- United States

- /

- Commercial Services

- /

- NYSE:GEO

3 US Stocks Estimated To Be Up To 34.2% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed landscape with fluctuating futures and varied earnings reports, investors are keenly observing economic indicators for insights into potential Federal Reserve actions on interest rates. Amidst this environment, identifying stocks that are trading below their intrinsic value can offer strategic opportunities for those looking to capitalize on discrepancies between market price and fundamental worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | $38.12 | $75.65 | 49.6% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $32.25 | $61.63 | 47.7% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $28.57 | $56.53 | 49.5% |

| Old National Bancorp (NasdaqGS:ONB) | $22.76 | $44.25 | 48.6% |

| German American Bancorp (NasdaqGS:GABC) | $39.96 | $78.06 | 48.8% |

| Kanzhun (NasdaqGS:BZ) | $14.01 | $27.22 | 48.5% |

| Dynatrace (NYSE:DT) | $50.52 | $96.67 | 47.7% |

| LifeMD (NasdaqGM:LFMD) | $4.90 | $9.77 | 49.8% |

| Bilibili (NasdaqGS:BILI) | $16.83 | $32.75 | 48.6% |

| Coeur Mining (NYSE:CDE) | $6.39 | $12.63 | 49.4% |

We're going to check out a few of the best picks from our screener tool.

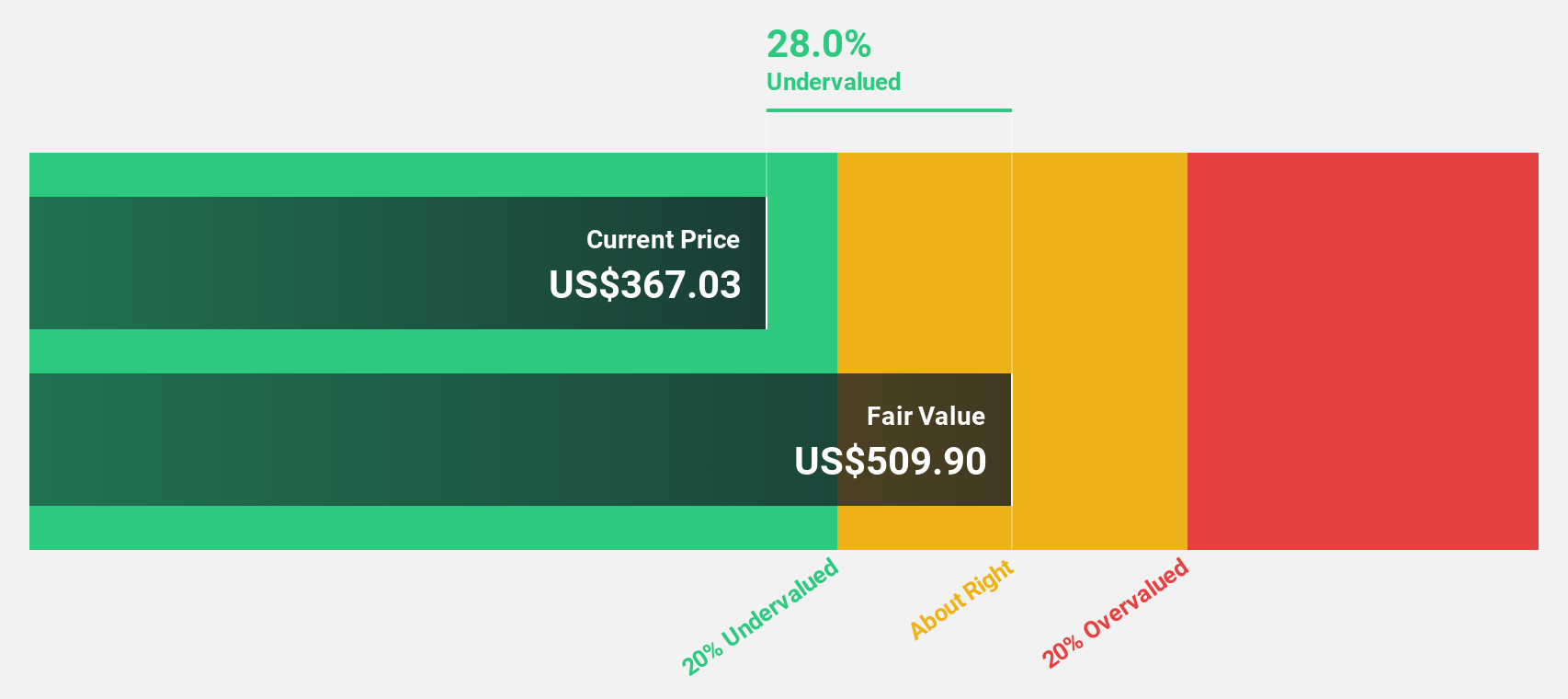

Futu Holdings (NasdaqGM:FUTU)

Overview: Futu Holdings Limited operates as a digitalized securities brokerage and wealth management product distribution service provider in Hong Kong and internationally, with a market cap of approximately $10.71 billion.

Operations: The company generates revenue primarily from its online brokerage services and margin financing services, amounting to HK$10.16 billion.

Estimated Discount To Fair Value: 34.2%

Futu Holdings is trading at US$80.13, significantly below its estimated fair value of US$121.76, highlighting potential undervaluation based on cash flows. Recent earnings reports show robust revenue and net income growth, with Q3 2024 revenue reaching HKD 3.44 billion from HKD 2.65 billion a year ago. The company announced a special dividend funded by surplus cash, underscoring strong financial health and liquidity management amidst expanding services in ETF-based robo-advisory with BlackRock collaboration.

- In light of our recent growth report, it seems possible that Futu Holdings' financial performance will exceed current levels.

- Navigate through the intricacies of Futu Holdings with our comprehensive financial health report here.

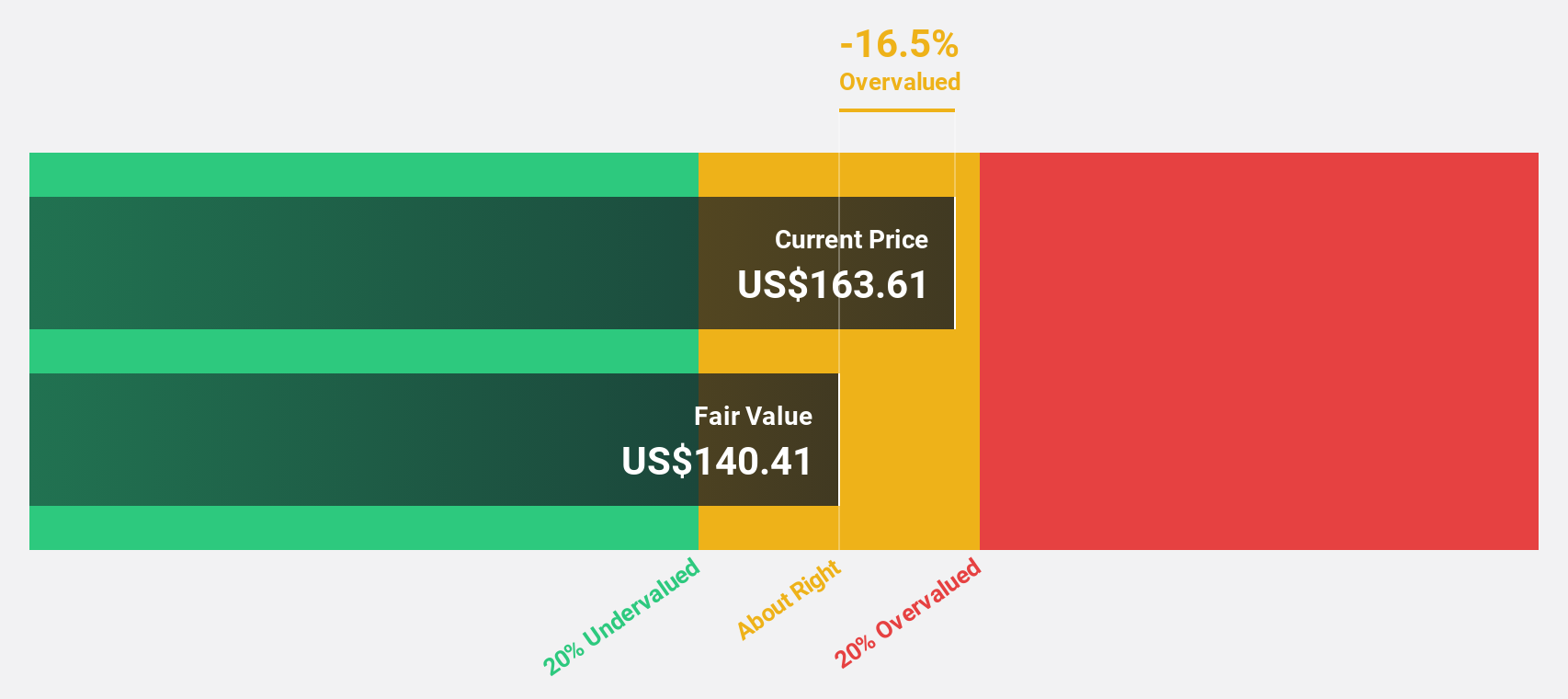

LPL Financial Holdings (NasdaqGS:LPLA)

Overview: LPL Financial Holdings Inc. offers a comprehensive platform of brokerage and investment advisory services to independent financial advisors and enterprise-based advisors across the United States, with a market cap of approximately $25.05 billion.

Operations: The company generates revenue primarily from its brokerage segment, which amounts to $11.27 billion.

Estimated Discount To Fair Value: 11.6%

LPL Financial Holdings is trading at US$338.25, below its estimated fair value of US$382.55, suggesting potential undervaluation based on cash flows. The company reported Q3 2024 revenue of US$3.11 billion and net income of US$255.3 million, showing solid growth from the previous year. Despite a forecasted high return on equity and faster-than-market earnings growth, debt coverage by operating cash flow remains a concern for financial positioning.

- According our earnings growth report, there's an indication that LPL Financial Holdings might be ready to expand.

- Get an in-depth perspective on LPL Financial Holdings' balance sheet by reading our health report here.

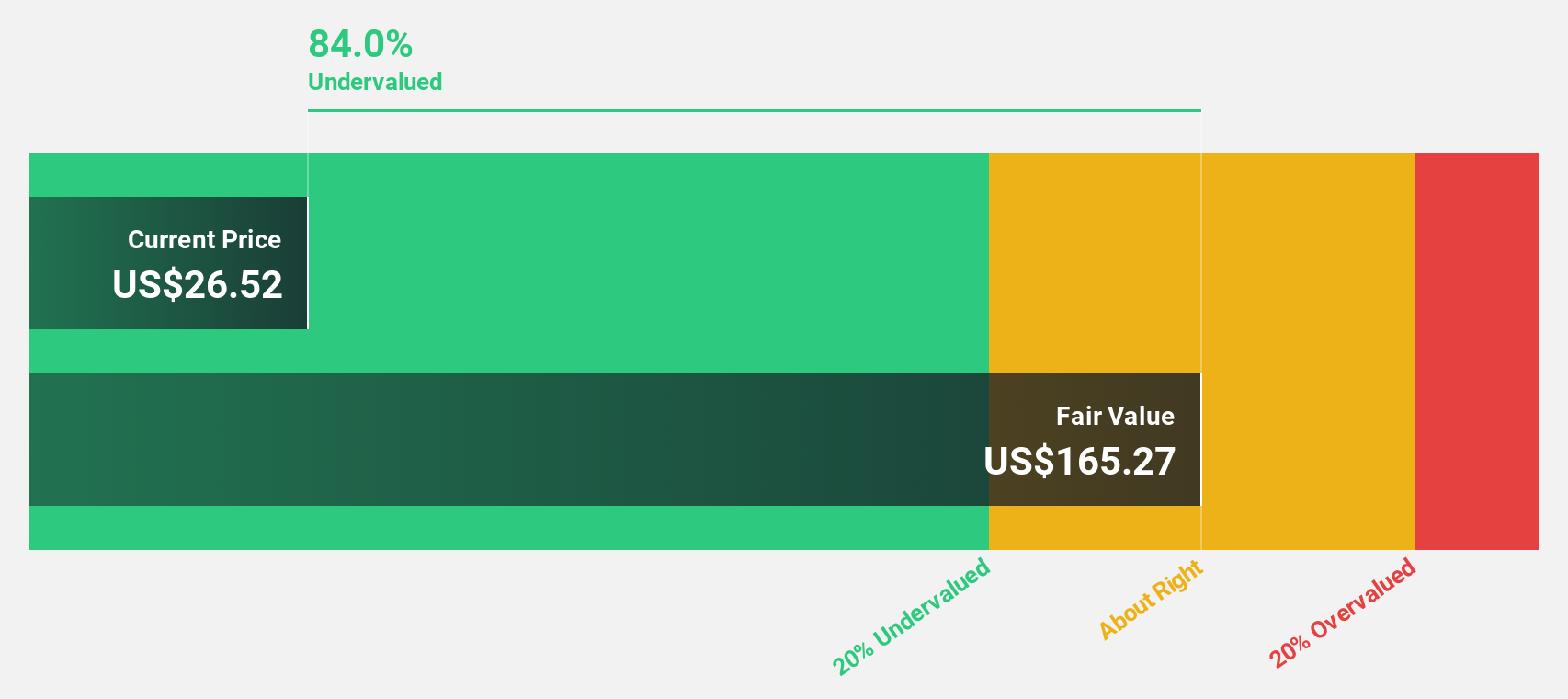

GEO Group (NYSE:GEO)

Overview: The GEO Group, Inc. (NYSE: GEO) operates in the ownership, leasing, and management of secure facilities and reentry centers across the United States, Australia, the United Kingdom, and South Africa with a market capitalization of approximately $4.31 billion.

Operations: The company's revenue segments include Reentry Services ($278.81 million), U.S. Secure Services ($1.60 billion), International Services ($204.41 million), and Electronic Monitoring and Supervision Services ($342.32 million).

Estimated Discount To Fair Value: 16.3%

GEO Group, trading at US$33.85, is below its estimated fair value of US$40.44, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly faster than the U.S. market over the next three years, despite recent volatility in profit margins and interest coverage challenges. Recent leadership changes and a $70 million investment to expand services for ICE could impact future performance as GEO seeks to optimize operations by selling underperforming assets.

- The analysis detailed in our GEO Group growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in GEO Group's balance sheet health report.

Where To Now?

- Investigate our full lineup of 169 Undervalued US Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEO

GEO Group

The GEO Group, Inc. (NYSE: GEO) engages in ownership, leasing, and management of secure facilities, processing centers, and community-based reentry facilities in the United States, Australia, the United Kingdom, and South Africa.

Reasonable growth potential slight.