- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

Top 3 US Dividend Stocks To Consider

Reviewed by Simply Wall St

As U.S. markets experience volatility with technology stocks tumbling and oil prices rising due to Middle East tensions, investors are seeking stability in their portfolios. In such uncertain times, dividend stocks can offer a reliable income stream and potential for long-term growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.99% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.70% | ★★★★★★ |

| Hope Bancorp (NasdaqGS:HOPE) | 4.60% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.54% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.76% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.46% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.44% | ★★★★★★ |

| CVB Financial (NasdaqGS:CVBF) | 4.60% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.36% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.39% | ★★★★★★ |

Click here to see the full list of 174 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

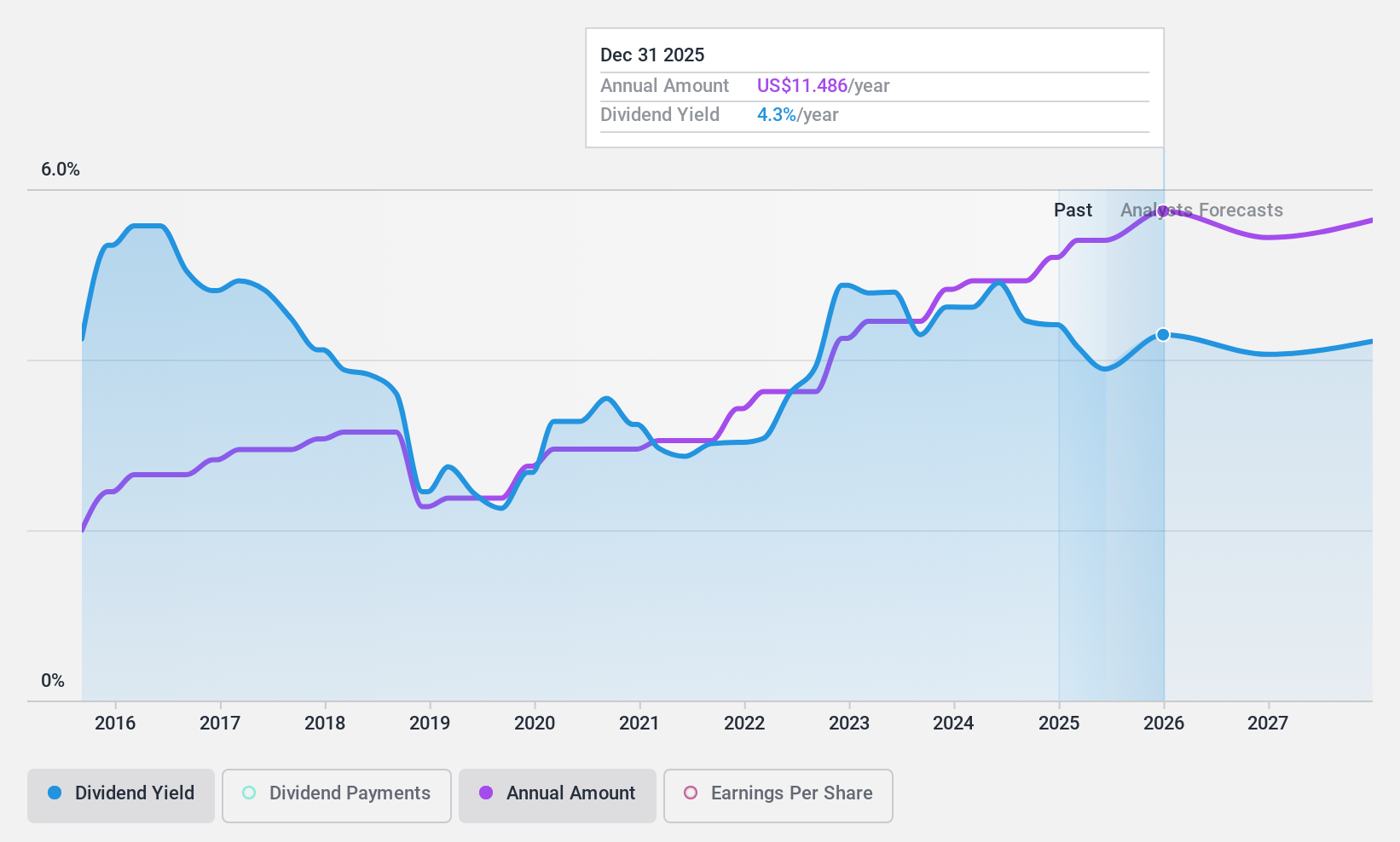

CME Group (NasdaqGS:CME)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CME Group Inc., with a market cap of $79.46 billion, operates global contract markets for trading futures and options on futures contracts through its subsidiaries.

Operations: CME Group Inc. generates revenue of $5.79 billion from unclassified services related to its global trading operations in futures and options on futures contracts.

Dividend Yield: 4.4%

CME Group's dividend payments, though yielding 4.37%, have been volatile over the past decade and are not well covered by free cash flows, with a high cash payout ratio of 101.6%. However, its earnings growth has averaged 10.5% annually over the past five years, and recent product launches like Bitcoin Friday futures indicate ongoing innovation. The dividend is well-covered by earnings due to a low payout ratio of 49.6%.

- Take a closer look at CME Group's potential here in our dividend report.

- Our valuation report here indicates CME Group may be overvalued.

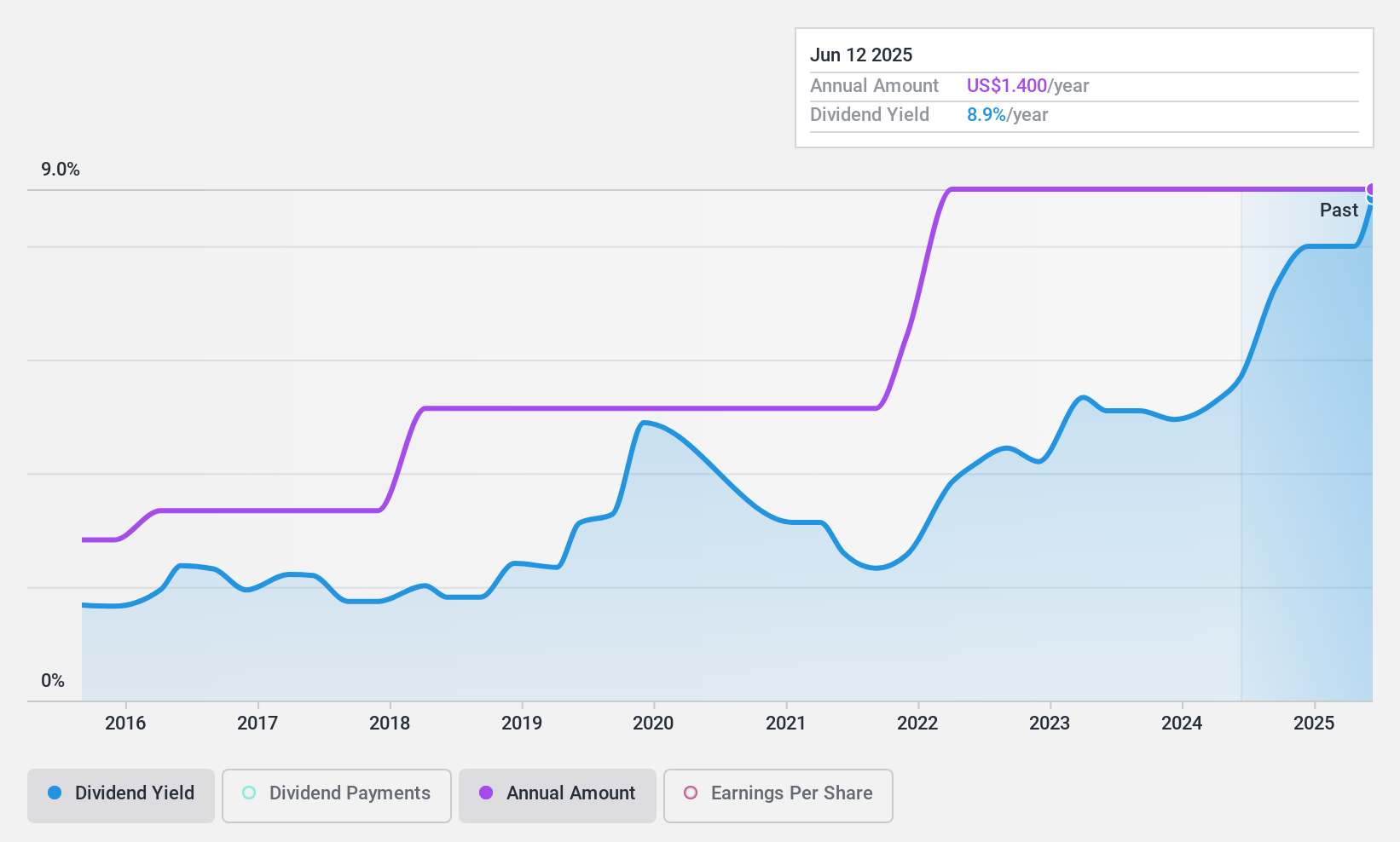

Movado Group (NYSE:MOV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Movado Group, Inc. designs, sources, markets, and distributes watches in the United States and internationally with a market cap of $413.78 million.

Operations: Movado Group, Inc. generates revenue primarily from its Watch and Accessory Brands segment ($562.31 million) and Company Stores segment ($100.98 million).

Dividend Yield: 7.2%

Movado Group's dividend yield of 7.24% is attractive but not well-covered by free cash flows, with a high cash payout ratio of 130%. Although dividends have increased over the past decade, they have been volatile and unreliable. Recent earnings guidance revisions indicate lower expectations for fiscal year 2025, with net sales projected between US$665 million and US$675 million. Additionally, Movado was dropped from multiple S&P indices in September 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Movado Group.

- According our valuation report, there's an indication that Movado Group's share price might be on the cheaper side.

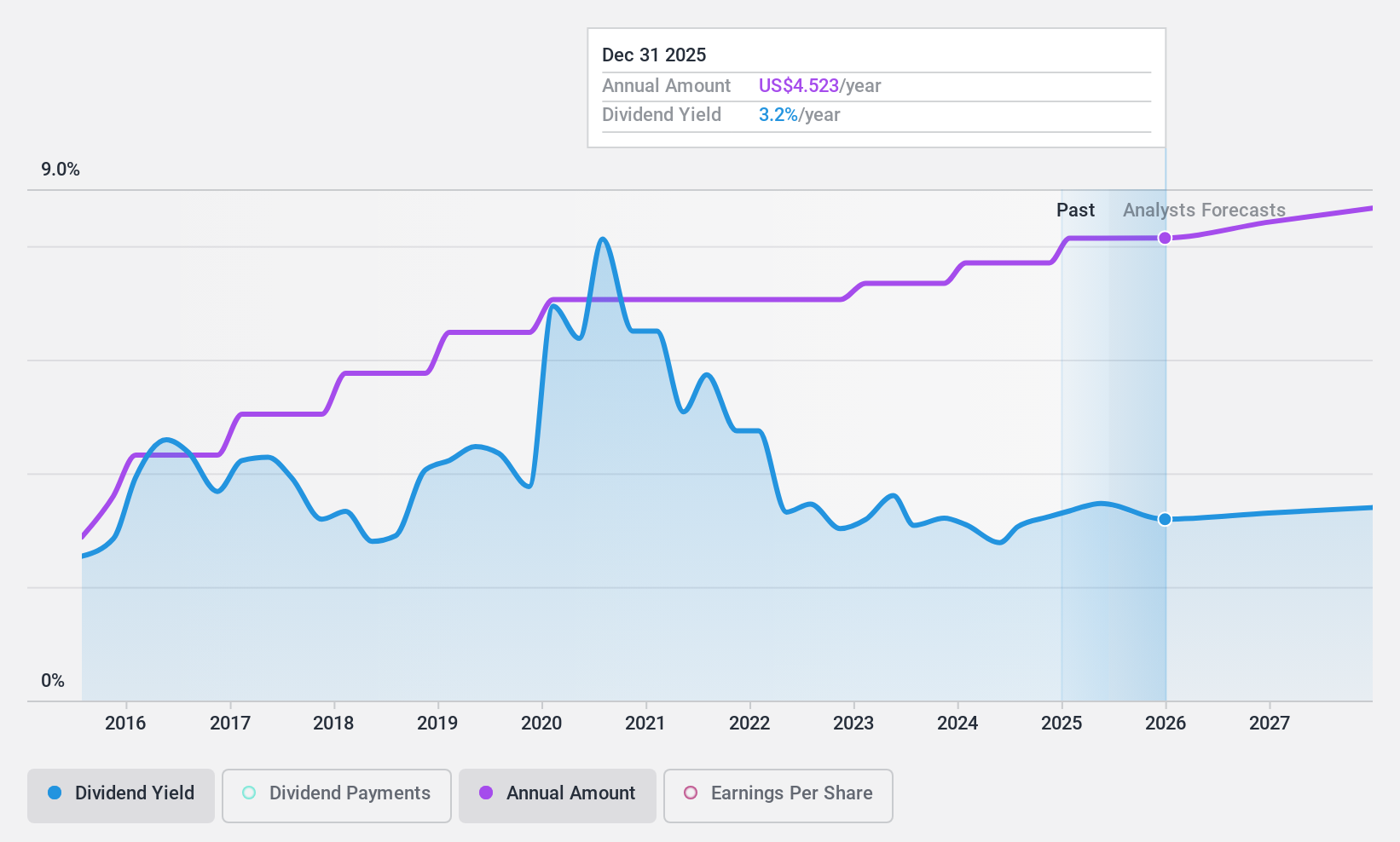

Valero Energy (NYSE:VLO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valero Energy Corporation manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products across various regions including the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally with a market cap of $43.26 billion.

Operations: Valero Energy Corporation's revenue segments consist of Ethanol ($4.99 billion), Renewable Diesel ($5.66 billion), and Refining (excluding Renewable Diesel) ($133.28 billion).

Dividend Yield: 3.1%

Valero Energy’s dividend yield of 3.11% is lower than the top 25% of US dividend payers but has been stable and growing over the past decade. The company maintains a low payout ratio of 23.6%, ensuring dividends are well-covered by earnings and cash flows. Despite recent declines in net income and profit margins, Valero continues to repurchase shares, enhancing shareholder value. The latest quarterly dividend was affirmed at $1.07 per share, payable on September 3, 2024.

- Click here to discover the nuances of Valero Energy with our detailed analytical dividend report.

- Our expertly prepared valuation report Valero Energy implies its share price may be lower than expected.

Where To Now?

- Investigate our full lineup of 174 Top US Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives