- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm Holdings (NasdaqGS:AFRM) Sees 7% Dip After 22 Million Share Equity Offering

Reviewed by Simply Wall St

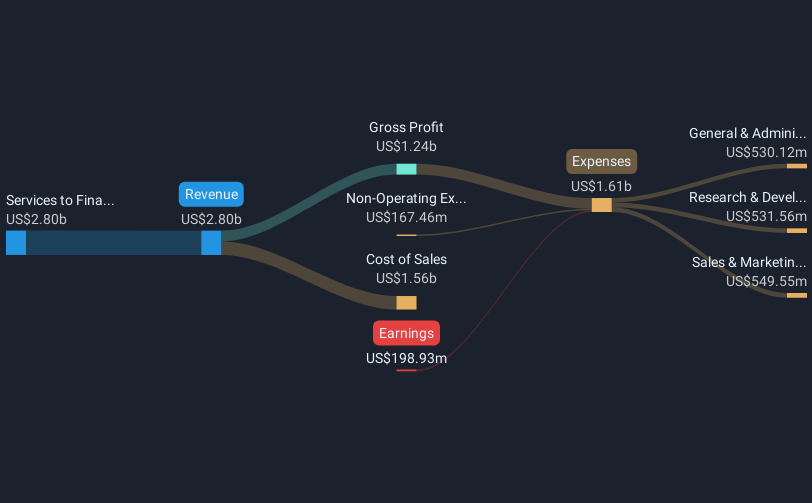

Affirm Holdings (NasdaqGS:AFRM) recently saw a 6.65% decline in its stock price over the last month. Despite the company's positive financial performance, with substantial year-over-year increases in sales and revenue, and a shift from a net loss to a net income for the second quarter, the market reacted to its follow-on equity offering for 22 million shares on February 28, potentially signaling shareholder dilution concerns. The announcements of partnerships with Stitch Fix, Shopify, FIS, and Coast Dental, which expand Affirm's network, seemed insufficient to counterbalance these concerns. The broader market context featured volatility, with the Dow Jones near flat and major indexes experiencing losses amid tariff tensions and economic data fluctuations. As investors balanced these mixed signals, Affirm's stock performance reflects a complex interplay of internal developments and external market forces.

Take a closer look at Affirm Holdings's potential here.

Over the past three years, Affirm Holdings has delivered a total shareholder return of 66.31%. This figure reflects a combination of share price appreciation and dividend distributions. Though currently unprofitable, Affirm has exceeded the US Diversified Financial industry's one-year return, highlighting its appeal among investors chasing growth potential. Despite its valuation appearing higher than its industry peers, Affirm's strategic moves to partner with notable companies, including Shopify and Stitch Fix, have bolstered its market presence, adding credibility to the company's long-term growth story.

Looking specifically at the past year, Affirm's revenue and sales growth have been substantial, fueled by an expanding merchant network now comprising over 320,000 partners. The company's transition from a net loss to a US$80.36 million net income reflects its improving financial health. With expected profitability on the horizon, Affirm presents a compelling growth narrative, benefiting from strong execution in product enhancement and client acquisition. As such, its performance stands apart from the broader market context, despite volatility and economic uncertainties.

- See whether Affirm Holdings' current market price aligns with its intrinsic value in our detailed report

- Gain insight into the risks facing Affirm Holdings and how they might influence its performance—click here to read more.

- Invested in Affirm Holdings? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with mediocre balance sheet.