- United States

- /

- Consumer Finance

- /

- NasdaqGS:ECPG

Why Encore Capital Group (ECPG) Is Up 8.5% After $500 Million Debt Refinancing Announcement and What's Next

Reviewed by Sasha Jovanovic

- On October 1, 2025, Encore Capital Group issued US$500.0 million in 6.625% senior secured notes due 2031, fully guaranteed by its material subsidiaries and secured by substantially all company assets.

- This refinancing move, used to repay the revolving credit facility, reflects a significant step in reshaping the company's capital structure and enhancing financial flexibility.

- We'll explore how Encore's sizeable new senior secured debt issuance could influence its investment narrative and future capital allocation.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Encore Capital Group Investment Narrative Recap

To be a shareholder in Encore Capital Group, you need to believe in the company’s ability to capitalize on rising U.S. consumer credit imbalances and ongoing charge-off rates, while managing its debt profile and interest costs. The recent US$500.0 million senior secured notes issuance enhances short-term funding certainty and capital flexibility, potentially supporting Encore’s ability to purchase non-performing loans. However, the key near-term catalyst remains the supply of those loans, while the biggest risk is pressure from rising interest expense; this news event modestly improves liquidity but does not fully resolve earnings risk from higher borrowing costs.

Relevant to Encore’s refinancing, the May 2025 announcement to increase and extend its global revolving credit facility directly supported the company’s current funding stability. Together, the new notes and expanded facility underpin Encore’s access to capital, but investors will continue to watch for impacts to net interest margins as debt costs rise faster than revenues. Yet, for those tracking the supply of non-performing loans, changes in consumer credit behavior may still take precedence over funding structure as the decisive factor.

But unlike its bolstered liquidity position, growing interest expense is an issue every investor should watch, especially since...

Read the full narrative on Encore Capital Group (it's free!)

Encore Capital Group's outlook projects $2.1 billion in revenue and $838.0 million in earnings by 2028. This requires 11.8% annual revenue growth and a $927.1 million increase in earnings from the current level of -$89.1 million.

Uncover how Encore Capital Group's forecasts yield a $57.25 fair value, a 30% upside to its current price.

Exploring Other Perspectives

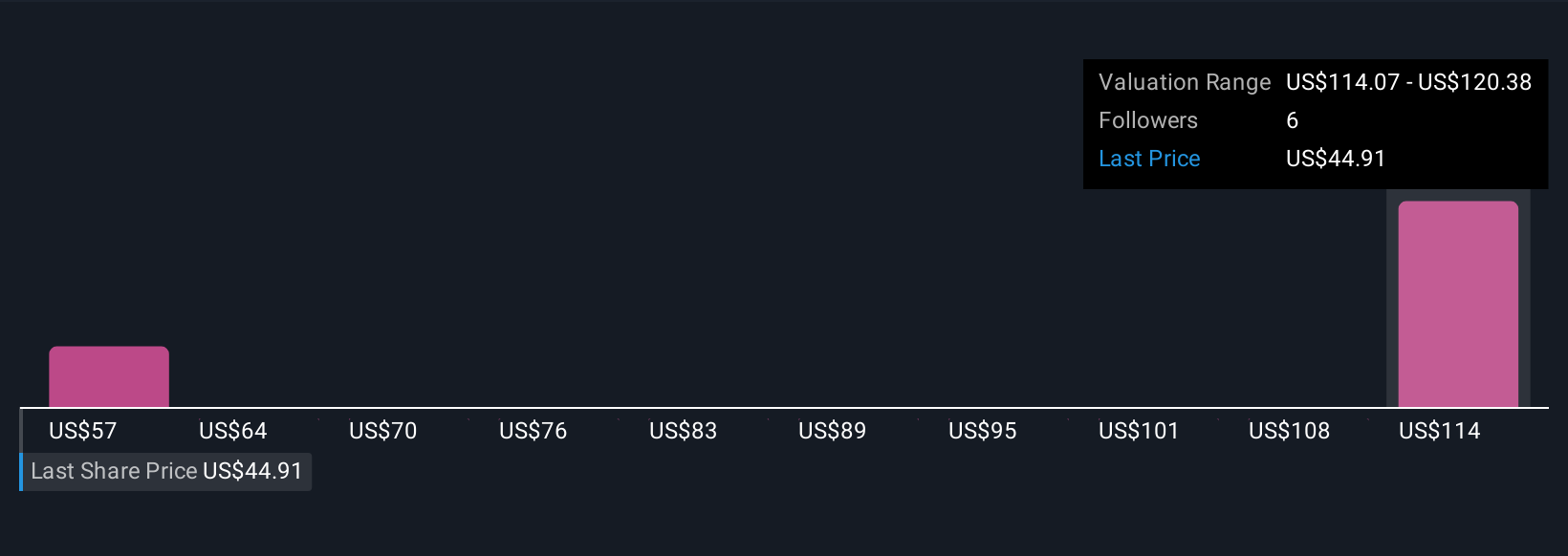

Simply Wall St Community members assigned fair values for Encore Capital Group from US$57.25 to US$120.38, reflecting two distinct outlooks before the refinancing. Consider how heightened interest costs could affect future earnings, with dramatic impacts if credit conditions tighten further.

Explore 2 other fair value estimates on Encore Capital Group - why the stock might be worth over 2x more than the current price!

Build Your Own Encore Capital Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encore Capital Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encore Capital Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encore Capital Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Encore Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ECPG

Encore Capital Group

A specialty finance company, provides debt recovery solutions and other related services for consumers across financial assets worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives