- United States

- /

- Banks

- /

- NasdaqGS:CCB

3 Elite Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As the United States stock market reaches record highs, buoyed by a tame inflation reading and expectations of an interest rate cut, investors are increasingly focused on companies that combine robust growth prospects with strong insider ownership. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations and future potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 75.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11% | 30.4% |

| Celsius Holdings (CELH) | 10.8% | 31.6% |

| Atour Lifestyle Holdings (ATAT) | 18.3% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| AppLovin (APP) | 27.5% | 25.7% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Underneath we present a selection of stocks filtered out by our screen.

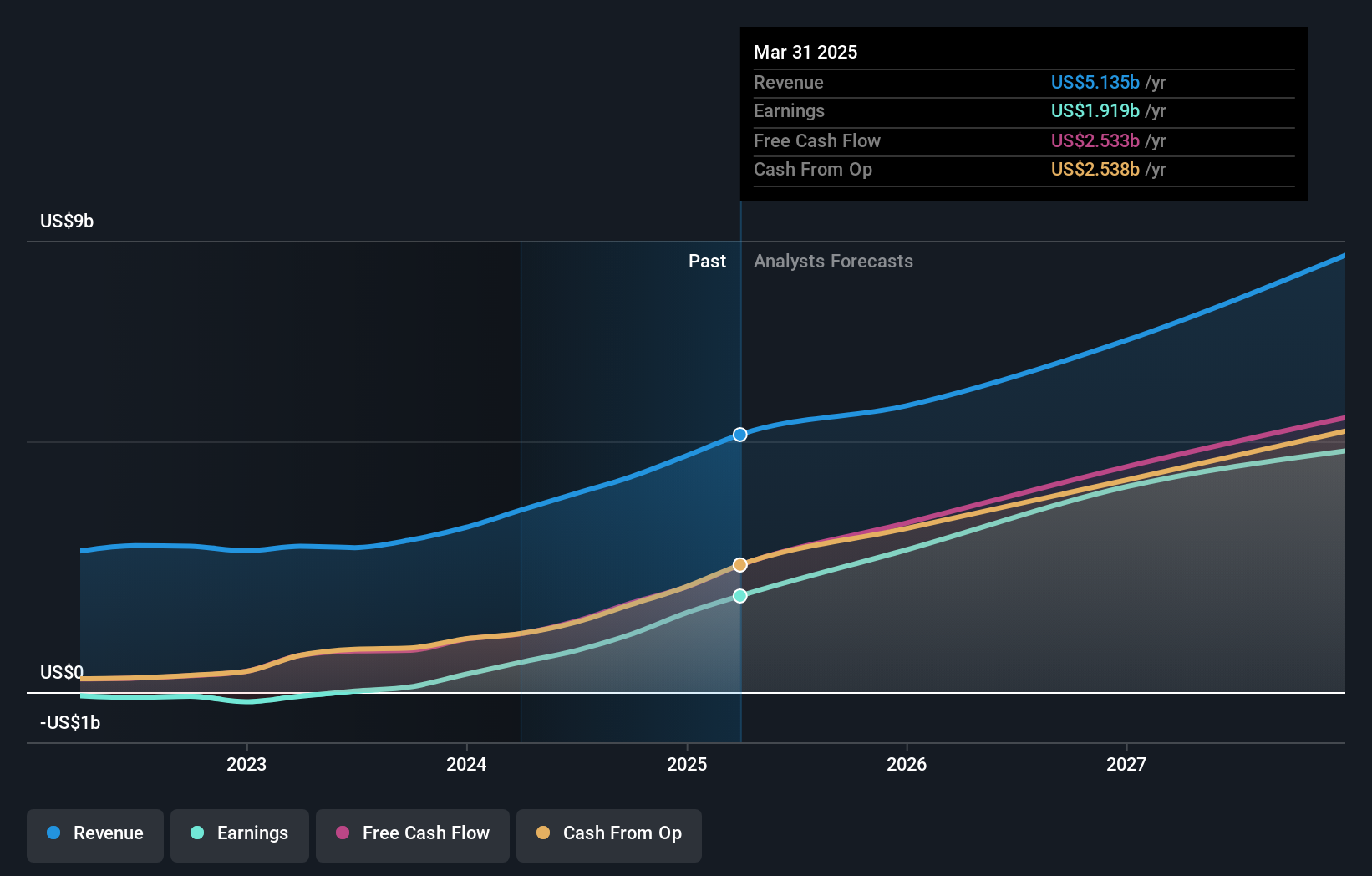

AppLovin (APP)

Simply Wall St Growth Rating: ★★★★★★

Overview: AppLovin Corporation operates a software-based platform that aids advertisers in marketing and monetizing their content globally, with a market cap of $209.71 billion.

Operations: The company's revenue is primarily derived from its advertising segment, which generated $4.25 billion.

Insider Ownership: 27.5%

AppLovin has demonstrated substantial growth, with earnings rising by 199.9% over the past year and forecasts of continued revenue growth at 20.4% annually. Despite high debt levels, insider transactions show more buying than selling in recent months, indicating confidence among insiders. The company has been added to several S&P indices, enhancing its visibility and investor appeal. Recent earnings reports highlight significant increases in sales and net income, underscoring its strong financial performance amidst a competitive market landscape.

- Click here and access our complete growth analysis report to understand the dynamics of AppLovin.

- Our valuation report unveils the possibility AppLovin's shares may be trading at a premium.

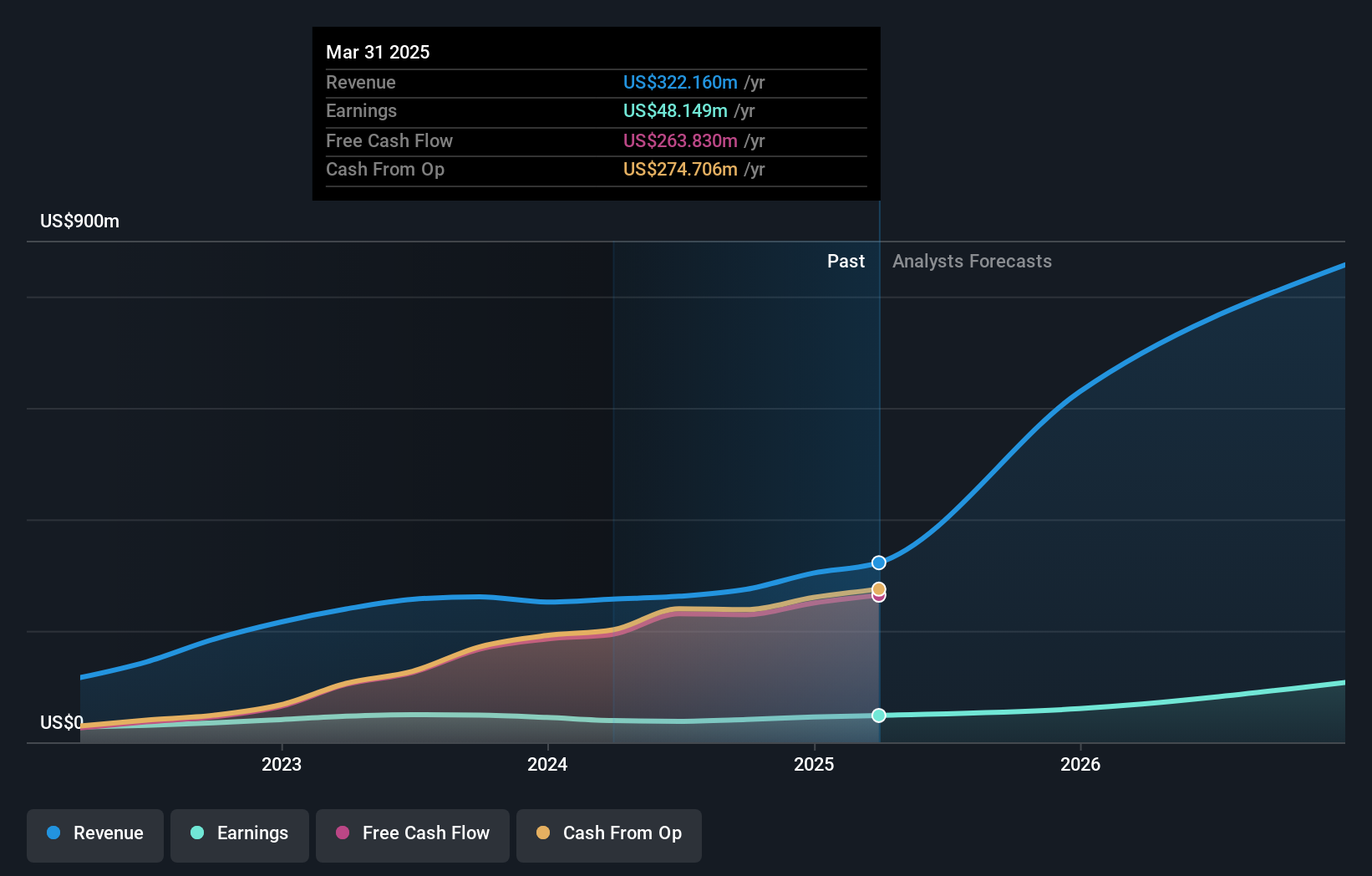

Coastal Financial (CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation, with a market cap of $1.64 billion, operates as the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Operations: Coastal Financial's revenue is primarily derived from its CCBX segment at $234.44 million, followed by the Community Bank segment at $85.81 million, and Treasury & Administration contributing $16.15 million.

Insider Ownership: 13.9%

Coastal Financial exhibits strong growth potential with earnings expected to rise significantly at 44.3% annually, outpacing the US market. Despite recent insider selling, overall transactions show more buying than selling, suggesting insider confidence. Revenue is projected to grow substantially at 28.7% per year. Recent leadership changes, including a new CFO with extensive financial expertise, aim to bolster operational excellence and strategic growth in its fintech and community banking sectors amidst evolving market dynamics.

- Take a closer look at Coastal Financial's potential here in our earnings growth report.

- According our valuation report, there's an indication that Coastal Financial's share price might be on the expensive side.

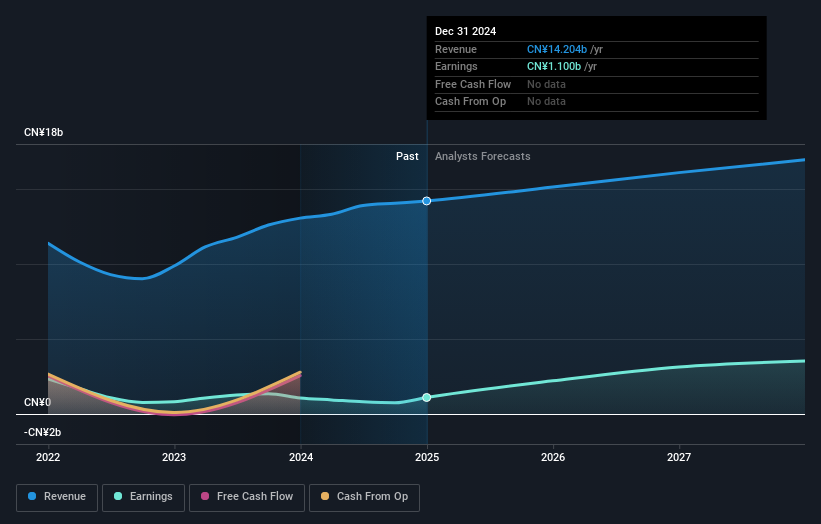

LexinFintech Holdings (LX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LexinFintech Holdings Ltd. operates in the People's Republic of China, providing online direct sales and consumer finance services, with a market cap of approximately $960.78 million.

Operations: The company generates revenue from its online retailers segment, which amounts to CN¥14.01 billion.

Insider Ownership: 35%

LexinFintech Holdings demonstrates strong growth potential with earnings forecasted to grow significantly at 32.65% annually, outpacing the US market. Despite a slight dip in revenue, net income surged, reflecting robust profitability improvements. The company trades at a good value compared to peers and industry standards. Recent executive changes include the resignation of its CTO for personal reasons. LexinFintech's dividend track record remains unstable despite recent increases approved by its board.

- Dive into the specifics of LexinFintech Holdings here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, LexinFintech Holdings' share price might be too pessimistic.

Taking Advantage

- Get an in-depth perspective on all 201 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Seeking Other Investments? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCB

Coastal Financial

Operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives