“I have an eccentric view on commodities not necessarily shared by my colleagues - or by almost anybody. And that is, we're running out of everything.“

- Jeremy Grantham

One of the reasons for the recent market volatility was the rising odds of a recession in the US.

Copper (AKA Dr Copper) is often regarded as a leading indicator for the global economy because it is used in so many industries. Interestingly, the copper price peaked in May and has fallen as much as 22% since then.

In the short term, it appears that copper supply is overwhelming demand, and that may be a warning sign for the global economy. But the longer-term picture is very different with a potential supply deficit on the horizon.

If that’s the case the current weakness may be offering investors an opportunity. This week we are taking a look at the outlook for copper producers, and how to gain exposure if you agree with this narrative.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube ! (Posted on Monday the 19th of August)

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🎡 Disney Unveils Plan To Invest $60bn In Expansion Of Theme Parks And Cruise Line ( IBD )

- What’s our take?

- Disney plans to invest $60 billion in its ‘Experiences’ segment over the next 10 years. The investments will include several new cruise ships, new theme parks and new rides. These investments make sense as this segment currently accounts for half of Disney's revenue and most of its operating income. In the long term, these investments should create value for shareholders.

- In the medium term, investors are going to have an interesting time valuing the company. When Disney launched the streaming service in 2020 the PE ratio shot up - as the share suddenly became a growing tech stock, rather than a mature media company.

- Now, just as the streaming business has become profitable, cash flows and margins are going to come under pressure from another part of the business. Investors might be in for a free roller coaster ride as the market figures out the right multiple.

- What’s our take?

-

🇪🇺 European Investor Sentiment Falls Most In 2 Years ( FT )

- What’s our take?

- When optimism drops, opportunities arise. The ZEW Indicator of Economic Sentiment fell 25 points, its biggest drop since April 2020. This has been attributed to uncertainty about interest rates, two wars in the region, and slowing growth.

- Some see this as an opportunity. Morgan Stanley’s European equity strategists said their Market Sentiment Indicator (MSI) is now indicating a buy signal. This isn’t really surprising - weak sentiment creates opportunities for patient investors.

- What’s our take?

-

🤖 Huawei Set To Rival Nvidia With New AI Chip Amid US Sanctions ( Techopedia )

- What’s our take?

- New rules require new approaches. Since banning the export of high-performance AI chips from the U.S. to China in 2022, companies like Huawei have had to start making their own. In October it plans to launch a chip called the Ascend 910C that reportedly rivals Nvidia’s H100.

- The development isn’t without hurdles though, since the chips are experiencing production delays and Huawei is facing the prospect of further US restrictions. The smuggling of Nvidia chips into China has reportedly become rampant.

- Even U.S. companies are trying to find creative workarounds to the restrictions. Nvidia is working on a custom chip tentatively named B20 to comply with the export restrictions. The restrictions introduced in 2022 lowered Nvidia’s market share in China from 90% to 17%.

- If tensions between the U.S. and China remain elevated, new restrictions may be introduced as both countries want to be in the lead when it comes to AI advancements.

- What’s our take?

-

🎵 Universal Music Group And Meta Expand Their Partnership As Labels Lean On Social Media ( Sherwood )

- What’s our take?

- The music labels need the social platforms more than the platforms need the labels. It’s one thing to have a catalogue of valuable music, but it’s another thing entirely to actually distribute it and help listeners discover new music. So why not partner up with platforms that have huge amounts of engaged users?

- That’s exactly what the labels have done. Meta and Universal Music Group have had a relationship since 2017, and according to UMG executives, this renewed multi-year contract “ expands moneymaking opportunities, addresses issues with artist royalties, and aims to curb unauthorised AI-generated content.”

- Both Universal Music Group and Warner Music Group have shown how reliant they are on these channels. UMG’s music streaming revenue in Q2 suffered during a TikTok blackout, and Warner said it would lose up to $10m per quarter after Meta removed its premium video catalogue.

- What’s our take?

-

☕ Starbucks Jumps 24% On News Of CEO Replacement ( CNBC )

- What’s our take?

- One man’s pain is another man’s gain. After only 16 months in the CEO role at Starbucks, Laxman Narasimhan is being replaced by Brian Niccol, the CEO of Chipotle.

- Starbucks has declined 20% under Laxman’s leadership (excluding Tuesday’s meteoric $20bn gain), meanwhile Chipotle has climbed 773% since 2018 under Brian’s leadership. But it should be noted that Laxman didn’t have prior restaurant experience, while Brian had plenty from Pizza Hut and Taco Bell.

- Activist investors in Starbucks like Elliot Management and Starboard Value are in full support of Brian, as well as Starbucks’s founder Howard Shultz. Brian Niccol reportedly said “ I know what to do ” when he was contacted by a board member about potentially taking the CEO role.

- Change takes time, especially for big companies. So while the current CEO was only given 16 months, any new CEO should be given at least a year to implement some meaningful change with results.

- What’s our take?

-

☢️ Nuclear Is Having A Moment As Investment Skyrockets In 2024 ( Axios )

- What’s our take?

- Power-hungry data centres, the fragility in the energy market, and nuclear’s political revival are all contributing to more investment in this energy source, according to Axios.

- Investment in advanced nuclear fission technology has jumped tenfold from $355m in 2023 to $3.9bn in just the first 7 months of 2024.

- The funding is coming mostly from VCs, private equity, and billionaires like Sam Altman, Jeff Bezos, and Bill Gates.

- Tech companies could play a key role in funding development and progress as they form partnerships to meet the needs of their AI-focused data centres.

- As for the political side, it appears nuclear energy is the one thing that Democrats and Republicans can agree on, for now at least. Axios said the Department of Energy’s nuclear research and commercialisation programs consistently get big funding and bipartisan support in annual appropriation bills.

- So while nuclear power is not without its challenges, it is receiving increased investment and recognition as a viable energy source for the future.

- What’s our take?

⚖️ Copper: The Precarious Balance Between Supply and Demand

Copper is the third most used industrial metal in the world by volume, behind iron and aluminium. About 75% of that goes towards making electrical wires, telecommunication cables and electronics.

For more than a hundred years it's been a key resource for several industries, and its use cases continue to grow. As the chart below illustrates, the price is prone to extreme volatility due to all the different dynamics affecting supply and demand.

Copper Price 1987 to 2024 - TradingEconomics

Demand Continues Its Steady Rise

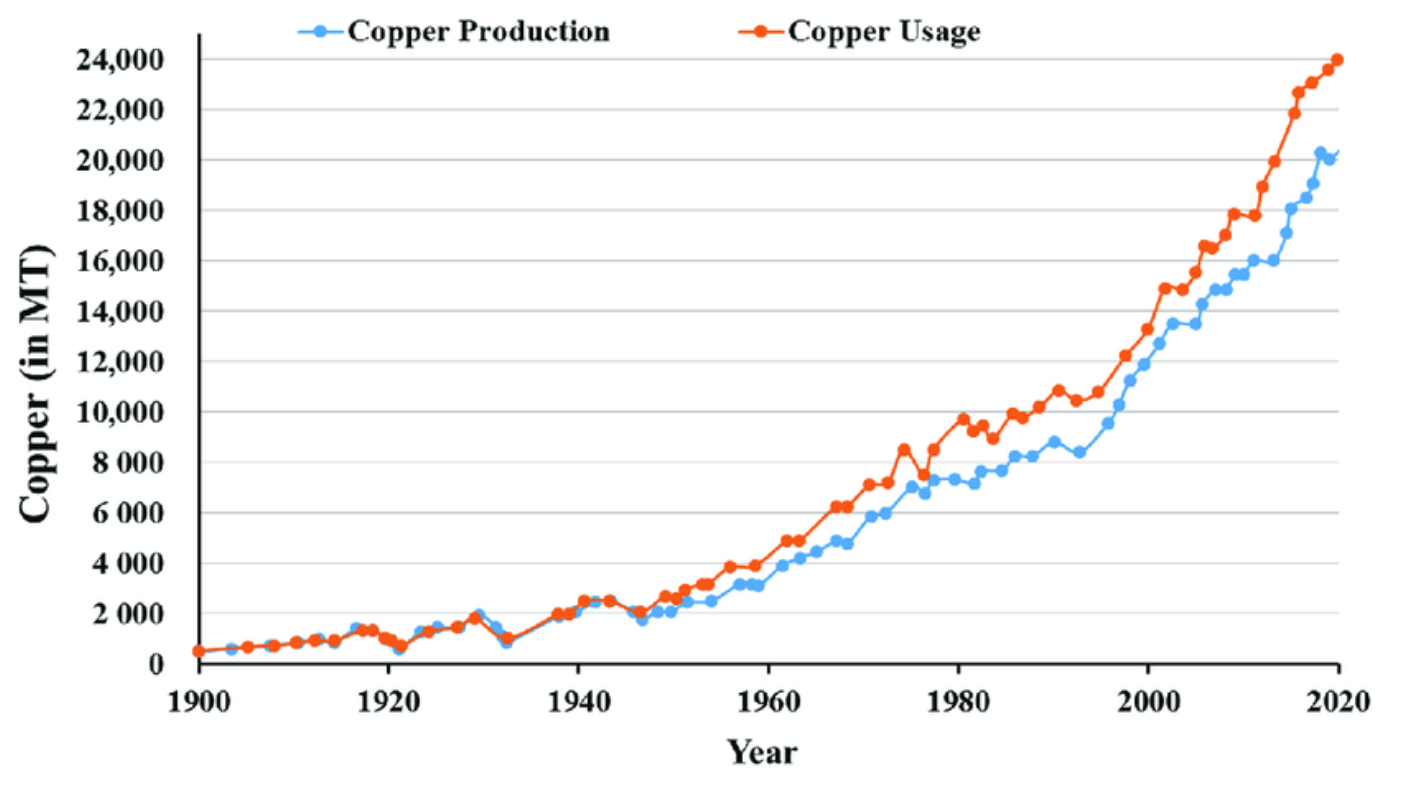

Copper consumption has increased steadily since before 1900.

Until recently, it was primarily used for construction, power, communication, electronics, and manufacturing. Copper is now also an essential input for renewable energy, automation, and the electrification of the economy.

✨ Copper demand is therefore driven by rising global prosperity AND most of the new growth industries.

Global Copper Production and Usage from 1900 to 2020 - ResearchGate

China consumes about 55% of the world’s copper, while the rest of Asia consumes around 15%.

This consumption is related to both economic development AND manufacturing. The rapid increase in demand (and the copper price) in the early 2000s was a result of China’s infrastructure development. While that investment has slowed, demand from the manufacturing sector has continued to increase.

Despite the slowdown in China over the last few years, annual copper imports have remained stable, even at higher prices. However, small changes in inventories and demand can lead to big price moves on a month-to-month basis.

New Supply May Not Keep Up

Global copper demand is currently about 28 million tonnes a year, and increasing at around 2% a year. This demand is satisfied via a combination of newly mined and refined copper, and recycled copper.

Current reserves are estimated at around 870 million tonnes, which should be enough to satisfy demand for over 20 years - except that it’s a little more complicated than that.

Like any mine, the cost of production depends on the grade and how easy it is to access the copper ore. Some reserves aren’t viable unless the copper price is high enough. Similar dynamics apply to recycling: higher prices mean more recycled copper can be processed.

✨ Most of the copper mines being developed currently are actually existing mines that are being redeveloped.

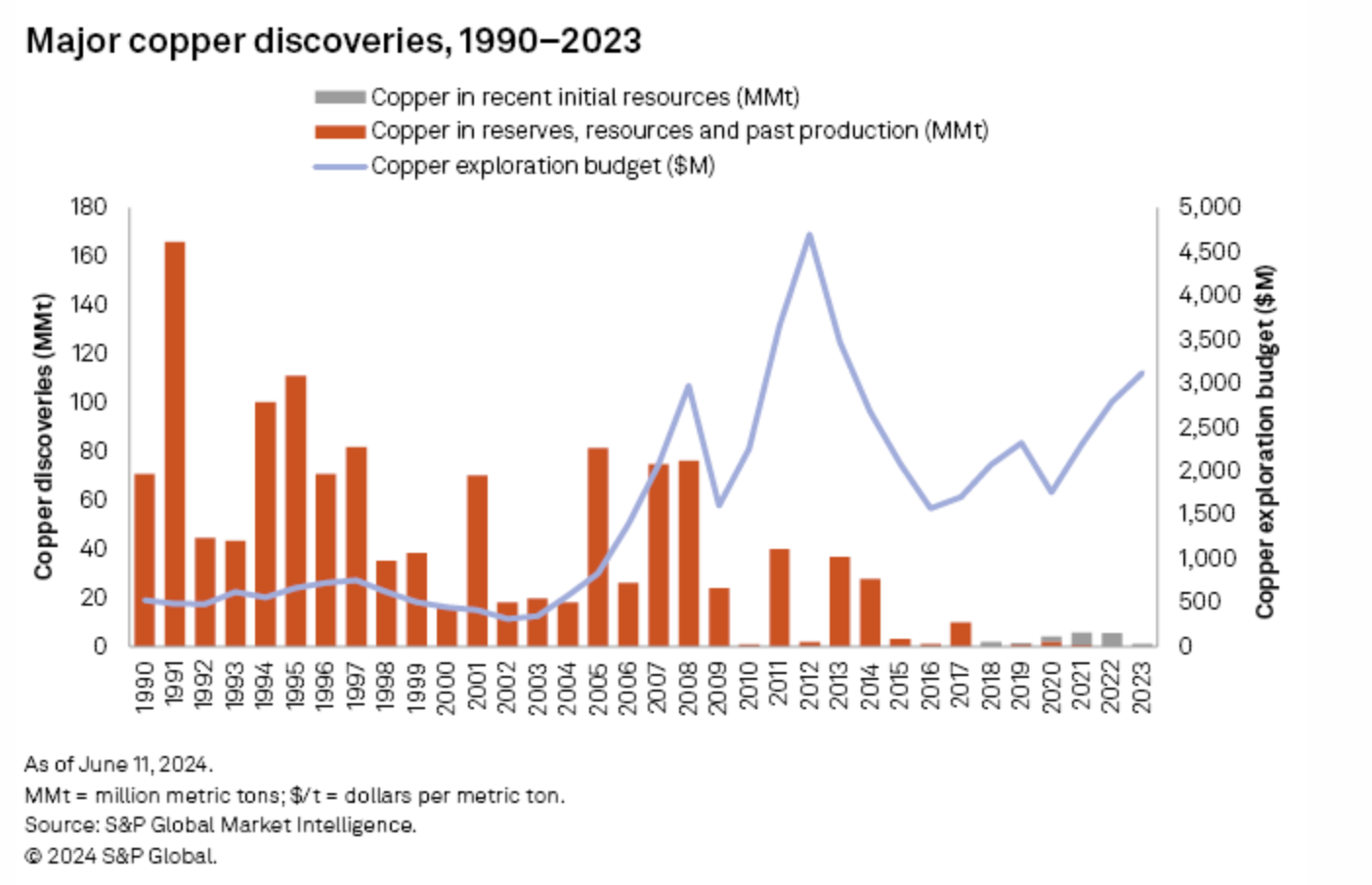

S&P Global recently updated its annual analysis of copper discoveries which showed how few new discoveries have been made in the last 15 years:

New Copper Discoveries 1990 to 2023 - S&P Global

The large copper producers are choosing to redevelop existing mines rather than exploring and developing new reserves. There are three reasons for this:

- 💸 🗓️ Exploration and development of new sites is costly and takes a very long time.

- S&P estimated that on average it takes over 16 years from discovery to production. This period has increased due to the number of regulatory hurdles that need to be overcome.

- 🏛️ Many of the world’s copper reserves happen to be in countries prone to political instability, or where the risk of nationalization of assets is common.

- This list includes Zambia, Chile, Peru and Panama.

- ⏩ Redeveloping existing assets is cheaper, faster and comes with less risk and uncertainty.

These factors mean producers are reluctant to invest in new sites, even when it means margins may be lower.

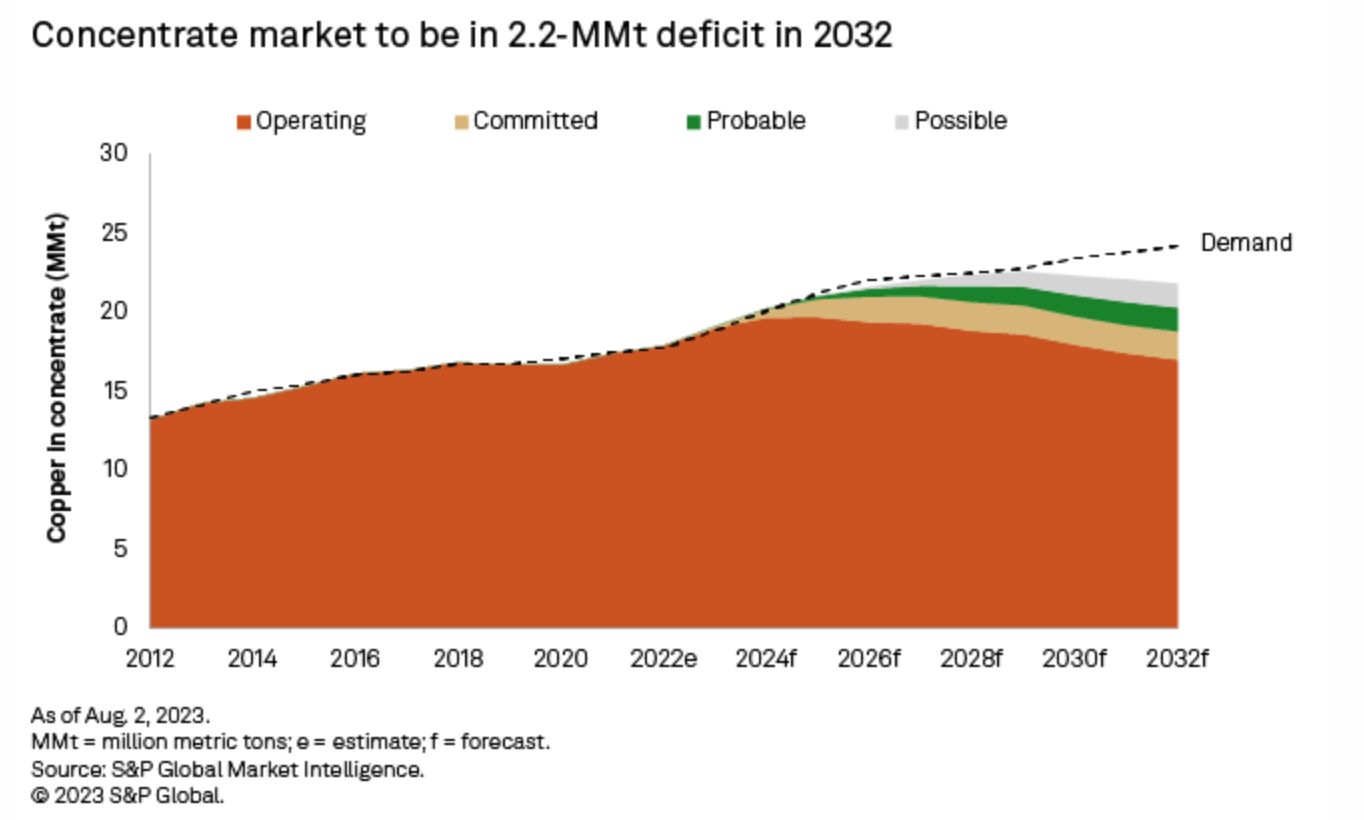

All of this has led economists to forecast a gap between demand and supply for copper concentrate. The reality is that that gap will depend on the copper price - when prices are high enough new sources become available.

Copper Concentrate Supply vs Demand - S&P Global

Copper Producers

The world’s largest producers of copper are Freeport-McMoRan , BHP Group, Coldeco, and Anglo American all of which produced over a million tonnes in 2023.

Of these companies:

- Freeport-McMoRan derives most of its revenue from copper, but also produces gold as a by-product.

- Coldeco in Chile is state-owned.

- BHP and Anglo American are diversified miners and earn 25 to 30% of their revenue from copper.

Diversified miners Rio Tinto Group and Glencore also produce copper alongside other commodities.

The other large producers which derive most of their revenue from copper are:

The diversified miners spread their exposure across multiple commodities, as well as multiple locations which is just as important given the political risk.

✨ If you are investing in the smaller companies, make sure you know where their assets are, and what the potential risks are in those countries.

There are several copper ETFs, but it’s worth noting that most of them have slightly underperformed the copper price over time. The largest is the Global X Copper Miners ETF which holds 40 shares and caps the weight of each at 4.7%. The United States Copper Index Fund is an ETN that tracks the copper price via the futures market.

💡 The Insight: Investing in Junior Copper Miners

If investing in copper ETFs or big diversified miners isn’t your thing, or you already own them but want more exposure, you may want to look at the smaller players. That is of course if you’re an investor with the risk appetite for them.

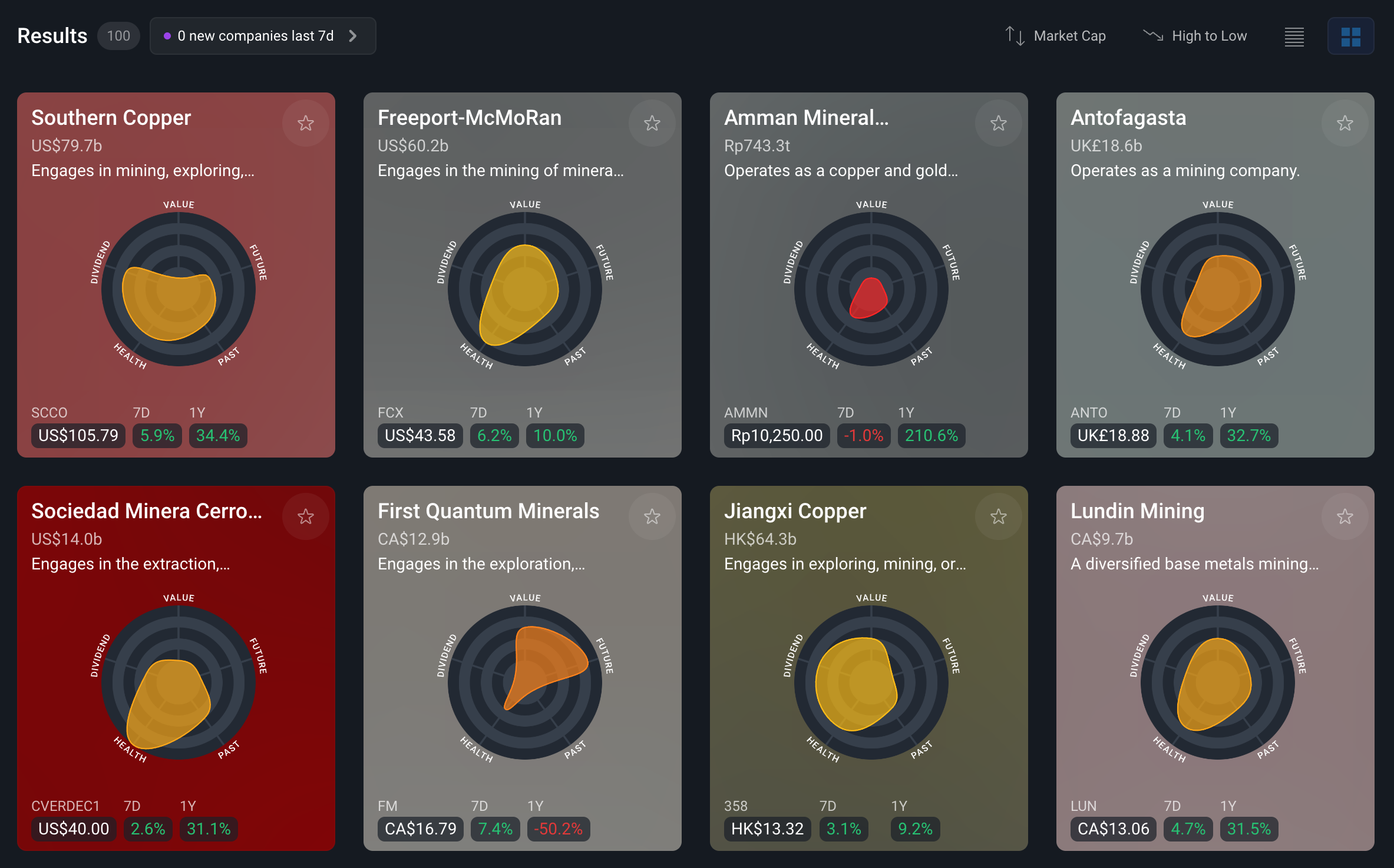

If you use the Simply Wall St stock screener to list all the copper mining companies in the world, you’ll see there are 100. Of these, most have market caps below $1 billion, and quite a few are valued at less than $50 million.

Copper Miners - Simply Wall St

✨ Small mining companies offer the potential for large upside but also come with numerous risks. When it comes to copper, the really compelling argument for investing in small caps is their potential to be acquired.

If the large mining houses don’t want to invest in exploration, the next best option is to acquire smaller companies with proven assets. BHP Group recently tried to acquire Anglo American for $49 billion for exactly that reason. That deal fell through, but it’s likely that more acquisitions will follow.

If you are looking at small-cap copper producers, here are a few things to keep in mind:

- 💲 Valuations are very likely to be inflated when the copper price is rallying.

- If you are going to find a bargain it's far more likely to be during a slump in the copper price.

- 🧑💼 Do your due diligence on the management team

- Make sure they have a successful track record with similar assets.

- 📑 Find independent assessments of the company’s reserves, including grades and likely production costs.

- Use this information to make a conservative estimate of the value of the assets. Consider the valuation from the perspective of likely acquirers.

- 💰 Make sure the company has a strong enough balance sheet.

- Look for those that could survive for at least three years before running out of cash and becoming a forced seller. The less debt they have and the more cash they have, the better they can handle downturns in the market.

Key Events During the Next Week

After a flood of data over the past two weeks, analysts are taking a breather this week.

Tuesday

- The Reserve Bank of Australia will release the minutes from the last monetary policy meeting.

- Canada’s inflation rate is forecast to remain at 2.7%

Wednesday

- Japan’s trade data will be published. Economists expect the surplus to narrow to $50bn.

- The US Fed will publish the minutes from the recent FOMC meeting.

Friday

- Japan's inflation rate will be published. It’s expected to rise slightly to 2.9%.

Earnings season continues with SaaS companies, China’s tech companies and a few retailers:

- PDD Holdings

- Intuit

- Lowe’s

- Palo Alto

- Analog Devices

- Medtronic

- Synopsys

- Target

- Snowflake

- Baidu

- Dollar Tree

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.