- United States

- /

- Capital Markets

- /

- NasdaqCM:BULL

Is Webull a Standout After Its New Trading Tools and a 5.7% Weekly Surge?

Reviewed by Bailey Pemberton

- Thinking about whether Webull is actually a bargain or just another name in the headlines? You are not alone. Understanding what sets its value apart is key.

- Webull’s stock has shown its share of volatility, jumping 5.7% in the last week but still sitting down 15.0% over the past month and 20.8% year-to-date.

- Recent news has highlighted increased interest in online brokers as investors seek new platforms amid ongoing market shifts. Headlines have focused on Webull’s updates to its trading tools and partnerships, drawing attention from both individual investors and industry watchers.

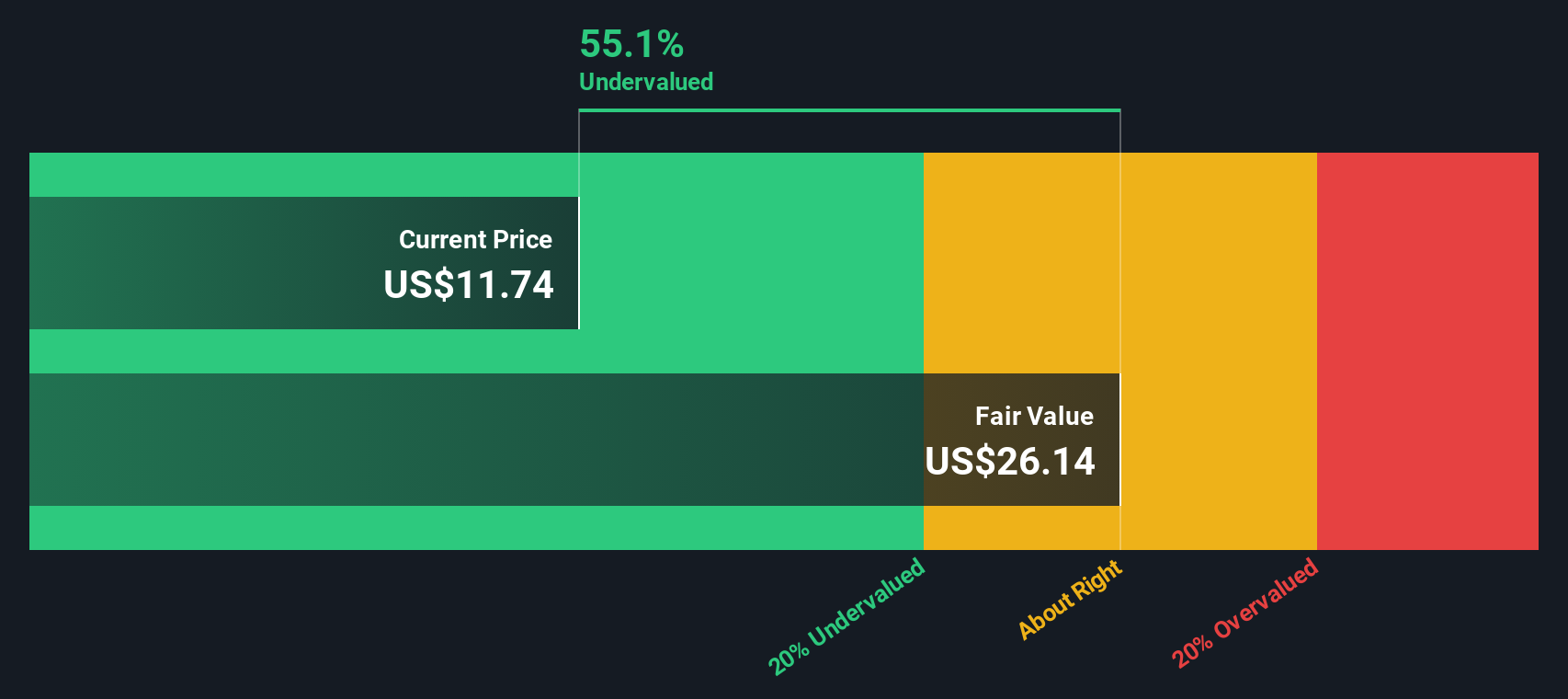

- On our valuation checks, Webull scores a 2 out of 6. This means there is still plenty to consider before deciding if it is undervalued. Let us break down the most popular ways investors judge if a stock is a good buy and, at the end, explore a smarter approach that could give you an extra edge.

Webull scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Webull Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting those amounts back to today's dollars. It is widely used by investors to get a sense of what a company's shares should be worth if forecasts are accurate.

For Webull, the most recent reported Free Cash Flow is $386 million. Analysts forecast moderate growth each year, with expectations of $411.6 million in 2026 and $590.9 million by 2035. It is important to note that after about five years, these figures become less certain because they are increasingly based on more generalized assumptions.

According to the DCF model, the estimated intrinsic value for Webull stock comes out to $17.95 per share. This is about 48.8% higher than its current market price, suggesting the stock is significantly undervalued based on these projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Webull is undervalued by 48.8%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

Approach 2: Webull Price vs Sales

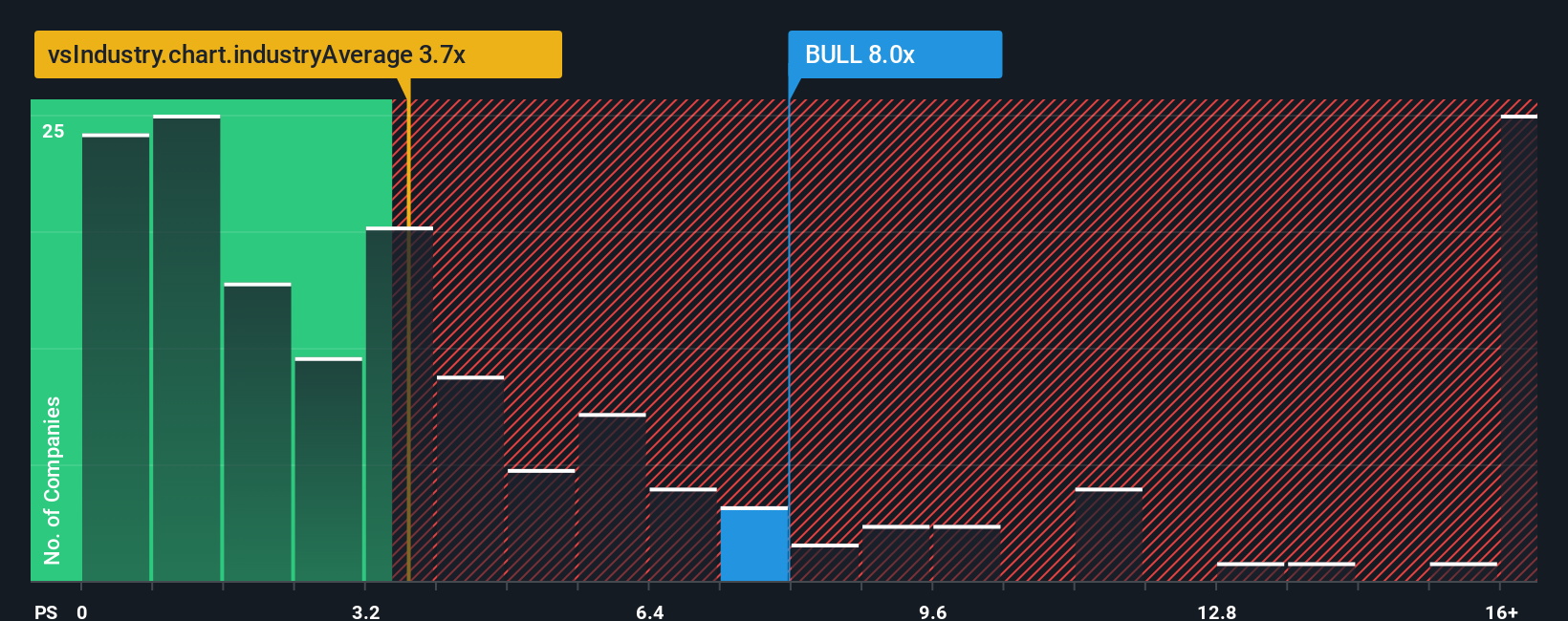

The Price-to-Sales (P/S) ratio is commonly used for valuing companies in the Capital Markets sector, especially when earnings are either negative or volatile. For businesses like Webull, which are still scaling and may reinvest heavily into growth, this metric provides a helpful gauge of how the market values the company’s revenue, regardless of current profitability.

While high-growth prospects tend to justify a higher P/S multiple, investors should also consider the risks and future expectations. A “normal” or “fair” P/S ratio is shaped by how quickly revenue is expected to grow, the company’s profit margins, its size, and how stable its market is relative to peers.

Currently, Webull trades at a P/S ratio of 8.97x. For comparison, the peer average sits at 1.75x, while the broader Capital Markets industry average is 3.74x. Simply Wall St’s proprietary Fair Ratio for Webull, which adjusts for factors like growth, risk, margins, and company size, sits at 5.68x. Unlike a basic industry or peer comparison, the Fair Ratio aims to reflect what investors should expect a company like Webull to trade at, given its unique characteristics and prospects.

Comparing Webull’s current P/S of 8.97x with its Fair Ratio of 5.68x suggests the market is pricing in more optimism than is warranted by underlying fundamentals right now.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

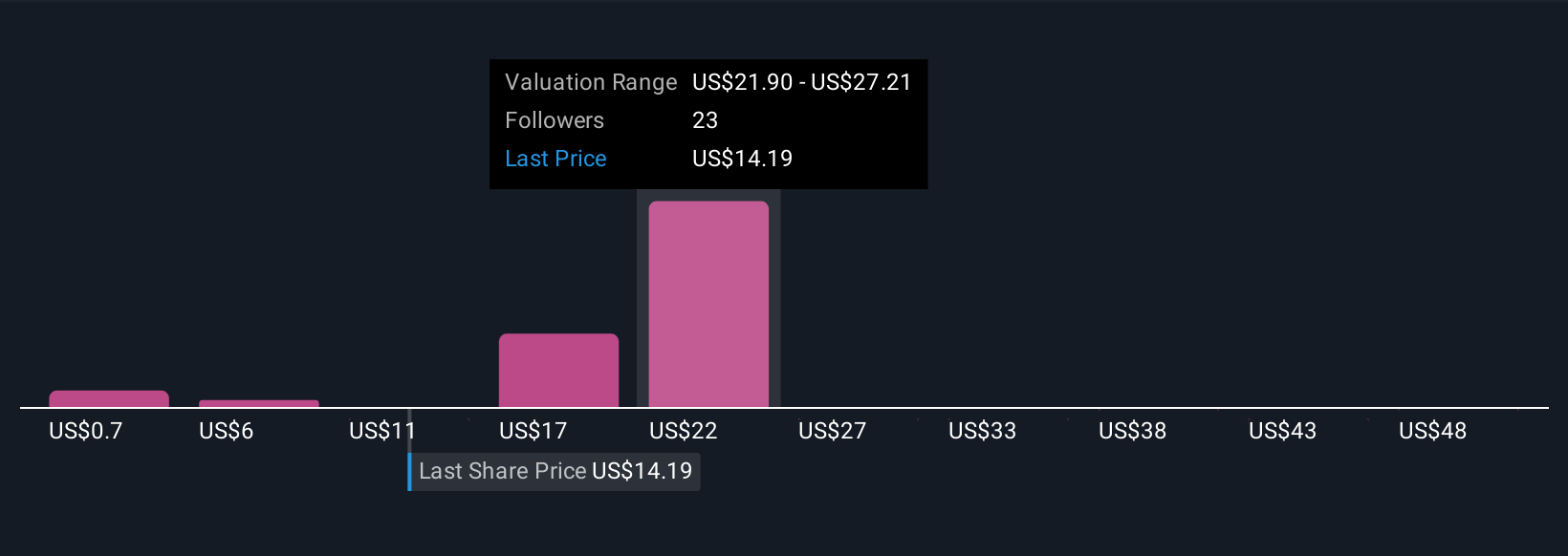

Upgrade Your Decision Making: Choose your Webull Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful tool that lets you attach your personal story or perspective to a company's numbers, allowing you to project your own estimates for future revenue, earnings, and fair value.

Unlike static models, Narratives connect the company's story, such as expansion plans or product innovations, directly to your financial forecast and ultimately to a fair value. This makes the entire investment process more meaningful and transparent. Narratives are available on Simply Wall St's Community page, used by millions of investors, and are designed to be intuitive, empowering you to move smoothly from “what do I believe” to “what is my estimated fair value?”

By comparing the Fair Value from your Narrative to the current market Price, you can make smarter, more confident decisions about when to buy or sell. Narratives are dynamically updated whenever new information, like news or earnings, is released, so your investment thesis stays current and relevant without extra effort.

For Webull, one Narrative assumes strong global growth and rising margins, projecting a fair value above $18, while another focuses on regulatory risks and slowing revenue, landing closer to $13. This highlights how different perspectives, built into the platform, can shape your investment call.

Do you think there's more to the story for Webull? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Webull might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BULL

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026