- United States

- /

- Consumer Finance

- /

- NasdaqGS:CACC

3 US Growth Companies With Up To 29% Insider Ownership

Reviewed by Simply Wall St

As U.S. stock markets edge higher and investors await key earnings reports, the focus remains on companies that demonstrate robust growth potential and strong insider ownership. In this environment, stocks with significant insider investment can signal confidence in a company's future prospects, making them particularly noteworthy for growth-oriented portfolios.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.7% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 60.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 66.5% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 78.8% |

Let's take a closer look at a couple of our picks from the screened companies.

LINKBANCORP (NasdaqCM:LNKB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LINKBANCORP, Inc., with a market cap of $253.33 million, operates as a bank holding company for The Gratz Bank, offering a range of banking products and services to individuals, families, nonprofits, and businesses in Pennsylvania.

Operations: The company's revenue segment includes banking, generating $68.14 million.

Insider Ownership: 29.4%

LINKBANCORP has demonstrated strong growth potential with substantial insider ownership and notable revenue increases. Recent earnings reports show significant improvements, with net interest income rising to US$24.48 million from US$8.09 million year-over-year, and net income reaching US$5.8 million from US$1.35 million a year ago. The company has been added to several Russell indices, indicating market confidence in its future performance, despite previous shareholder dilution concerns.

- Delve into the full analysis future growth report here for a deeper understanding of LINKBANCORP.

- Our valuation report here indicates LINKBANCORP may be undervalued.

Allegiant Travel (NasdaqGS:ALGT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Allegiant Travel Company, with a market cap of $753.75 million, is a leisure travel company that offers travel services and products to residents of under-served cities in the United States.

Operations: Revenue segments include Airline services generating $2.46 billion and a Segment Adjustment of $43.59 million.

Insider Ownership: 15.5%

Allegiant Travel is forecast to achieve profitability within 3 years, with earnings expected to grow significantly at over 100% annually. Despite recent financial challenges, including a net income drop to US$13.7 million in Q2 2024 and suspended dividends, insider ownership remains strong with more shares bought than sold recently. The company continues strategic reviews and leadership changes aimed at enhancing operational performance and maximizing asset value, particularly for Sunseeker Resort.

- Take a closer look at Allegiant Travel's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Allegiant Travel's current price could be quite moderate.

Credit Acceptance (NasdaqGS:CACC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Credit Acceptance Corporation provides financing programs and related products and services in the United States, with a market cap of $5.77 billion.

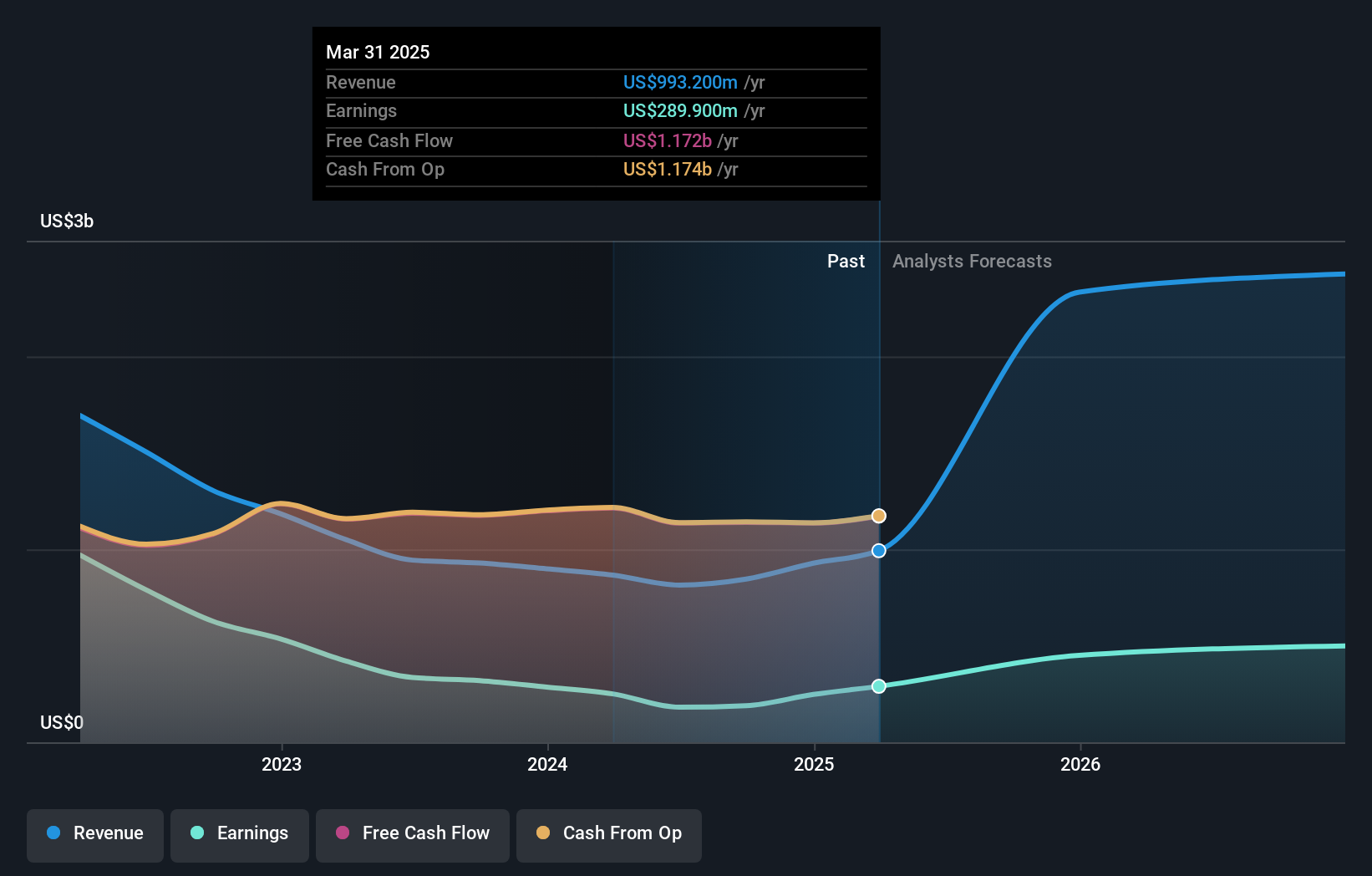

Operations: The company generates $815.20 million from offering dealers financing programs and related products and services in the United States.

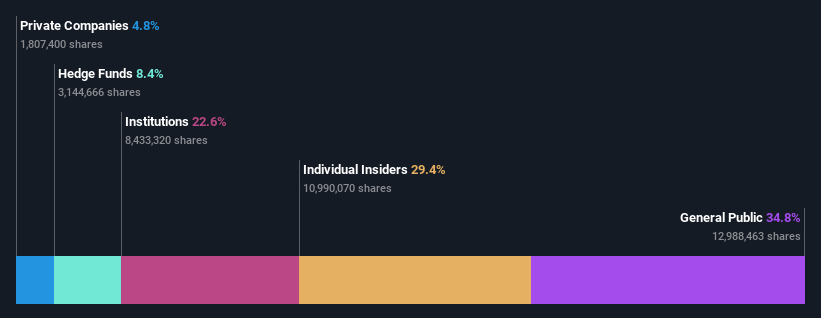

Insider Ownership: 14.1%

Credit Acceptance Corporation, with substantial insider ownership, is forecast to achieve significant earnings growth of 72% per year and revenue growth of 49.1% per year. Despite a recent net loss of US$47.1 million in Q2 2024 and declining profit margins, the company continues strategic share buybacks and has made several amendments to its credit agreements to improve financial flexibility. The stock trades at a discount to its estimated fair value by 24.5%.

- Dive into the specifics of Credit Acceptance here with our thorough growth forecast report.

- Our expertly prepared valuation report Credit Acceptance implies its share price may be lower than expected.

Make It Happen

- Click through to start exploring the rest of the 173 Fast Growing US Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CACC

Credit Acceptance

Engages in the provision of financing programs, and related products and services in the United States.

High growth potential and fair value.