- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

Insider Action On These 3 Undervalued Small Caps Across Regions

Reviewed by Simply Wall St

The United States market has experienced a modest climb of 1.2% over the last week and a more robust increase of 7.7% over the past year, with earnings projected to grow by 14% annually in the coming years. In this environment, identifying stocks that are potentially undervalued can provide opportunities for investors seeking to capitalize on insider actions across various regions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.1x | 2.8x | 49.22% | ★★★★★☆ |

| Flowco Holdings | 6.7x | 1.0x | 39.96% | ★★★★★☆ |

| West Bancorporation | 12.5x | 3.9x | 39.14% | ★★★★☆☆ |

| S&T Bancorp | 10.7x | 3.7x | 45.49% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 37.54% | ★★★★☆☆ |

| Forestar Group | 5.9x | 0.7x | -410.66% | ★★★★☆☆ |

| Franklin Financial Services | 14.7x | 2.4x | 30.32% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -11.99% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.5x | -2926.48% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -354.18% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

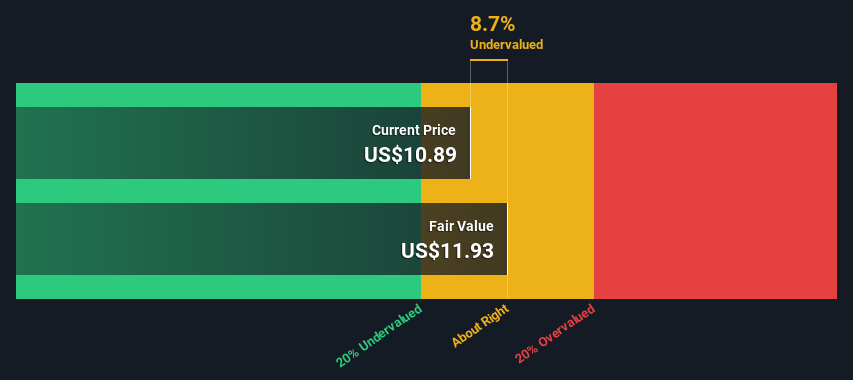

Flywire (NasdaqGS:FLYW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Flywire is a global payments enablement and software company that provides integrated solutions for complex payment processes, with a market cap of approximately $3.23 billion.

Operations: Flywire generates revenue primarily through its services, with a gross profit margin that has fluctuated between 61.31% and 63.94% over the observed periods. The company incurs costs of goods sold (COGS) and operating expenses, which include significant allocations to sales & marketing, research & development, and general & administrative expenses. Recent financial data shows a positive net income margin reaching up to 4.23%, indicating an improvement in profitability from previous negative margins.

PE: 268.0x

Flywire, a small company in the U.S., is gaining attention for its recent strategic moves and financial performance. In Q1 2025, they reported sales of US$133.45 million, up from US$114.1 million the previous year, with net losses narrowing to US$4.16 million from US$6.22 million. Their partnership with Avanse Financial Services enhances their foothold in education payments globally, while insider confidence was evident as insiders purchased shares over the past six months—indicating trust in future growth despite volatile share prices and reliance on external funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of Flywire.

Evaluate Flywire's historical performance by accessing our past performance report.

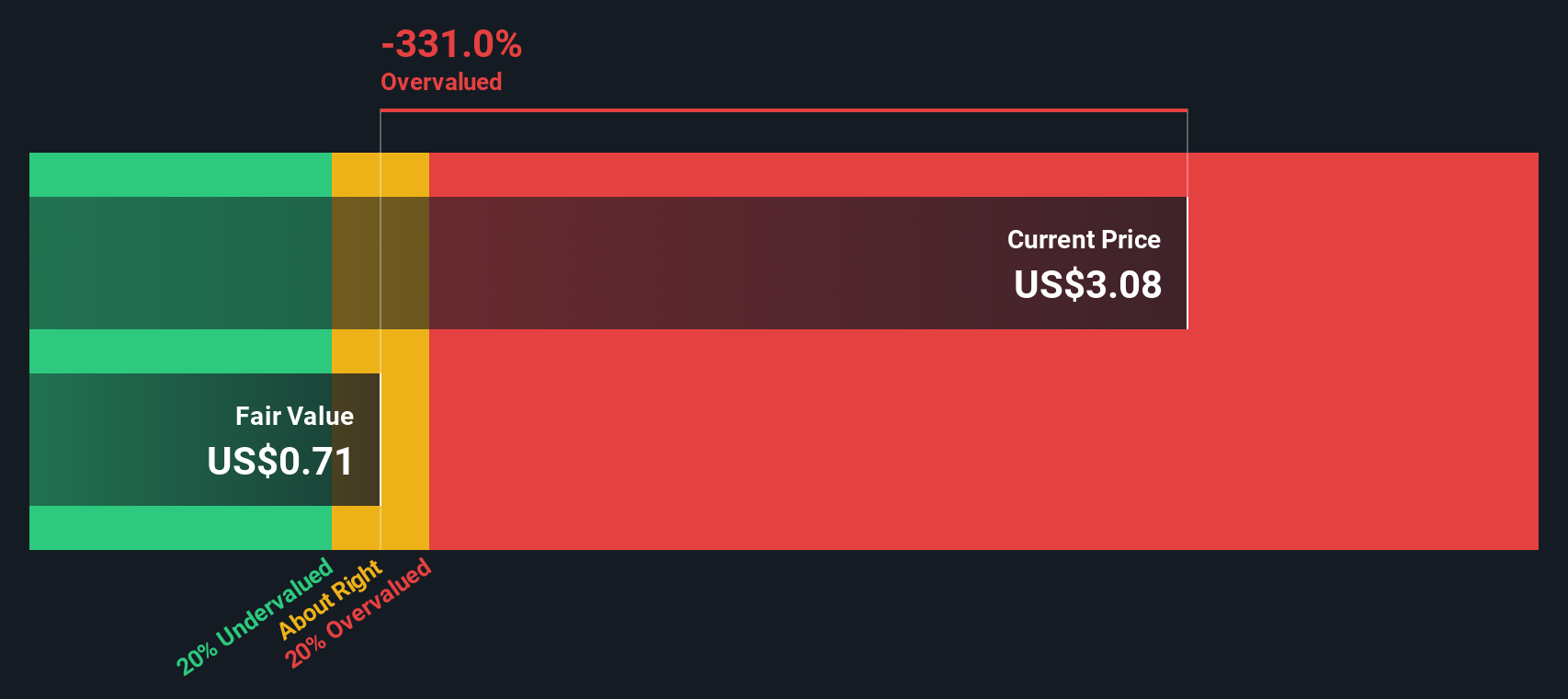

Petco Health and Wellness Company (NasdaqGS:WOOF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Petco Health and Wellness Company operates as a retailer specializing in pet care products and services, with a market cap of approximately $1.77 billion.

Operations: The company's revenue primarily stems from retail operations, with a recent figure reaching $6.12 billion. Over the observed periods, the gross profit margin showed a declining trend, most recently at 38.00%. Operating expenses are substantial and have consistently been close to or exceeded gross profit in several periods, impacting net income significantly.

PE: -8.7x

Petco Health and Wellness Company, a key player in pet care, recently reported a decrease in revenue to US$6.1 billion for the year ending February 2025, with net losses narrowing significantly to US$101.82 million. Despite high share price volatility and reliance on external borrowing, insider confidence is evident as Joel Anderson acquired over 1.5 million shares valued at approximately US$4.7 million, reflecting belief in potential growth. The appointment of experienced executives like Sabrina Simmons as CFO might enhance strategic financial planning amid ongoing challenges.

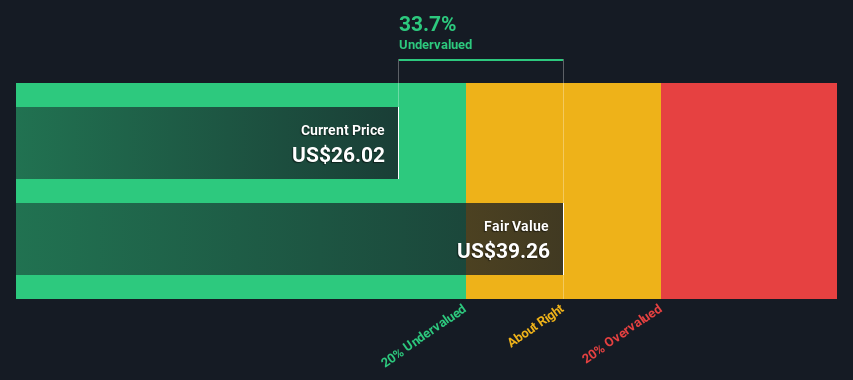

Heritage Insurance Holdings (NYSE:HRTG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Heritage Insurance Holdings is a property and casualty insurance company focused on providing personal and commercial residential insurance across several U.S. states, with a market cap of approximately $53.16 million.

Operations: Heritage Insurance Holdings generates revenue primarily through its operations, with the gross profit margin showing notable fluctuations, peaking at 51.91% in mid-2015 before declining to 0.75% by the end of 2022, and then recovering to 24.21% by early 2025. The company has experienced variations in net income margins as well, with periods of both positive and negative outcomes over time. Operating expenses have consistently impacted profitability, contributing to shifts in net income results across different periods.

PE: 9.3x

Heritage Insurance Holdings, a smaller player in the insurance sector, shows potential for growth despite its reliance on higher-risk external borrowing. Recent insider confidence is evident as an independent director purchased 10,000 shares worth US$133,500 in early May 2025. The company reported strong earnings growth with Q1 2025 revenue at US$211.52 million and net income doubling to US$30.47 million from the previous year. Earnings per share also saw significant improvement, indicating positive momentum for future performance.

- Take a closer look at Heritage Insurance Holdings' potential here in our valuation report.

Gain insights into Heritage Insurance Holdings' past trends and performance with our Past report.

Where To Now?

- Unlock our comprehensive list of 93 Undervalued US Small Caps With Insider Buying by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives