- United States

- /

- Consumer Finance

- /

- NasdaqGS:FCFS

Did CFPB Settlement and New Military Lending Product Just Shift FirstCash (FCFS) Investment Narrative?

Reviewed by Simply Wall St

- FirstCash Holdings recently reached a settlement with the Consumer Financial Protection Bureau regarding alleged violations of the Military Lending Act, agreeing to introduce a new pawn lending product for military members, provide consumer redress estimated between US$5 million and US$7 million, and pay a US$4 million fine.

- This settlement marks a significant compliance shift for FirstCash, directly impacting its operations and financial reporting in the second quarter of 2025.

- We'll explore how the introduction of a new pawn lending product for military families could reshape FirstCash's investment narrative.

What Is FirstCash Holdings' Investment Narrative?

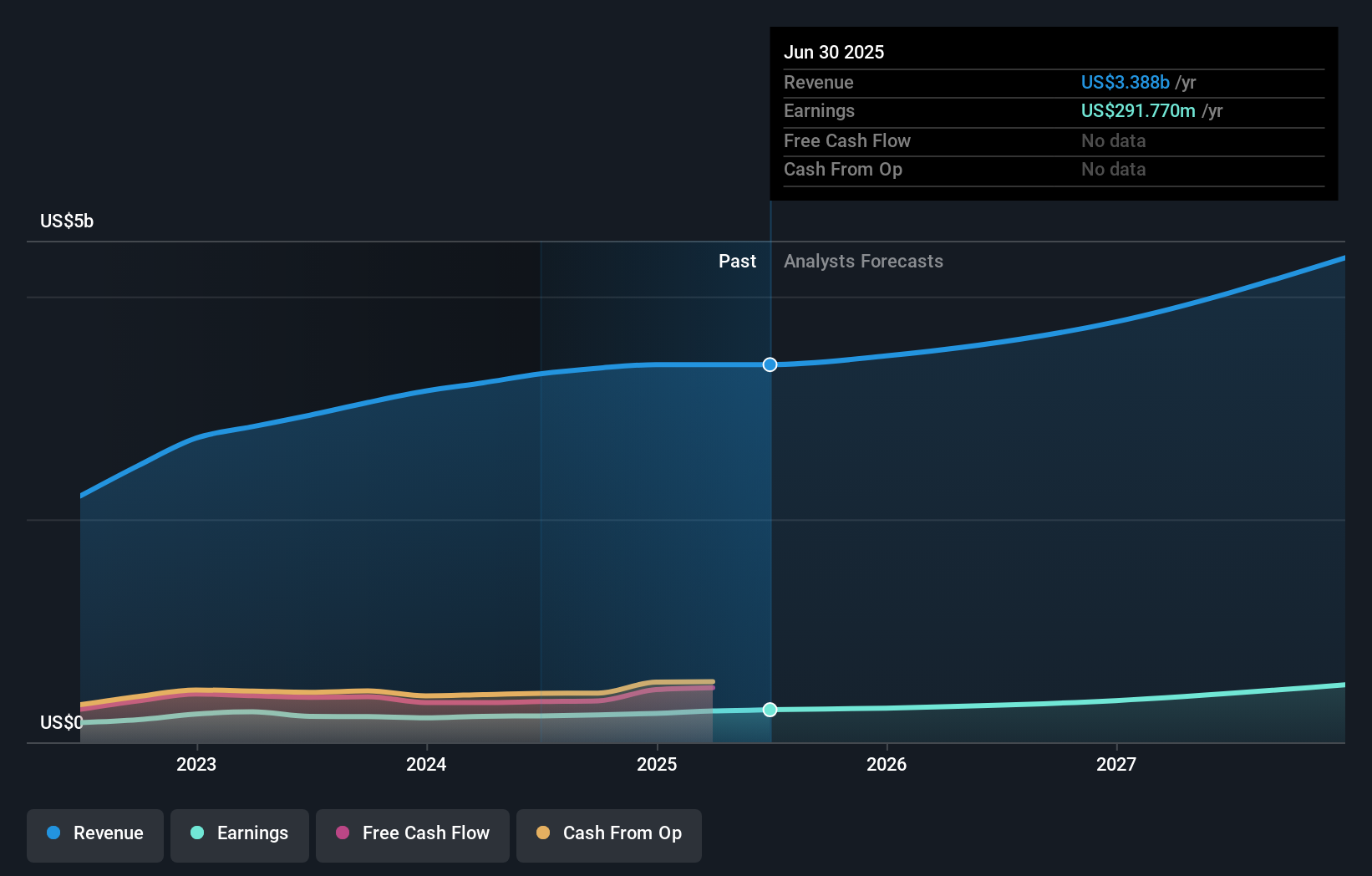

If you’re considering FirstCash Holdings as a potential holding, the investment thesis hinges on belief in the company’s resilience, continued expansion of its pawn store network, and sustainable earnings growth. The recent CFPB settlement introduces new operational and regulatory pivots, most immediately seen through the launch of a specific lending product for military customers and an associated financial charge set to appear in second quarter 2025 results. While the settlement will temporarily weigh on profits and may slow near-term momentum, it could also reduce legal risk and strengthen compliance, important factors given the backdrop of elevated debt levels and questions around executive compensation. These developments do add a material short-term risk, shifting the focus to how FirstCash adapts operationally and manages the financial impact in upcoming disclosures. The biggest question now is how the compliance-focused product launch fits with existing profit growth trends and management’s expansion ambitions.

But with new compliance costs appearing, investors should consider evolving profitability risks. FirstCash Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Build Your Own FirstCash Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FirstCash Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FirstCash Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FirstCash Holdings' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FCFS

FirstCash Holdings

Operates retail pawn stores in the United States, Mexico, and rest of Latin America.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives