- United States

- /

- Capital Markets

- /

- NasdaqGS:LPLA

Revisiting LPL Financial Holdings (LPLA) Valuation After Recent Pullback From Record Highs

Reviewed by Simply Wall St

LPL Financial Holdings (LPLA) has quietly outperformed over the past few years, and its recent pullback from record highs is giving investors a fresh chance to revisit the story at a more grounded valuation.

See our latest analysis for LPL Financial Holdings.

After a strong run earlier in the year, LPL’s 1 month share price return of negative 6.23 percent has cooled the pace, but a 5 year total shareholder return of 270.14 percent still points to powerful, long term momentum behind the story.

If this kind of compounding track record has you thinking bigger, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other under the radar growth names.

With earnings still growing faster than revenue and the stock trading below consensus price targets, investors now face a familiar crossroads: is LPL modestly undervalued after its pullback, or is the market already pricing in years of growth?

Most Popular Narrative Narrative: 15.6% Undervalued

With LPL Financial Holdings closing at $355.35 versus a narrative fair value near $420.93, the current market price trails the growth story being modeled.

The acquisition and successful integration of platforms like Atria and Commonwealth, combined with industry-leading asset retention, are enabling LPL to further leverage economies of scale and expand its market share. This is positioning the firm for stronger long-term earnings growth as these integrations are completed.

Want to see what kind of revenue ramp, margin lift, and future earnings power it takes to back this gap? The narrative’s underlying math might surprise you.

Result: Fair Value of $420.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fee compression or a sharp drop in rate sensitive cash sweep income could quickly erode margins and challenge this undervaluation thesis.

Find out about the key risks to this LPL Financial Holdings narrative.

Another View On Valuation

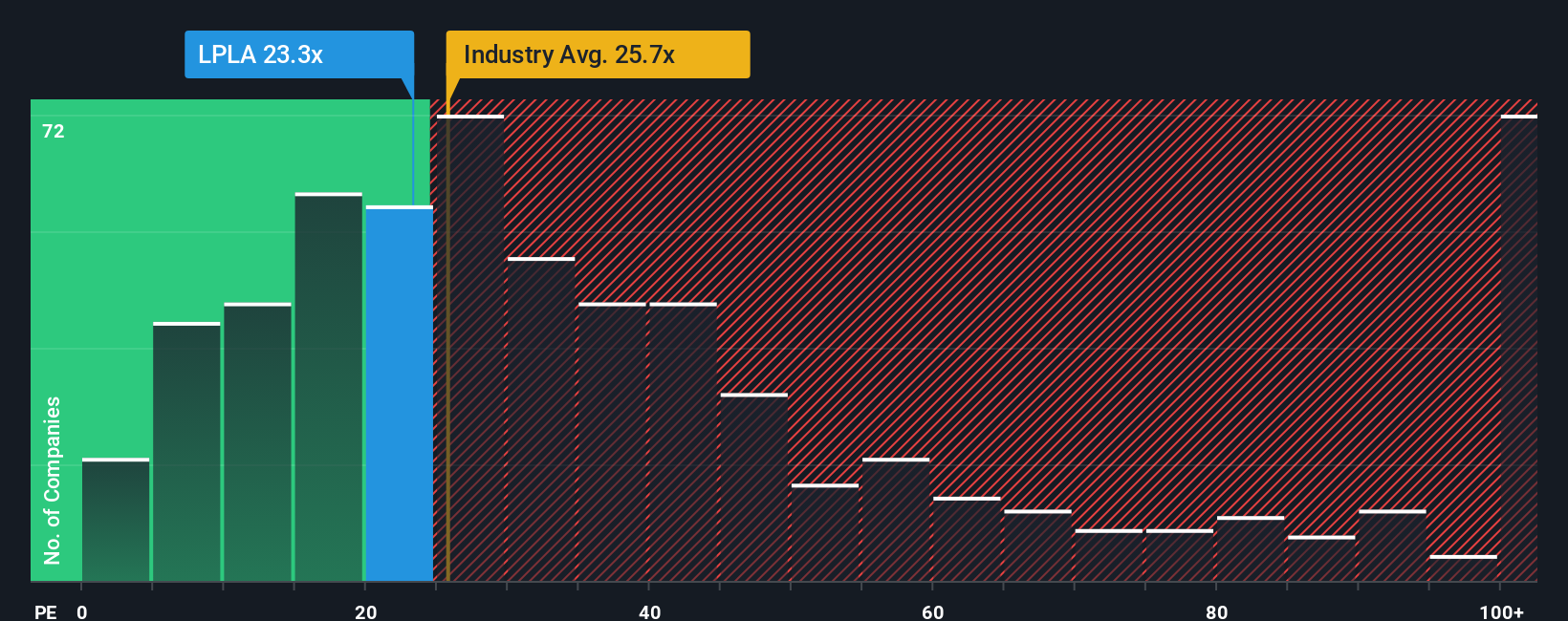

While the narrative suggests LPL is 15.6 percent undervalued, our ratio based view tells a different story. The shares trade on a 34.1 times price to earnings multiple versus a 23.6 times industry average and a 20.8 times fair ratio, implying meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LPL Financial Holdings Narrative

If you are skeptical of these assumptions or simply want to stress test the outlook yourself, you can build a custom LPL narrative in under three minutes: Do it your way.

A great starting point for your LPL Financial Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity, use the Simply Wall St Screener to surface fresh, data driven ideas and stay ahead of investors who only watch headlines.

- Capture early stage potential by scanning these 3570 penny stocks with strong financials that pair tiny market caps with surprisingly solid fundamentals and momentum.

- Position your portfolio for structural tech shifts by targeting these 24 AI penny stocks pushing real world applications of machine intelligence.

- Lock in compelling value by filtering for these 930 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LPLA

LPL Financial Holdings

Provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026