- United States

- /

- Consumer Finance

- /

- NasdaqGS:ATLC

3 Stocks Estimated To Be Undervalued By Up To 46.2%

Reviewed by Simply Wall St

As the U.S. stock market navigates through a mix of rising indices and ongoing concerns about AI valuations, investors are keeping a close eye on potential opportunities amid fluctuating conditions. In this environment, identifying undervalued stocks can be crucial for those looking to capitalize on discrepancies between current prices and intrinsic value, offering potential upside in an unpredictable market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $126.92 | $251.66 | 49.6% |

| Warrior Met Coal (HCC) | $78.05 | $155.79 | 49.9% |

| TransMedics Group (TMDX) | $117.07 | $229.89 | 49.1% |

| TowneBank (TOWN) | $32.12 | $62.85 | 48.9% |

| Perfect (PERF) | $1.73 | $3.46 | 50% |

| Horizon Bancorp (HBNC) | $15.63 | $30.81 | 49.3% |

| Hasbro (HAS) | $76.04 | $150.19 | 49.4% |

| GeneDx Holdings (WGS) | $126.92 | $253.46 | 49.9% |

| Caris Life Sciences (CAI) | $23.76 | $46.82 | 49.3% |

| Beacon Financial (BBT) | $24.52 | $48.50 | 49.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Eagle Bancorp (EGBN)

Overview: Eagle Bancorp, Inc. is the bank holding company for EagleBank, offering commercial and consumer banking services primarily in the United States, with a market cap of approximately $508.72 million.

Operations: The company's revenue is derived entirely from its banking services segment, totaling $3.97 million.

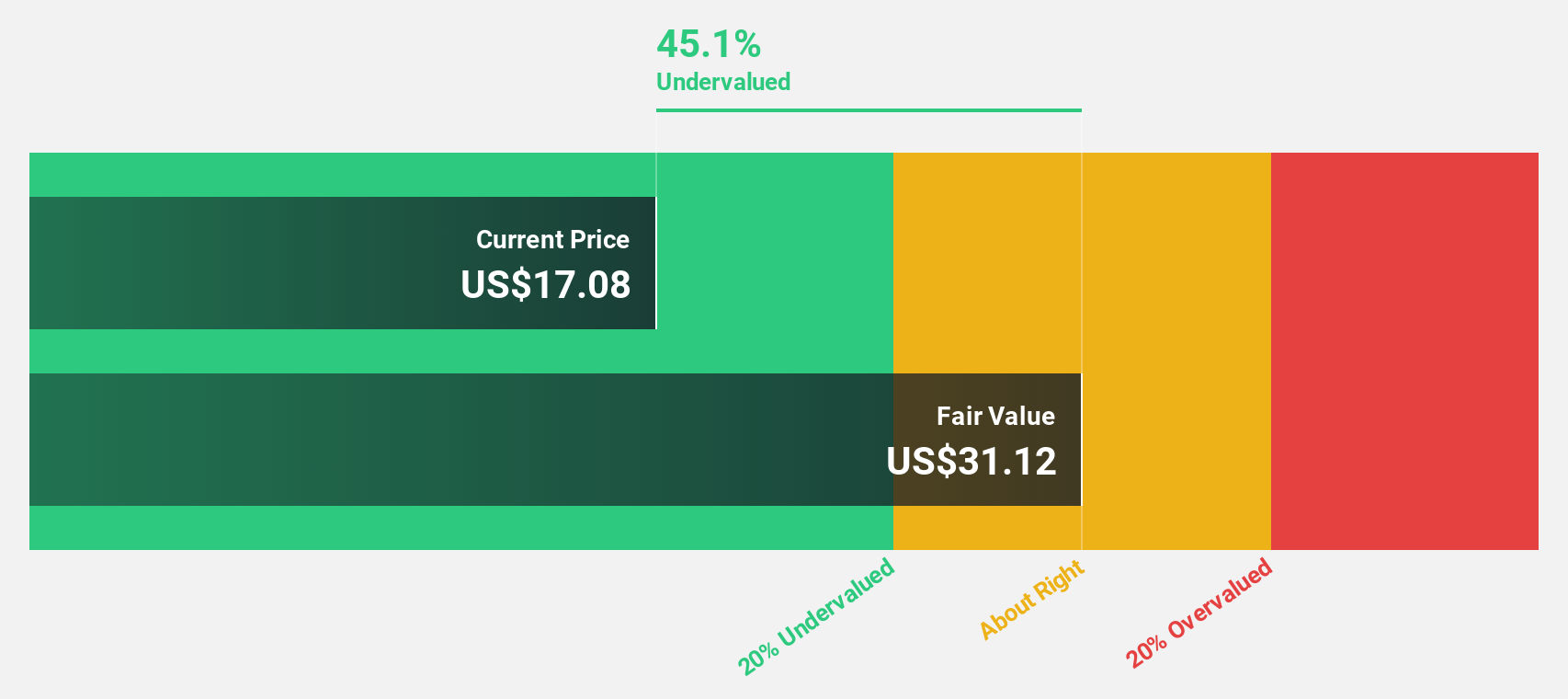

Estimated Discount To Fair Value: 46.2%

Eagle Bancorp appears undervalued, trading at US$16.75, significantly below its estimated fair value of US$31.12. Despite a challenging third quarter with net losses and substantial charge-offs, the company is forecast to achieve high revenue growth of 42% annually and become profitable within three years. Executive leadership changes are underway as CEO Susan G. Riel plans retirement in 2026, potentially impacting strategic direction amid ongoing board restructuring efforts.

- Our growth report here indicates Eagle Bancorp may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Eagle Bancorp stock in this financial health report.

Atlanticus Holdings (ATLC)

Overview: Atlanticus Holdings Corporation is a financial technology company that offers products and services to lenders in the United States, with a market cap of approximately $775.40 million.

Operations: The company's revenue is primarily generated from its Credit as a Service segment, which accounts for $466.00 million, while its Auto Finance segment contributes $32.49 million.

Estimated Discount To Fair Value: 30.6%

Atlanticus Holdings is trading at US$52.59, notably below its estimated fair value of US$75.82, indicating a substantial undervaluation based on discounted cash flow analysis. Despite a recent dip in quarterly net income to US$24.98 million, earnings are forecasted to grow significantly at 36% annually over the next three years, outpacing the broader market. However, debt coverage by operating cash flow remains inadequate, posing potential financial challenges ahead.

- Our comprehensive growth report raises the possibility that Atlanticus Holdings is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Atlanticus Holdings' balance sheet health report.

Energy Recovery (ERII)

Overview: Energy Recovery, Inc. designs, manufactures, and sells energy efficiency technology solutions globally, with a market cap of $764.39 million.

Operations: The company's revenue segments consist of $134.79 million from Water and $0.40 million from Emerging Technologies.

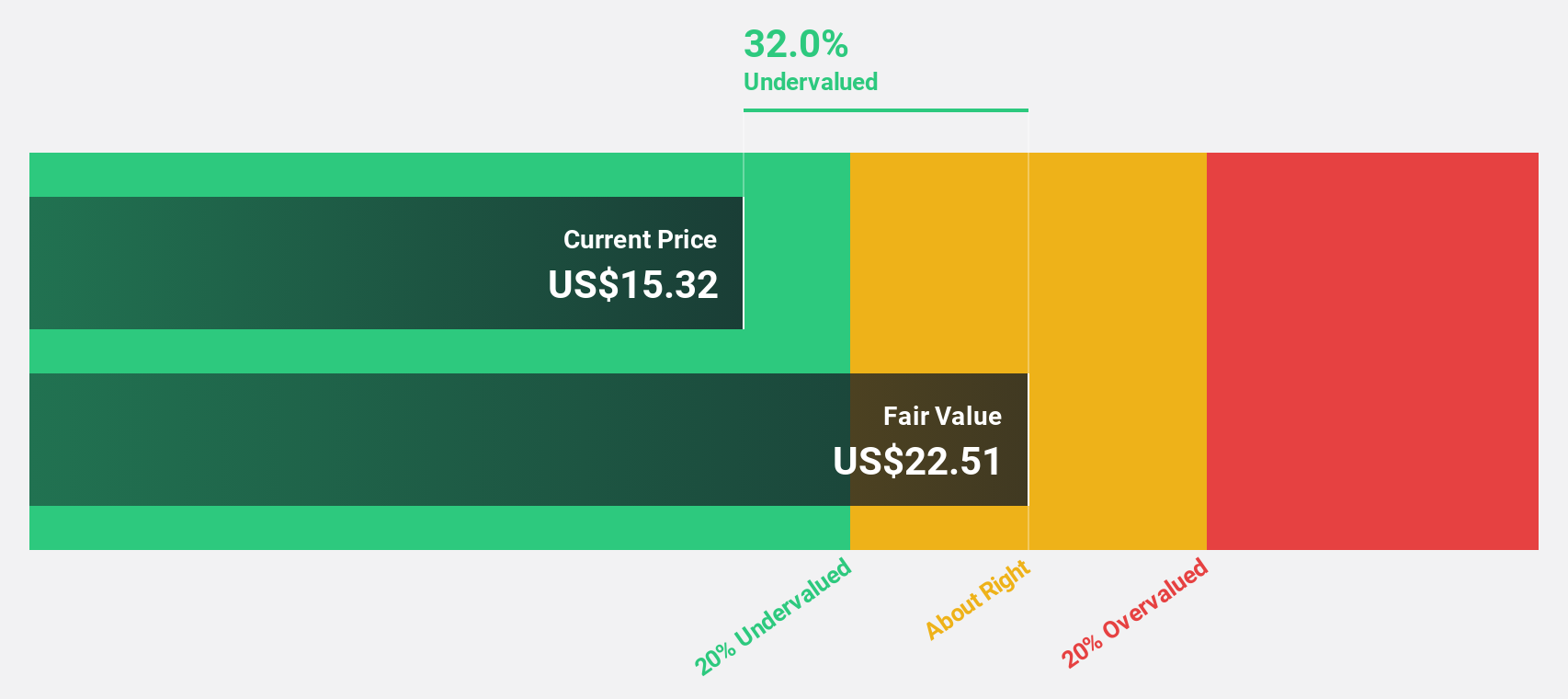

Estimated Discount To Fair Value: 33.6%

Energy Recovery is trading at US$14.43, significantly below its fair value estimate of US$21.73, highlighting an undervaluation based on discounted cash flow analysis. Despite a decline in quarterly sales to US$32 million and net income to US$3.87 million, earnings are expected to grow 35% annually, surpassing the broader market's growth rate. However, recent financial results show challenges with declining revenue and profitability compared to the previous year.

- The growth report we've compiled suggests that Energy Recovery's future prospects could be on the up.

- Dive into the specifics of Energy Recovery here with our thorough financial health report.

Taking Advantage

- Unlock our comprehensive list of 211 Undervalued US Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATLC

Atlanticus Holdings

A financial technology company, provides products and services to lenders in the United States.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives