- United States

- /

- Capital Markets

- /

- NasdaqGM:MKTW

Exploring 3 Undervalued Small Caps With Insider Action In Global Markets

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by tech-driven gains and fluctuating Treasury yields, small-cap stocks in the S&P 600 are drawing attention amidst broader economic uncertainties. In this environment, identifying promising small-cap opportunities often involves examining factors such as insider activity and market positioning, which can signal potential value in these lesser-known companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Angel Oak Mortgage REIT | 6.3x | 4.1x | 33.47% | ★★★★★★ |

| PCB Bancorp | 10.1x | 3.0x | 31.87% | ★★★★★☆ |

| Tandem Diabetes Care | NA | 0.8x | 49.96% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 21.39% | ★★★★★☆ |

| Citizens & Northern | 11.6x | 2.9x | 40.78% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 30.65% | ★★★★☆☆ |

| Tilray Brands | NA | 1.6x | 1.22% | ★★★★☆☆ |

| Shore Bancshares | 10.5x | 2.7x | -86.37% | ★★★☆☆☆ |

| Limbach Holdings | 35.8x | 2.3x | 38.73% | ★★★☆☆☆ |

| Farmland Partners | 7.0x | 8.5x | -40.52% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

MarketWise (MKTW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MarketWise operates as an internet information provider, offering a range of financial research and software services, with a focus on empowering individual investors.

Operations: MarketWise generates revenue primarily from its Internet Information Providers segment, with recent quarterly figures showing $358.12 million in revenue. The company has seen fluctuations in its gross profit margin, which reached 87.06% as of the latest period. Operating expenses have been significant, notably in sales and marketing and general and administrative categories. Net income margins have varied over time, reflecting changes in both operating efficiency and non-operating expenses.

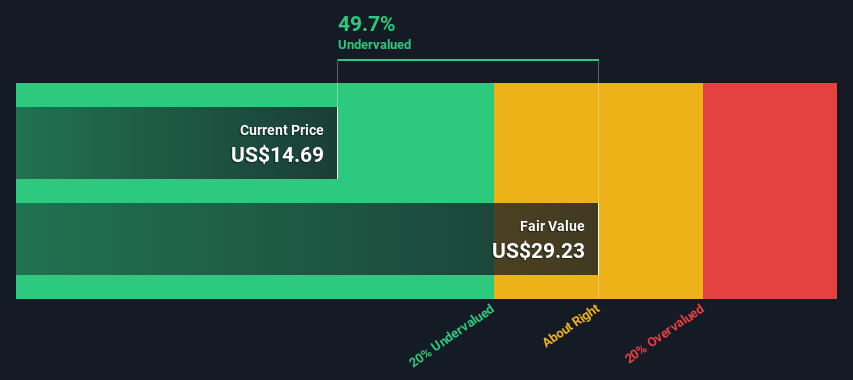

PE: 8.0x

MarketWise has faced challenges, with revenue decreasing to US$79.95 million in Q2 2025 from US$105.05 million the previous year, and earnings expected to decline by 48.3% annually over the next three years. Despite being dropped from multiple growth benchmarks, insider confidence is evident through recent share repurchases totaling US$1.85 million for 117,673 shares between April and June 2025. The appointment of Erik Mickels as COO aims to enhance operational excellence amidst these hurdles.

- Dive into the specifics of MarketWise here with our thorough valuation report.

Understand MarketWise's track record by examining our Past report.

Strategic Education (STRA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Strategic Education is an education services company focusing on higher education and educational technology, with a market cap of approximately $2.05 billion.

Operations: The company generates revenue primarily from U.S. Higher Education, Australia/New Zealand, and Education Technology Services segments. Its net income margin has varied significantly over time, with a recent figure of 9.27%. Operating expenses are a substantial component of costs, including significant allocations to sales and marketing as well as general and administrative expenses.

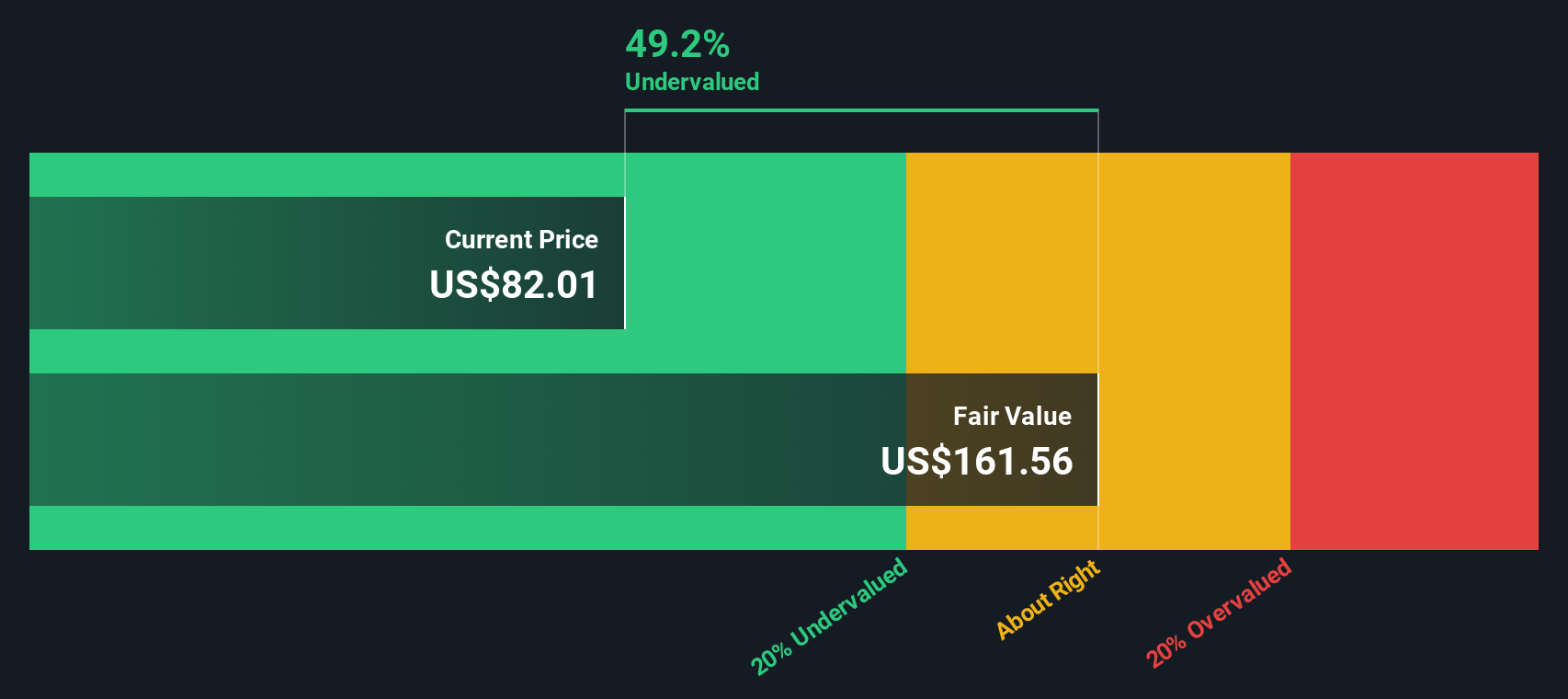

PE: 17.0x

Strategic Education, a small-cap company, demonstrates potential as an undervalued stock. With earnings projected to grow 18.35% annually, it shows promising financial health despite relying solely on external borrowing for funding. Recent reports highlight sales of US$321 million in Q2 2025, up from US$312 million the previous year, with net income rising to US$32 million from US$30 million. Insider confidence is evident with share repurchases totaling 325,844 shares for US$28 million between April and June 2025.

- Unlock comprehensive insights into our analysis of Strategic Education stock in this valuation report.

Explore historical data to track Strategic Education's performance over time in our Past section.

Colony Bankcorp (CBAN)

Simply Wall St Value Rating: ★★★★★☆

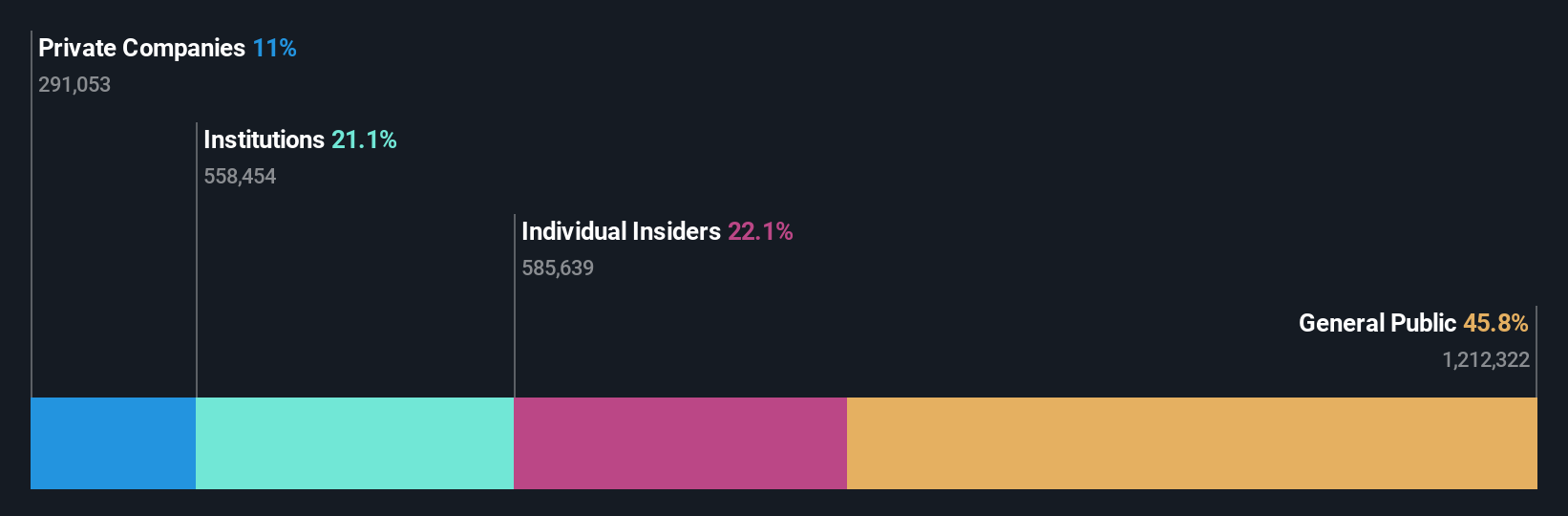

Overview: Colony Bankcorp operates primarily through its Banking, Mortgage Banking, and Small Business Specialty Lending divisions, with a market capitalization of $0.16 billion.

Operations: Colony Bankcorp's revenue is primarily derived from its Banking, Mortgage Banking, and Small Business Specialty Lending divisions. The company has experienced fluctuations in net income margin, which reached 22.11% by June 2025. Operating expenses have shown variability over time, with General & Administrative expenses being a significant component of the cost structure.

PE: 10.7x

Colony Bankcorp, a small player in the financial sector, has shown promising growth with net interest income rising to US$22.39 million for Q2 2025 from US$18.41 million last year. Net income also increased to US$7.98 million from US$5.47 million, indicating strong operational performance. Insider confidence is evident as insiders have been actively purchasing shares recently, suggesting belief in future prospects. The company repurchased 62,017 shares worth US$0.96 million between April and June 2025, enhancing shareholder value amid steady earnings growth projections of 22.58% annually.

- Click here and access our complete valuation analysis report to understand the dynamics of Colony Bankcorp.

Assess Colony Bankcorp's past performance with our detailed historical performance reports.

Next Steps

- Discover the full array of 79 Undervalued US Small Caps With Insider Buying right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MKTW

MarketWise

Operates a content and technology multi-brand platform for self-directed investors in the United States and Internationally.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion