- United States

- /

- Construction

- /

- NasdaqCM:LMB

Exploring Three Undiscovered Gems in United States Markets

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 28% over the past year with earnings expected to grow by 15% per annum in the coming years. In this dynamic environment, identifying stocks that are not only underappreciated but also poised for growth can offer intriguing opportunities for investors seeking diversification and potential value.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Limbach Holdings (NasdaqCM:LMB)

Simply Wall St Value Rating: ★★★★★★

Overview: Limbach Holdings, Inc. operates as a building systems solution company in the United States with a market cap of $1.06 billion.

Operations: Limbach Holdings generates revenue primarily through Owner Direct Relationships (ODR) at $328.65 million and General Contractor Relationships (GCR) at $189.18 million.

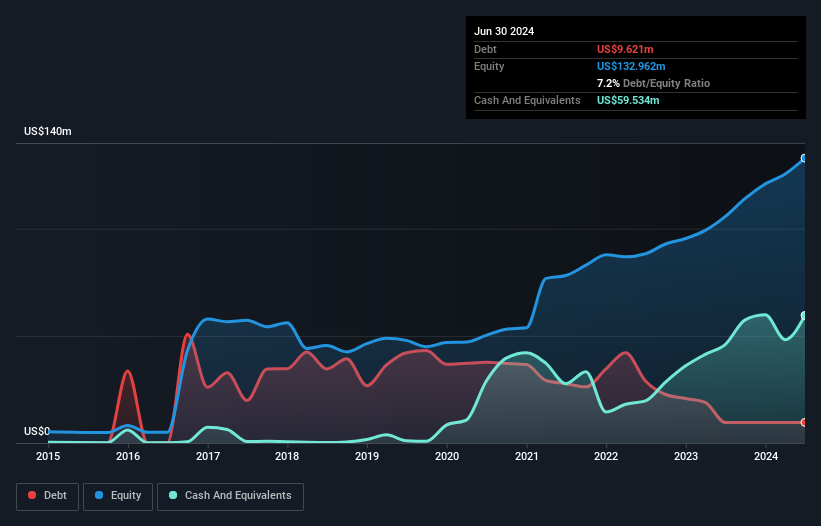

Limbach Holdings, a small cap player in the construction industry, is strategically pivoting towards Owner Direct Relationships (ODR) to bolster profitability and expand high-margin services. With $4 million earmarked for climate control equipment rentals, this shift aims to enhance gross margins and foster long-term customer ties. The company has reduced its debt-to-equity ratio from 95.9% to 6.8% over five years, showcasing financial prudence. Recent earnings reports indicate sales of US$133.92 million for Q3 2024 with net income at US$7.48 million, reflecting growth compared to the previous year’s figures of US$127.77 million and US$7.19 million respectively.

EZCORP (NasdaqGS:EZPW)

Simply Wall St Value Rating: ★★★★★☆

Overview: EZCORP, Inc. operates pawn services in the United States and Latin America with a market capitalization of approximately $664.48 million.

Operations: EZCORP generates revenue primarily from its U.S. Pawn segment, contributing $836.08 million, and its Latin America Pawn segment, adding $325.48 million.

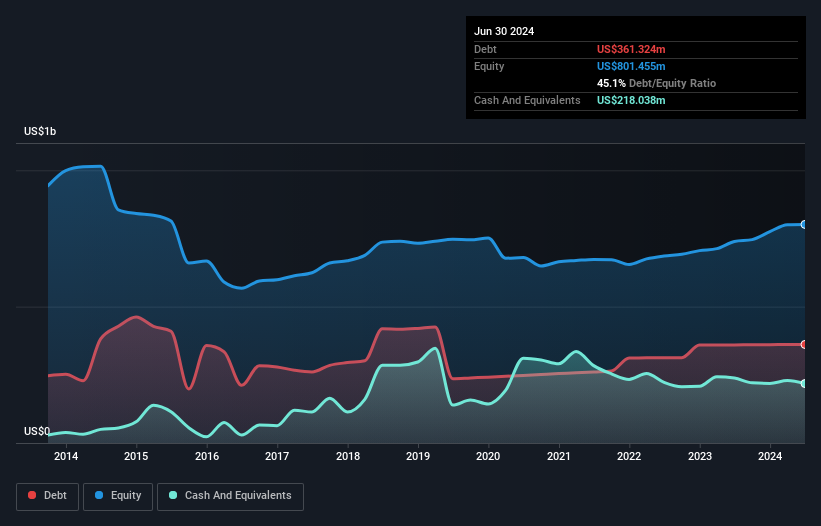

EZCORP, a notable player in consumer finance, is making waves with its strategic expansion and solid financial performance. The company reported a robust earnings growth of 116% over the past year, significantly outpacing the industry average. EZCORP's Price-To-Earnings ratio stands at 8x, indicating good value relative to the broader market's 19.1x. Over the past five years, their debt-to-equity ratio has increased from 32% to 40.7%, yet their net debt to equity remains satisfactory at 19.5%. Recent efforts include repurchasing shares worth US$26 million and expanding operations in Latin America and the U.S., signaling confidence in future growth prospects despite potential economic headwinds.

Graham (NYSE:GHM)

Simply Wall St Value Rating: ★★★★★★

Overview: Graham Corporation, with a market cap of $481.55 million, designs and manufactures fluid, power, heat transfer, and vacuum technologies for industries such as chemical processing, defense, space exploration, petroleum refining, cryogenics, and energy.

Operations: Graham Corporation generates revenue primarily from the design and manufacture of heat transfer and vacuum equipment, totaling $196.40 million.

Graham Corporation is making waves with its innovative NextGen steam ejector nozzle, which promises efficiency improvements and environmental benefits, evidenced by a 5.6% reduction in steam consumption at a Gulf Coast refinery. The company is also expanding with a new cryogenic propellant testing facility in Florida, targeting sectors like Space and Defense. Financially robust with no debt and high-quality earnings, Graham's recent quarterly sales hit US$53.56 million, up from US$45.08 million last year, while net income soared to US$3.28 million from US$0.41 million previously—a testament to its strategic growth initiatives and market adaptability.

Turning Ideas Into Actions

- Get an in-depth perspective on all 238 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LMB

Limbach Holdings

Operates as a building systems solution company in the United States.

Flawless balance sheet with proven track record.