concerns over economic policies and potential stock bubbles. In this environment, growth companies with high insider ownership often attract attention due to their perceived alignment of interests between management and shareholders, offering a compelling narrative for those seeking resilient investment opportunities in uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Let's uncover some gems from our specialized screener.

Pagaya Technologies (PGY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and AI-powered technology for financial services and other providers, with a market cap of approximately $1.99 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated approximately $1.25 billion.

Insider Ownership: 15.7%

Revenue Growth Forecast: 14.8% p.a.

Pagaya Technologies demonstrates strong growth potential, with earnings forecasted to grow significantly at 93.36% annually and expected profitability in three years. Despite substantial insider selling recently, the company is trading at a significant discount to its estimated fair value and offers good relative value compared to peers. Recent financial activities include a $1.26 billion shelf registration filing and a successful $500 million asset-backed securitization, highlighting robust investor interest and funding diversification efforts.

- Click to explore a detailed breakdown of our findings in Pagaya Technologies' earnings growth report.

- In light of our recent valuation report, it seems possible that Pagaya Technologies is trading behind its estimated value.

BillionToOne (BLLN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BillionToOne, Inc. is a precision diagnostics company focused on creating molecular diagnostics by quantifying biology, with a market cap of $4.97 billion.

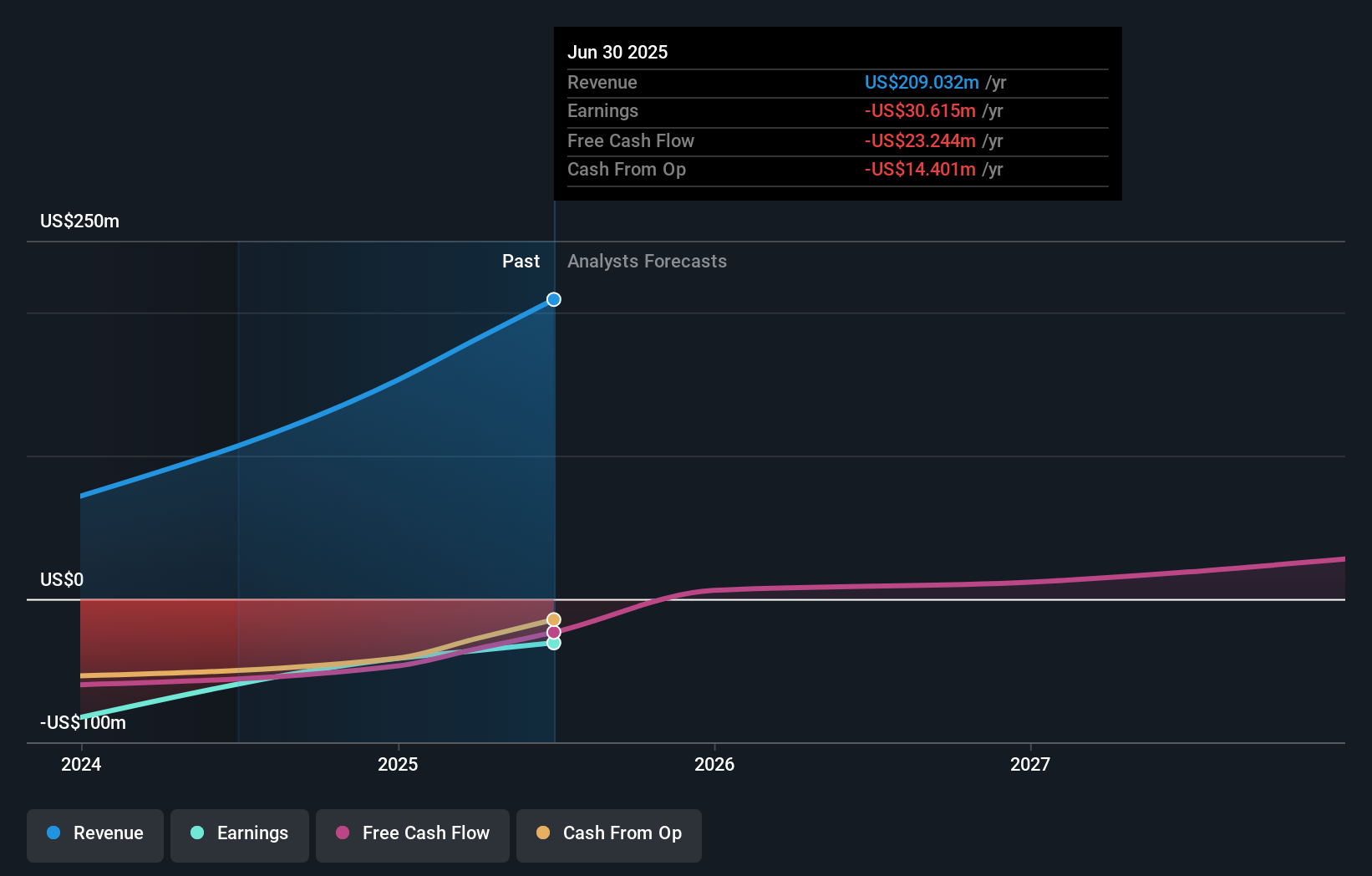

Operations: The company's revenue is primarily derived from its Medical Labs & Research segment, which generated $209.03 million.

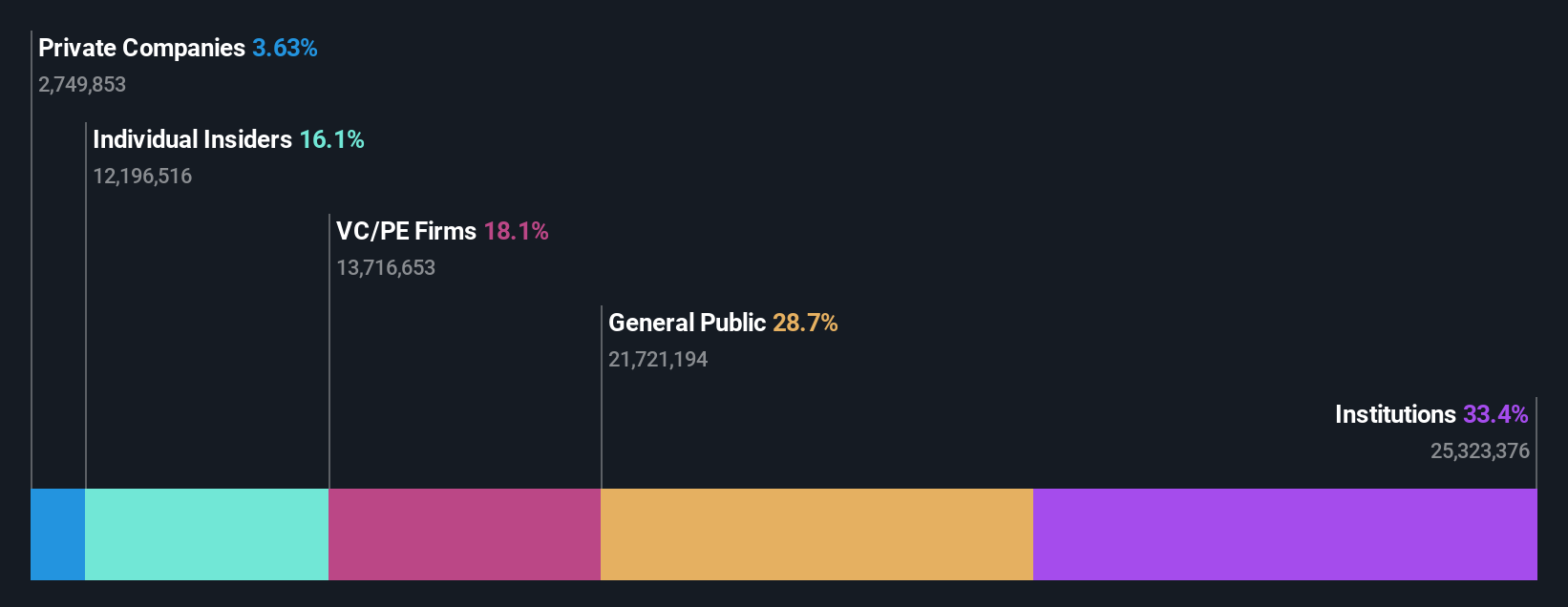

Insider Ownership: 11.3%

Revenue Growth Forecast: 32% p.a.

BillionToOne is experiencing rapid growth, with revenue increasing by 86.7% year-over-year and a forecasted annual growth rate of 32%. The company recently reported its first profitable quarter with US$1.51 million in net income, signaling a positive turnaround. Insider activity shows more buying than selling over the past three months, reflecting confidence in future prospects. Recent board appointment of Anthony Pagano suggests strategic focus on financial performance and governance as the company scales operations post-IPO.

- Get an in-depth perspective on BillionToOne's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility BillionToOne's shares may be trading at a premium.

Marqeta (MQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Marqeta, Inc. operates a cloud-based open API platform for card issuing and transaction processing services, with a market cap of approximately $2.12 billion.

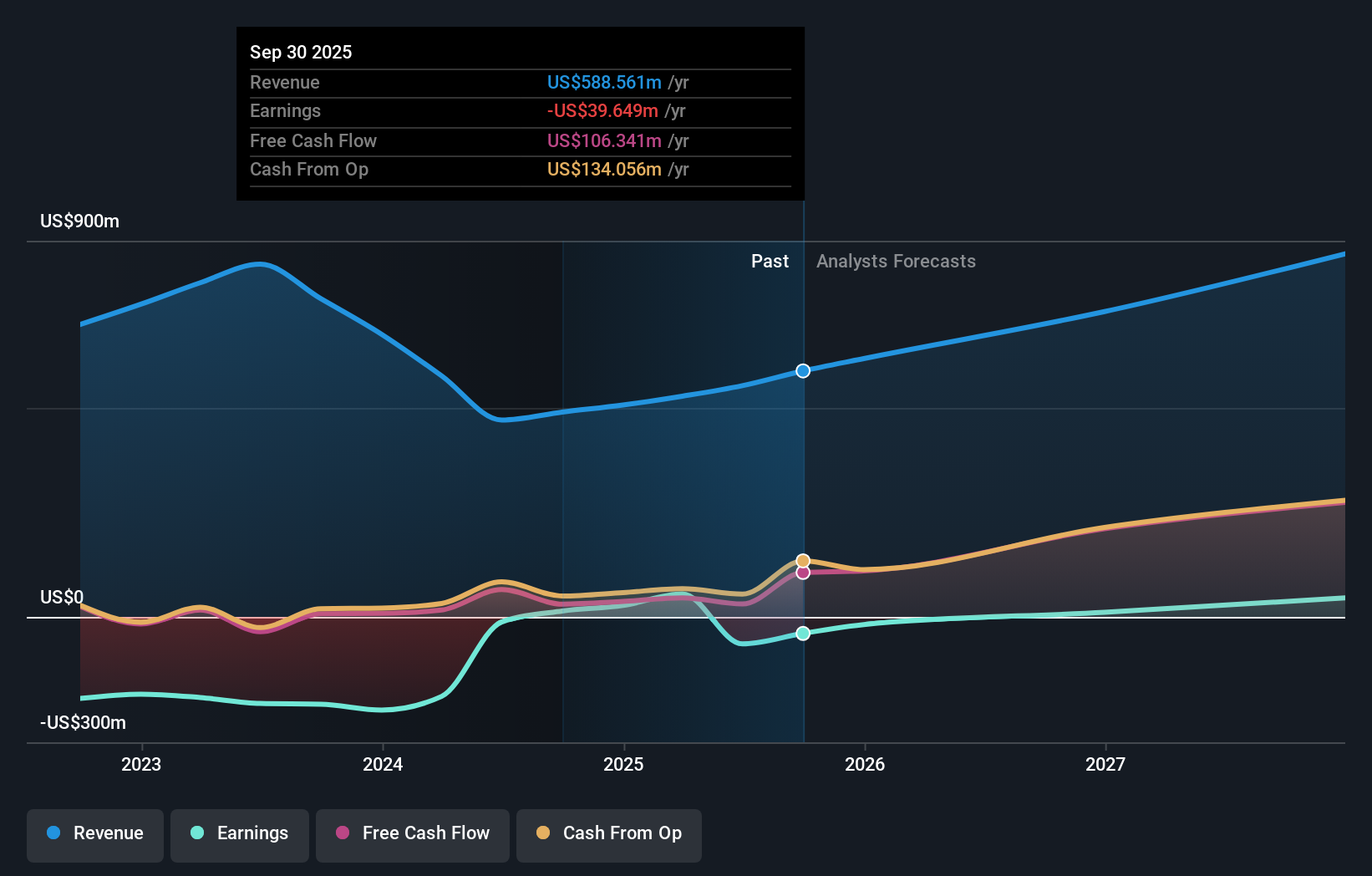

Operations: The company generates revenue primarily through its data processing segment, which amounted to $588.56 million.

Insider Ownership: 12.1%

Revenue Growth Forecast: 14.8% p.a.

Marqeta's growth trajectory is underscored by its strategic expansion with Klarna into new European markets, leveraging Visa's technology to enhance customer payment flexibility. Despite a net loss of US$3.62 million in Q3 2025, revenue rose to US$163.31 million from the previous year. The company announced a US$100 million share buyback program, indicating strong capital management strategies. While insider buying hasn't been substantial recently, Marqeta's projected profitability within three years points to potential long-term growth.

- Delve into the full analysis future growth report here for a deeper understanding of Marqeta.

- Our valuation report here indicates Marqeta may be overvalued.

Seize The Opportunity

- Click this link to deep-dive into the 203 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Interested In Other Possibilities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BillionToOne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BLLN

BillionToOne

A precision diagnostics company, quantifies biology to create molecular diagnostics.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026